Be Wary Of Compass Group (LON:CPG) And Its Returns On Capital

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Compass Group (LON:CPG) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Compass Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = UK£1.1b ÷ (UK£15b - UK£5.6b) (Based on the trailing twelve months to March 2022).

Therefore, Compass Group has an ROCE of 11%. In absolute terms, that's a satisfactory return, but compared to the Hospitality industry average of 4.0% it's much better.

See our latest analysis for Compass Group

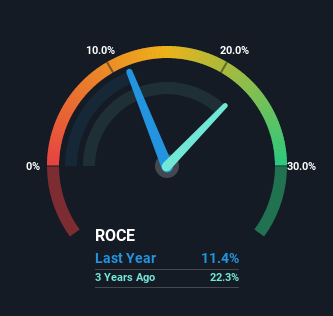

Above you can see how the current ROCE for Compass Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Compass Group here for free.

What Does the ROCE Trend For Compass Group Tell Us?

In terms of Compass Group's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 11% from 23% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

The Bottom Line

While returns have fallen for Compass Group in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. In light of this, the stock has only gained 15% over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

If you're still interested in Compass Group it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Compass Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance