Wasatch Invests in 7 New Holdings

- By David Goodloe

Wasatch International Growth (Trades, Portfolio) invested in seven new holdings in the third quarter. All but one are new to the portfolio; the exception had a brief presence in the fund's portfolio in the last five years. Wasatch is the only guru shareholder of all seven companies.

Warning! GuruFocus has detected 2 Warning Sign with TPE:8464. Click here to check it out.

The intrinsic value of TPE:8464

The fund bought 1,232,774 shares of Nien Made Enterprise Co. Ltd. (8464.TW), a Taiwan-based company that makes and sells window treatments, primarily curtains, blinds and shutters, for an average price of 341.93 Taiwan dollars ($10.61) per share. The transaction had a 1.11% impact on the portfolio.

Nien Made Enterprise has a price-earnings (P/E) ratio of 28.62, a price-book (P/B) ratio of 9.57 and a price-sales (P/S) ratio of 5.25. GuruFocus gives Nien Made Enterprise a Financial Strength rating of 8/10 with no debt and a Profitability and Growth rating of 6/10 with return on equity (ROE) of 35.97% that is higher than 95% of the companies in the Global Home Furnishings & Fixtures industry and return on assets (ROA) of 21.71% that is higher than 96% of the companies in that industry.

Nien Made Enterprise sold for 346 Taiwan dollars per share last week. The DCF Calculator gives Nien Made Enterprise a fair value of 128.85 Taiwan dollars.

The fund invested in 1,122,013 shares of XXL ASA (XXL.OL), a Norway-based sporting goods retailer, for an average price of 102.33 Norwegian kroner ($12.01) per share. The deal had a 1.08% impact on the portfolio.

XXL has a P/E ratio of 34.28, a P/B ratio of 4.20 and a P/S ratio of 1.91. GuruFocus gives XXL a Financial Strength rating of 5/10 and a Profitability and Growth rating of 5/10 with ROE of 12.49% that is higher than 72% of the companies in the Global Specialty Retail industry and ROA of 7.05% that is higher than 76% of the companies in that industry.

XXL sold for 102.5 Norwegian kroner. The DCF Calculator gives XXL a fair value of 32 Norwegian kroner.

The fund purchased 1,128,169 shares of UPL Ltd. (UPL.NS), an India-based crop protection, chemicals and seeds company, for an average price of 621.75 Indian rupees ($9.21) per share. The transaction had a 0.8% impact on the portfolio.

UPL has a P/E ratio of 22.84, a P/B ratio of 4.07 and a P/S ratio of 2.08. GuruFocus gives UPL a Financial Strength rating of 5/10 and a Profitability and Growth rating of 6/10 with ROE of 49.60% that is higher than 94% of the companies in the Global Agricultural Inputs industry and ROA of 19.39% that is higher than 92% of the companies in that industry.

UPL sold for 700.15 rupees per share. The DCF Calculator gives UPL a fair value of 823.89 rupees with a 15% margin of safety.

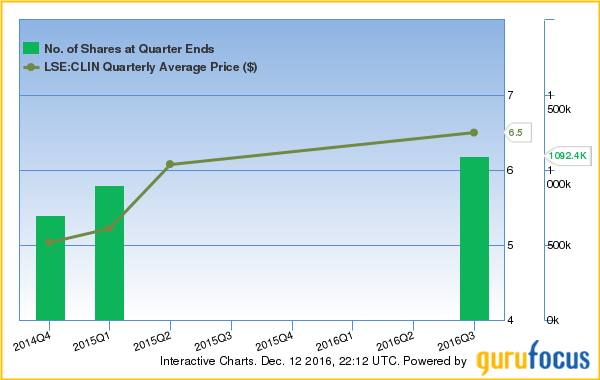

The fund bought 1,092,438 shares of Clinigen Group PLC (CLIN.L), a U.K.-based pharmaceutical company, for an average price of 6.5 British pounds ($8.17) per share. The deal had a 0.71% impact on the portfolio.

Wasatch sold its previous stake in Clinigen in the first quarter of 2015.

Clinigen has a P/E ratio of 59.78, a forward P/E ratio of 17.42, a P/B ratio of 3.48 and a P/S ratio of 2.41. GuruFocus gives Clinigen a Financial Strength rating of 6/10 and a Profitability and Growth rating of 7/10 with ROE of 6.09% that is lower than 72% of the companies in the Global Medical Distribution industry and ROA of 3.04% that is lower than 58% of the companies in that industry.

Clinigen Group sold for 7.21 British pounds. The DCF Calculator gives Clinigen a fair value of 1.18 British pounds.

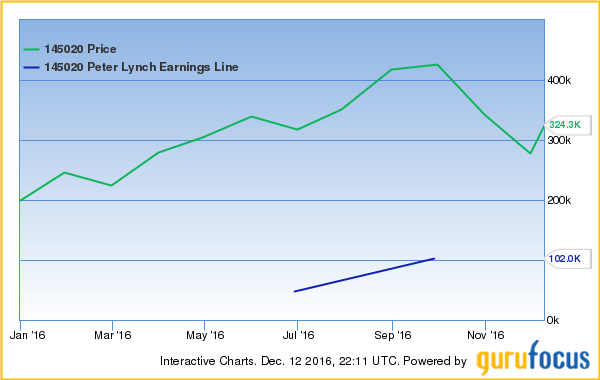

The fund invested in 20,083 shares of Hugel Inc. (XKRX:145020), a South Korean pharmaceutical company, for an average price of 394,864 South Korean won ($334.81) per share. The transaction had a 0.54% impact on the portfolio.

Hugel has a P/E ratio of 49.52, a P/B ratio of 6.53 and a P/S ratio of 23.99. GuruFocus gives Hugel a Financial Strength rating of 9/10 and a Profitability and Growth rating of 5/10 with ROE of 15.54% that is higher than 76% of the companies in the Global Drug Manufacturers - Specialty & Generic industry and ROA of 14.80% that is higher than 89% of the companies in that industry.

Hugel sold for 324,200 won. The DCF Calculator gives Hugel a fair value of 72,781.81.

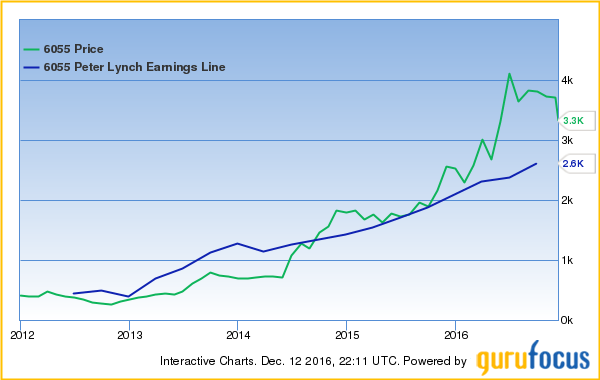

The fund purchased 205,579 shares of Japan Material Co. Ltd. (TSE:6055), a Japanese manufacturer of specialty gas supply devices, for an average price of 3,632.5 Japanese yen ($31.49) per share. The deal had a 0.54% impact on the portfolio.

Japan Material has a P/E ratio of 18.93, a P/B ratio of 4.06 and a P/S ratio of 2.68. GuruFocus gives Japan Material a Financial Strength rating of 7/10 and a Profitability and Growth rating of 6/10 with ROE of 22.60 that is higher than 86% of the companies in the Global Software - Application industry and ROA of 14.94% that is higher than 89% of the companies in that industry.

Japan Material sold for 3,425 yen per share. The DCF Calculator gives Japan Material a fair value of 1,859.73 yen.

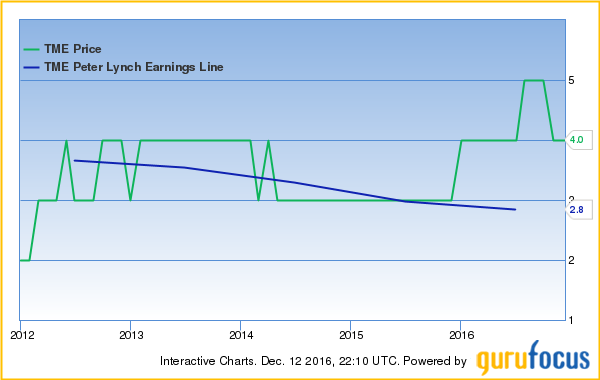

The fund bought 1,568,363 shares of Trade Me Group Ltd. (TME.NZ), a New Zealand-based Internet auction website, for an average price of 5.27 New Zealand dollars ($3.76) per share. The transaction had a 0.45% impact on the portfolio.

Trade Me Group has a P/E ratio of 25.88, a forward P/E ratio of 21.88, a P/B ratio of 2.78 and a P/S ratio of 8.88. GuruFocus gives Trade Me Group a Financial Strength rating of 7/10 and a Profitability and Growth rating of 7/10 with ROE of 11.17% that is higher than 65% of the companies in the Global Internet Content & Information industry and ROA of 8.84% that is higher than 73% of the companies in that industry.

Trade Me Group sold for 4.87 New Zealand dollars per share. The DCF Calculator gives Trade Me Group a fair value of 2.02 New Zealand dollars.

Disclosure: I do not own any stocks mentioned in this article.

Start afree seven-day trialof Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with TPE:8464. Click here to check it out.

The intrinsic value of TPE:8464

Yahoo Finance

Yahoo Finance