What to Watch: Tesco, Aston Martin's IPO, and May's Brexit speech

Here’s an overview of some key companies and political developments that the Yahoo Finance UK team is monitoring today in Europe:

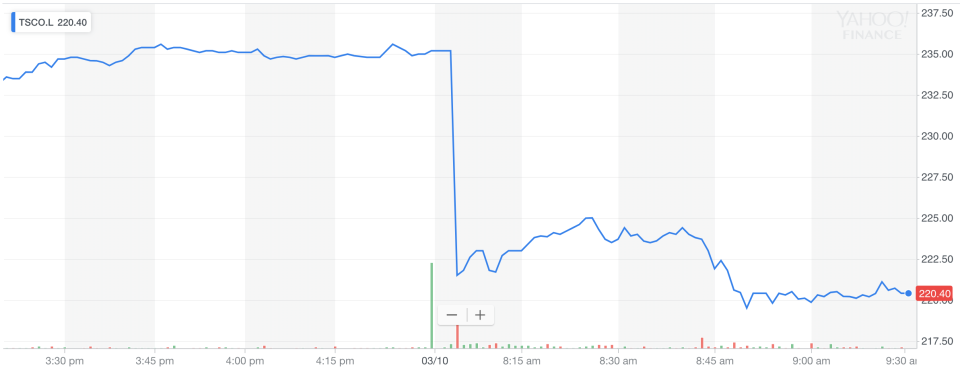

Tesco tumbles

Britain’s biggest retailer Tesco (TSCO.L) delivered its 11th consecutive quarter of rising UK and Ireland like-for-like sales, clocking a 47.6% jump in operating profits to £685m ($890m), in its interim results for 2018/2019. Out of that amount, £97m was linked to Booker, the wholesaler it acquired in 2017.

But the stock pulled down the FTSE in early trading, slumping by over 6% as of 0930 local time.

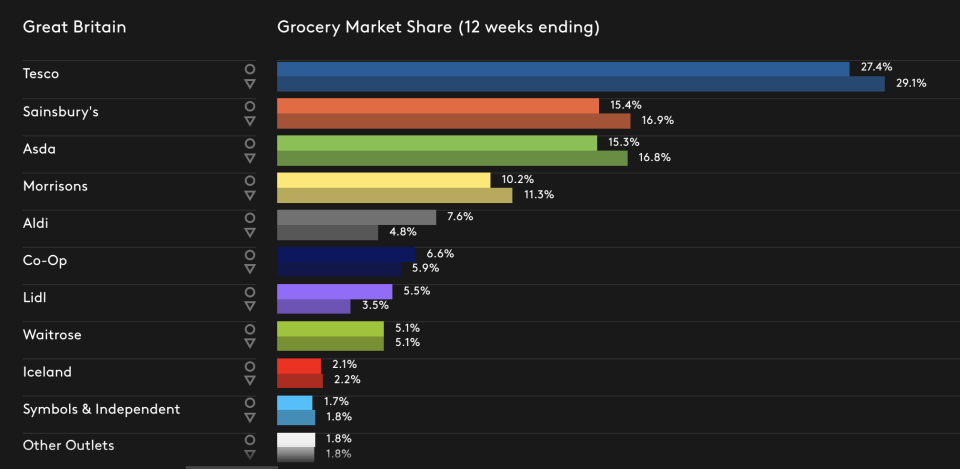

While Tesco dominates the market, the giant grocer has been facing a number of sector-wide challenges. German discounters like Aldi and Lidl are continuing to eat into marketshare of Tesco and even cheap outlets like Walmart’s (WMT) Asda. This chart shows the change in marketshare from January 2015 to 9 September 2018.

Tesco has been looking to diversify its offerings in order to put a stop to the German outlets chipping away at its position in the marketplace. It acquired Booker and recently announced that it was launching a new discount store format – Jack’s. Last month, the CEO Dave Lewis said: “If you can’t beat ’em, join ’em.”

Meanwhile, analysts at Barclays pointed out that Tesco has highlighted huge issues with overseas growth as the grocer put spotlight on Thailand, saying it will affect its second half of the year results.

READ MORE: Tesco posts rising sales as grocery giant boosted by Booker

Earlier this week, Tesco Bank (owned by the grocer) accepted the UK regulator Financial Conduct Authority’s notice and agreed to pay a settlement of £16.4m related to a fraud attack, which may have hurt customers.

“Poland lost a surprisingly large £32m in 1H – these losses will not be easy to eradicate but do present an opportunity (and show the rest of Central Europe is more profitable than we had guessed),” added Barclays analysts in a note.

Aston Martin skids on its IPO

There’s been a lot of fanfare surrounding the IPO of luxury carmaker Aston Martin.

However, on the first day of trading, the stock opened flat at the offer price of £19 per share in its London debut. It’s a disappointing start as usually stocks see a slight bump on the first day of trading which is seen as a way to build momentum around the share.

At a deflating start, Aston Martin’s stock price then fell by nearly 5%, giving it a valuation of £4.3bn ($5.6bn).

READ MORE: Why it’s a crummy time for a car IPO

“In the short term this might suggest that the shares may have been priced at too high a level,” said Michael Hewson, chief market analyst at CMC Markets UK, in a morning analyst note. “Aston Martin is one of those brands that has had a turbulent existence, seven bankruptcies in over 100 years it has enjoyed a mystical cachet for those who have charted its tribulations from afar and have seen the cars venerated in a number of James Bond films. It also has a Royal Warrant, what other car company can claim to have one of them?

“Some investors have expressed caution that the valuation seems a little on the high side, when compared to Ferrari, and the early price action certainly lends some support to that analysis. It is true that Aston Martin has only just recently returned to profit last year with revenues of £876m and pre-tax profits of £87m, after a whopping £163m loss the year before,” added Hewson.

May’s big Brexit speech

Traders will await UK prime minister Theresa May’s big speech that she’ll deliver today, giving an indication on how Britain is proceeding with Brexit talks with the European Union.

Britain has just over a month to finalise plans with the EU or risk walking away with no-deal.

May has been pushing for “Chequer’s plan” which is largely despised by the financial sector as well as even politicians within her party. The EU said large parts of it are “unworkable. This gives further suggestion that Britain will either crash out of the bloc with no-deal (also known as a hard Brexit) or have a soft Brexit (which currently looks a lot like how Britain interacts with the EU as a member state except it will relinquish decision-making powers in Brussels and will have to pay some fees).

Any indication of a no-deal or hard Brexit has sent the sterling tumbling against the US dollar (GBPUSD=X) due to the impact it would have on the economy, in which numerous analysts and thinktanks have warned would have a long-term detrimental hit on GDP.

“Brexit will continue to be the principle driving force for sterling. All eyes will be on Theresa May as the Conservative party annual conference enters into its final day,” said Jasper Lawler, analyst at London Capital Group.

Furthermore, it throws into question London’s ability to remain as a competitive financial centre as it is likely to be stripped of its $1tn euro clearing business.

If Britain did leave the EU without a deal, it would be able to pursue a number of bilateral trade deals with the likes of US and Japan. However, it has been made clear by a number of analysts and trade specialists that it would highly unlikely those types of deals would happen any time soon.

READ MORE: A no-deal Brexit won’t mean that a UK-US trade pact is going to happen anytime soon

Yahoo Finance

Yahoo Finance