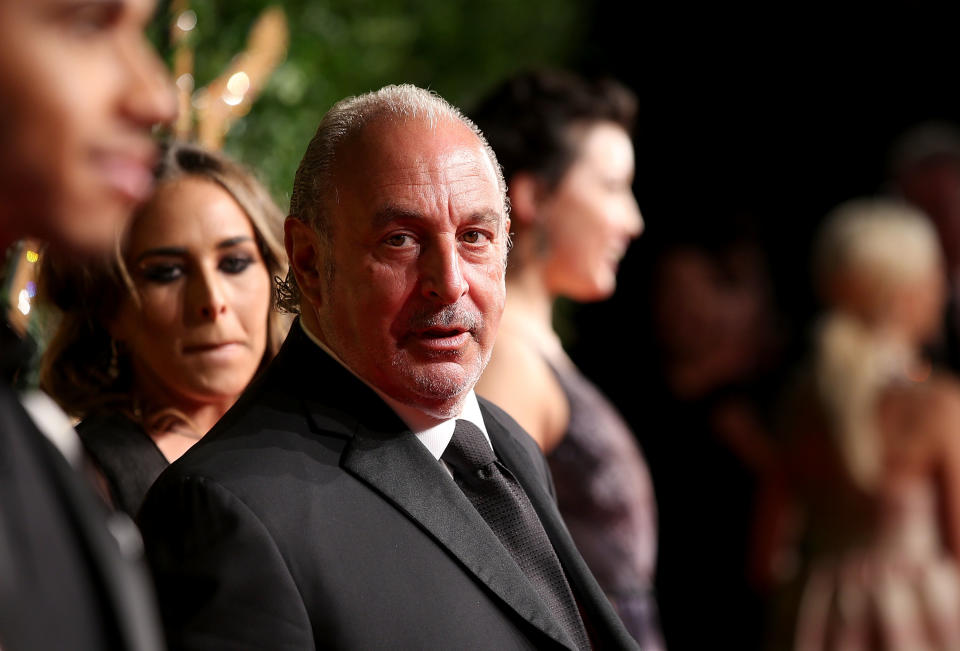

What to Watch: Resignations haunt Philip Green, pound lifted by Brexit delay expectations, stocks rise on US-China deadline delay

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and abroad:

Resignations within Philip Green’s retail empire

Karren Brady has resigned from Philip Green’s retail empire just weeks after insisting she would stay in the post despite a harassment scandal.

The Apprentice star has stepped down from her position as chairwoman of Taveta Investments, the holding company for Arcadia Group, which operates well-known UK retail chains including Topshop, Dorothy Perkins, Evans, and Burton.

Non-executive director Sharon Brown has also left the company.

In a statement, Taveta said it was “in active discussions” with potential replacements for the two outgoing board members.

Brady was accused of hypocrisy after she refused to step down earlier this month, despite the emergence of harassment claims against Sir Philip.

The businesswoman has been an outspoken critic of abuses of power in the workplace.

Her sudden departure presents another headache for retail tycoon Green, who is under investigation by US police over a groping allegation and facing renewed calls for his knighthood to be taken away.

Hope for Brexit delay lifts pound

The pound (GBPUSD=X) got a small lift on Monday morning as traders considered whether the British government might delay Brexit if prime minister Theresa May fails to secure support in parliament for her withdrawal agreement.

Britain’s Brexit crisis is going down to the wire as May struggles to get the changes she needs from the European Union to get her deal passed by parliament. She faces a growing risk that she will be forced to delay Brexit.

This has helped the pound gain about 2% over the last seven trading sessions. Traders are indicating that the chance of a disorderly no-deal exit — the worst-case scenario for the currency — is decreasing.

US delays China trade deadline

US President Donald Trump said on Sunday that he would delay an increase in US tariffs on Chinese goods thanks to “productive” trade talks.

The announcement was the clearest sign yet that China and the United States are closing in on a deal to end a months-long trade war that has slowed global growth and disrupted markets.

Trump had planned to raise tariffs from 10% to 25% on $200 billion (£153.1 billion) worth of Chinese imports into the US if an agreement between the world’s two largest economies was not reached by Friday.

After a week of talks that extended into the weekend, Trump said those tariffs would not go up for now. In a tweet, he said progress had been made in divisive areas including intellectual property protection, technology transfers, agriculture, services, and currency.

I am pleased to report that the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues. As a result of these very……

— Donald J. Trump (@realDonaldTrump) February 24, 2019

….productive talks, I will be delaying the U.S. increase in tariffs now scheduled for March 1. Assuming both sides make additional progress, we will be planning a Summit for President Xi and myself, at Mar-a-Lago, to conclude an agreement. A very good weekend for U.S. & China!

— Donald J. Trump (@realDonaldTrump) February 24, 2019

Stock markets react to deadline delay

Global stock markets were making gains on Monday morning, with investors demonstrating relief that Trump had delayed his self-imposed trade deadline with China.

Asian markets all jumped, with China’s benchmark Shanghai Composite (000001.SS) rallying by a stunning 5.6%. India’s Sensex (^BSESN) popped up by 1%.

European stock markets were rising by about 0.5% on Monday.

Britain’s FTSE 100 (^FTSE) was up by about 0.2% in morning trading, while Germany’s DAX (^GDAXI) added 0.5%. France’s CAC 40 (^FCHI) was up about 0.4%.

US stock futures were all pointing up ahead of the opening bell. The S&P 500 (ES=F), Dow Jones industrial average (YM=F), and Nasdaq (NQ=F) were rising by about 0.4% to 0.5%.

With files from PA and Reuters

Yahoo Finance

Yahoo Finance