Watch These 6 Internet Stocks for Q1 Earnings: Beat or Miss?

Internet companies are likely to have witnessed robust financial performance as they continue to benefit from the increased demand for solutions that support enterprises’ digital transformation initiatives. These companies are also gaining from the solid demand for digital offerings, as well as the increasing importance of video content and cloud-based applications.

For internet software solution providers, growth prospects are alluring, primarily owing to the rapid adoption of software-as-a-service (SaaS), which offers a flexible and cost-effective delivery method of applications. It also cuts down on the deployment time compared to legacy systems. Moreover, SaaS attempts to deliver applications to any user, anywhere, anytime and on any device.

The industry has been gaining from the increasing need for hybrid operating environments in working, learning and diagnosis software, as well as cybersecurity applications. The increasing deployment of AI and generative AI is driving prospects.

On the other hand, internet content providers are expanding their presence across social media, display and connected TV and search to drive top-line growth.

Outstanding penetration of mobile devices among users makes sense for businesses to invest heavily in web-based infrastructure, video content, applications and security software. Moreover, the pay-as-you-go model helps internet companies scale their offerings per the needs of different users. The subscription-based business model ensures recurring revenues for the industry participants.

Internet companies are a crucial component of the broader technology sector. Per the latest Zacks Earnings Preview article, the total earnings of technology companies for the first quarter of 2024 are expected to be up 19.4% from the same period last year on 8.3% higher revenues.

Amid the current scenario, investors interested in the internet software industry are eagerly awaiting the earnings releases of players like Opera Limited OPRA, Snap Inc. SNAP, Alphabet GOOGL, VeriSign, Inc. VRSN, AppFolio, Inc. APPF and Atlassian Corporation TEAM, scheduled to be released on Apr 25.

Our quantitative model predicts an earnings beat for a company if it has a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). This combination increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Let’s delve deeper.

Opera Limited will report first-quarter 2024 results. It surpassed earnings estimates for the fourth quarter of 2023 by a surprise of 666.7%. However, our proven model does not conclusively predict an earnings beat for OPRA this earnings season as it has an Earnings ESP of 0.00% and a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Opera Limited’s revenues is pegged at $100.6 million, which indicates a 15.6% increase from the year-ago quarter. The consensus estimate for the bottom line is pegged at 15 cents per share, which implies a year-over-year decrease of 11.8%.

Opera Limited Sponsored ADR Price and EPS Surprise

Opera Limited Sponsored ADR price-eps-surprise | Opera Limited Sponsored ADR Quote

Snap is set to report first-quarter 2024 results. It topped the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 103.6%. However, our proven model does not conclusively predict an earnings beat for SNAP this earnings season as it has an Earnings ESP of 0.00% and a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Snap’s revenues is pegged at $1.12 billion, which indicates a 13.2% increase from the year-ago quarter. The consensus estimate for the bottom line is pegged at a loss of 5 cents per share. In the year-ago quarter, the company reported earnings of a penny.

Snap Inc. Price and EPS Surprise

Snap Inc. price-eps-surprise | Snap Inc. Quote

Alphabet will release its first-quarter 2024 results. It surpassed the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 7.2%. Our proven model predicts an earnings beat for GOOGL this earnings season as it has an Earnings ESP of +1.43% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for Alphabet’s revenues is pegged at $66.02 billion, which indicates a 13.7% increase from the year-ago quarter. The consensus estimate for earnings is pegged at $1.49 per share, which calls for a year-over-year improvement of 27.4%.

Alphabet Inc. Price and EPS Surprise

Alphabet Inc. price-eps-surprise | Alphabet Inc. Quote

VeriSign will report first-quarter 2024 earnings. It has topped the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 4.8%. However, our proven model does not conclusively predict an earnings beat for VRSN this earnings season as it has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for VeriSign’s revenues is pegged at $388 million, which indicates a 6.5% increase from the year-ago quarter. The consensus estimate for earnings is pegged at $1.84 per share, which suggests a year-over-year increase of 8.2%.

VeriSign, Inc. Price and EPS Surprise

VeriSign, Inc. price-eps-surprise | VeriSign, Inc. Quote

AppFolio will post first-quarter 2024 results. It surpassed the Zacks Consensus Estimate for earnings in the preceding four quarters, the average surprise being 72.2%. However, our proven model does not conclusively predict an earnings beat for APPF this earnings season as it has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for AppFolio’s revenues is pegged at $175.5 million, which indicates a 29% rise from the year-ago quarter. The consensus estimate for earnings is pegged at 84 cents per share, which calls for a robust improvement from the year-ago quarter’s loss of a penny.

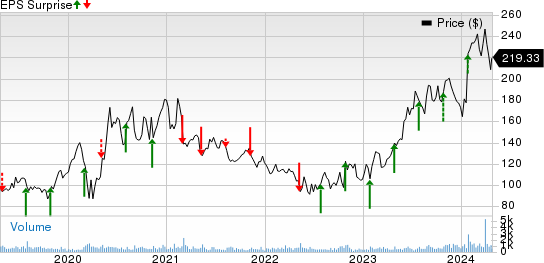

AppFolio, Inc. Price and EPS Surprise

AppFolio, Inc. price-eps-surprise | AppFolio, Inc. Quote

Atlassian will release its third-quarter fiscal 2024 results. It surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 34.2%. However, our proven model does not conclusively predict an earnings beat for TEAM this earnings season as it has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell) at present.

The Zacks Consensus Estimate for Atlassian’s revenues is pegged at $1.1 billion, which indicates a 19.7% increase from the year-ago quarter. The consensus estimate for earnings is pegged at 61 cents per share, which implies an improvement of 13% from the year-ago quarter’s earnings of 54 cents.

Atlassian Corporation PLC Price and EPS Surprise

Atlassian Corporation PLC price-eps-surprise | Atlassian Corporation PLC Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Opera Limited Sponsored ADR (OPRA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance