Warren Buffett's Recent Reduction in Bank of America Holdings

Overview of the Recent Transaction

On July 19, 2024, Warren Buffett (Trades, Portfolio)'s firm made a notable adjustment in its investment portfolio by reducing its stake in Bank of America Corp (NYSE:BAC). This move involved the sale of 33,890,927 shares at a price of $43.56 each. Following this transaction, the firm still holds a significant number of shares, totaling 998,961,079, indicating a continued belief in the bank's value but at a moderated position.

Profile of Warren Buffett (Trades, Portfolio)

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a legendary figure in the investment world. His firm, Berkshire Hathaway, is renowned for its substantial insurance and other diverse business holdings. Buffett's investment philosophy, deeply rooted in Benjamin Graham's principles of value investing, focuses on understanding a business deeply, investing with a margin of safety, and holding for the long term. His strategies have consistently outperformed the market, making him one of the most followed investors globally.

Details of the Trade

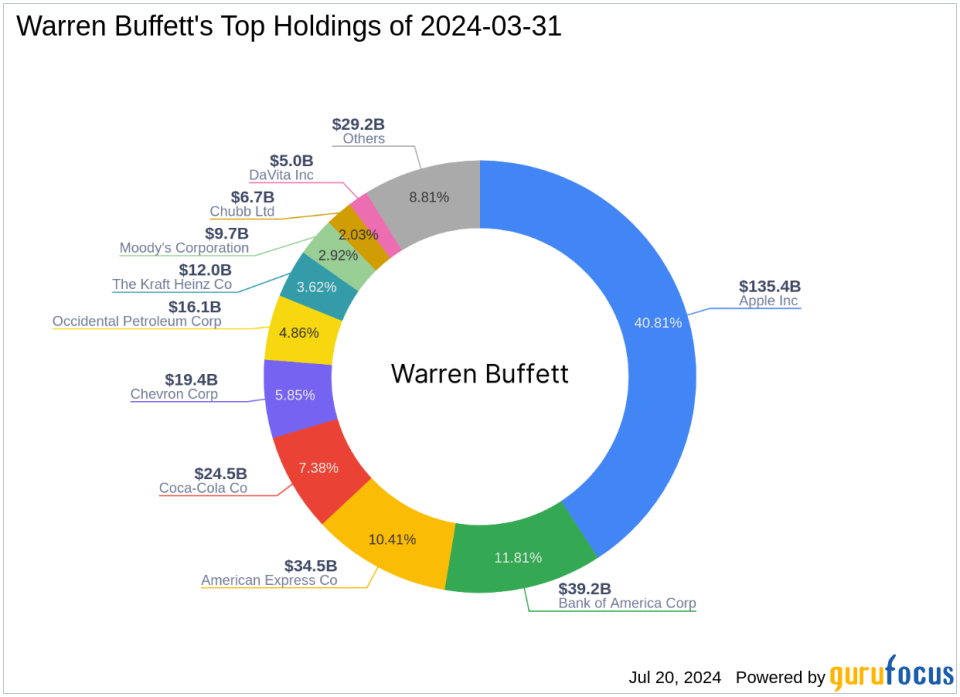

The recent transaction saw Buffett's firm decrease its position in Bank of America by 3.28%, which impacted the portfolio by -0.45%. After this sale, Bank of America still represents a substantial 12.85% of Buffett's total portfolio, underscoring its importance but aligning it more closely with his strategy of portfolio balance and risk management.

Bank of America Corporation Overview

Bank of America is one of the largest financial institutions in the U.S., with assets exceeding $3.0 trillion. It operates across various segments including consumer banking and global wealth management. Despite being marked as modestly overvalued with a GF Value of $38.22, the bank maintains a strong market presence. Its current stock price stands at $42.9, reflecting a slight decrease following Buffett's recent stock sale.

Market Impact and Analysis

The reduction by Buffett's firm has led to a minor dip in Bank of America's stock price, now trading at a 1.52% lower than the transaction price. This move could signal to the market a strategic realignment or cashing in on recent gains, considering the stock's 26.55% year-to-date increase. The GF Score of 81 indicates good potential for future performance despite the current overvaluation.

Sector and Industry Context

This transaction occurs within a broader financial services sector where Buffett maintains significant interests. Bank of America remains a major component of his portfolio, which also includes other significant holdings in the sector like American Express Co and Wells Fargo.

Insights from Other Market Gurus

Other notable investors such as Dodge & Cox, Ken Fisher (Trades, Portfolio), and Richard Pzena (Trades, Portfolio) also maintain holdings in Bank of America. Their investment strategies, while diverse, all signify a strong belief in the bank's fundamentals and future growth potential.

Conclusion

Warren Buffett (Trades, Portfolio)'s recent reduction in his Bank of America stake is a strategic move that aligns with his long-term investment philosophy and the need for portfolio balance. While still holding a significant number of shares, the adjustment reflects a nuanced approach to risk and value assessment, characteristic of Buffett's investment style. This transaction offers valuable insights into strategic portfolio management and market sentiment, which are crucial for value investors navigating the complexities of the financial services sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.