Waste Management Stocks Q1 Results: Benchmarking Stericycle (NASDAQ:SRCL)

Looking back on waste management stocks' Q1 earnings, we examine this quarter's best and worst performers, including Stericycle (NASDAQ:SRCL) and its peers.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 5 waste management stocks we track reported an ok Q1; on average, revenues were in line with analyst consensus estimates. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but waste management stocks have shown resilience, with share prices up 9.8% on average since the previous earnings results.

Weakest Q1: Stericycle (NASDAQ:SRCL)

Having completed 500 acquisitions since its inception, Stericycle (NASDAQ:SRCL) provides waste disposal and sensitive information destruction services.

Stericycle reported revenues of $664.9 million, down 2.8% year on year, falling short of analysts' expectations by 1.7%. Overall, it was a weak quarter for the company with a miss of analysts' organic revenue estimates.

“We are pleased with our first quarter results, which reflect improvement in adjusted EBITDA and adjusted EPS, driven by disciplined execution across our key priorities,” said Cindy J. Miller, President and Chief Executive Officer.

Stericycle delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is up 16.9% since reporting and currently trades at $58.30.

Read our full report on Stericycle here, it's free.

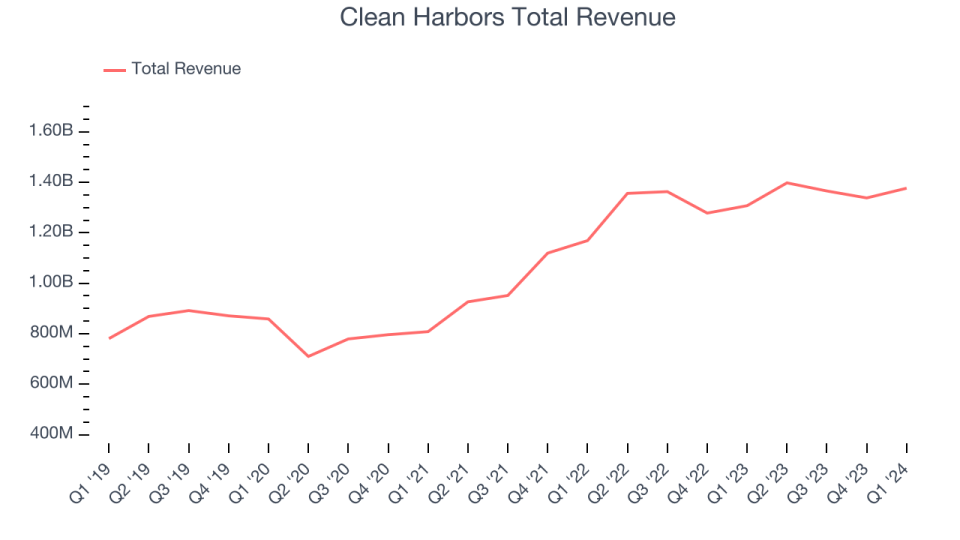

Best Q1: Clean Harbors (NYSE:CLH)

Having played a role in the cleanup of many historical oil spills, Clean Harbors (NYSE:CLH) provides environmental services like hazardous and non-hazardous waste disposal.

Clean Harbors reported revenues of $1.38 billion, up 5.3% year on year, outperforming analysts' expectations by 3%. It was a very strong quarter for the company with a solid beat of analysts' organic revenue estimates and a decent beat of analysts' earnings estimates.

Clean Harbors pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 19.4% since reporting. It currently trades at $226.44.

Is now the time to buy Clean Harbors? Access our full analysis of the earnings results here, it's free.

Republic Services (NYSE:RSG)

Using a purely natural gas-power truck fleet, Republic Services (NYSE:RSG) provides waste collection and related services across the United States and Canada.

Republic Services reported revenues of $3.86 billion, up 7.8% year on year, in line with analysts' expectations. It was a slower quarter for the company with a miss of analysts' volume estimates.

Interestingly, the stock is up 3.7% since the results and currently trades at $198.70.

Read our full analysis of Republic Services's results here.

Casella Waste Systems (NASDAQ:CWST)

Started with a single garbage truck back in 1975, Casella Waste (NASDAQ:CWST) is a waste services company that provides waste collection, disposal, and recycling.

Casella Waste Systems reported revenues of $341 million, up 29.9% year on year, in line with analysts' expectations. Zooming out, it was an ok quarter for the company with an impressive beat of analysts' earnings estimates but a miss of analysts' organic revenue estimates.

Casella Waste Systems delivered the fastest revenue growth among its peers. The stock is up 8% since reporting and currently trades at $101.65.

Read our full, actionable report on Casella Waste Systems here, it's free.

Waste Management (NYSE:WM)

Founded in 1968, Waste Management (NYSE:WM) specializes in waste collection, disposal, recycling, and environmental services across North America.

Waste Management reported revenues of $5.16 billion, up 5.5% year on year, falling short of analysts' expectations by 1.2%. Revenue aside, it was an ok quarter for the company with a solid beat of analysts' earnings estimates.

The stock is up 1.1% since reporting and currently trades at $212.66.

Read our full, actionable report on Waste Management here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.