Wasatch International Growth Hones in on Munters Group AB with a 1.75% Portfolio Stake

Insightful 13F Filing Update: A Deep Dive into Wasatch International Growth (Trades, Portfolio)'s Q4 Moves

Wasatch International Growth (Trades, Portfolio), known for its meticulous selection of high-quality small-cap growth companies outside the U.S., has revealed its investment activities for the fourth quarter of 2023 through the latest N-PORT filing. The fund, which commenced on June 28, 2002, is driven by a philosophy that focuses on sustainable earnings growth, experienced management, and strong financial health among other key attributes. Wasatch employs a rigorous bottom-up approach, combining financial screening, in-depth due diligence, proprietary earnings models, and careful valuation to identify and invest in companies with the potential for long-term growth.

Summary of New Buys

Wasatch International Growth (Trades, Portfolio)'s portfolio welcomed a new entrant in the fourth quarter:

Munters Group AB (OSTO:MTRS) stands out as the most significant addition with 465,402 shares, representing 1.75% of the portfolio and a total value of 75.89 million SEK.

Key Position Increases

The fund also bolstered its positions in several companies:

Japan Elevator Service Holdings Co Ltd (TSE:6544) saw a substantial increase of 262,830 shares, bringing the total to 663,510 shares. This represents a 65.6% increase in share count, impacting the portfolio by 1%, and a total value of 109.74 million JPY.

GMO Payment Gateway Inc (TSE:3769) experienced a 35.93% increase with an additional 45,600 shares, bringing the total to 172,500 shares, valued at 119.55 million JPY.

Summary of Sold Out Positions

Exiting several positions, Wasatch International Growth (Trades, Portfolio) made decisive moves:

Canada Goose Holdings Inc (TSX:GOOS) was completely sold off with all 455,978 shares, impacting the portfolio by -1.47%.

Clicks Group Ltd (JSE:CLS) also saw a complete exit with all 263,921 shares, causing a -0.79% impact on the portfolio.

Key Position Reductions

Reductions were made across the board in the fund's holdings:

Grupo Aeroportuario del Centro Norte SAB de CV (MEX:OMAB) was reduced by 531,200 shares, a -68.76% decrease, affecting the portfolio by -1.27%. The stock traded at an average price of MXN 155.42 during the quarter and has seen a 21.31% return over the past three months and a -12.03% year-to-date performance.

CTS Eventim AG & Co. KGaA (XTER:EVD) saw a reduction of 98,919 shares, a -50.79% decrease, with a -1.23% portfolio impact. The stock's average trading price was 60.1 during the quarter, returning 5.90% over the past three months and 6.15% year-to-date.

Portfolio Overview

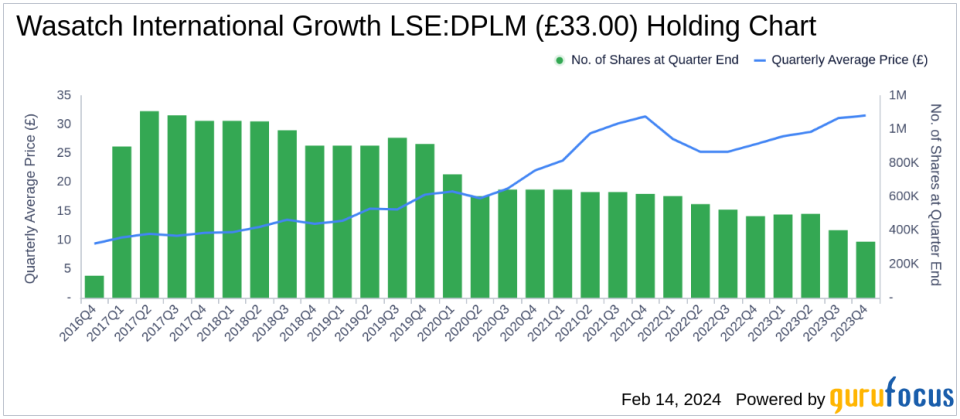

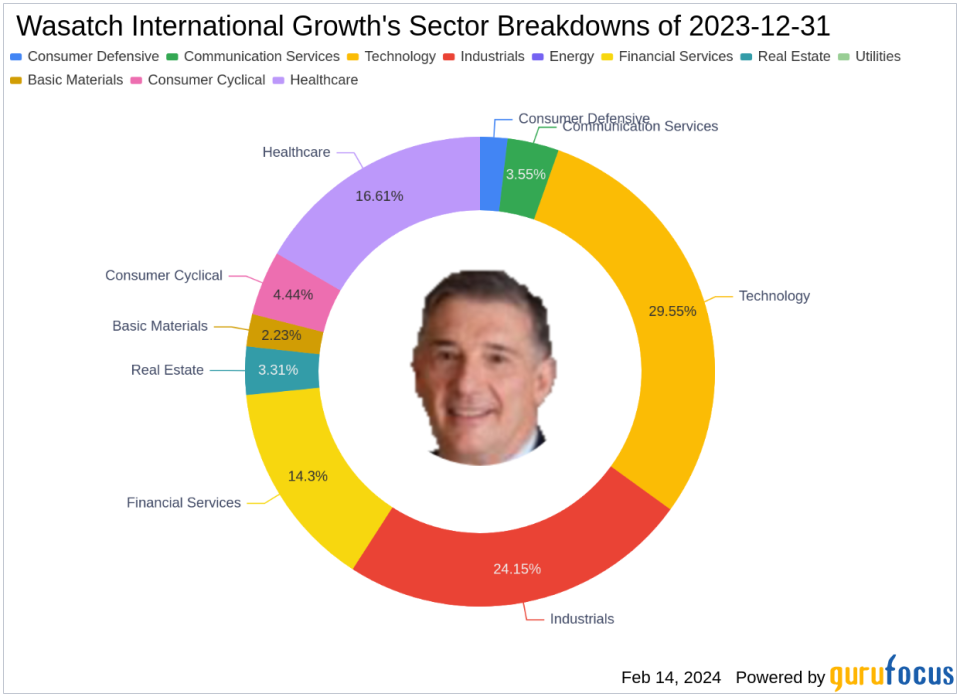

As of the fourth quarter of 2023, Wasatch International Growth (Trades, Portfolio)'s portfolio is composed of 62 stocks. The top holdings include 3.51% in Diploma PLC (LSE:DPLM), 3.3% in The Descartes Systems Group Inc (TSX:DSG), 3.12% in SMS Co Ltd (TSE:2175), 3.05% in Voltronic Power Technology Corp (TPE:6409), and 3.01% in EQB Inc (TSX:EQB). The investments are predominantly spread across nine industries, with a focus on Technology, Industrials, Healthcare, Financial Services, Consumer Cyclical, Communication Services, Real Estate, Basic Materials, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance