Waters to Buy Andrew Alliance, Expand Technology Portfolio

Waters Corporation WAT announced that it has agreed to acquire Andrew Alliance for an undisclosed amount.

Created in 2011, Andrew Alliance is the Swiss pioneer in robotics for the Life Sciences sector. The company manufactures artificial teeth, dental metals, alloys, amalgams, and other equipment and instruments.

Andrew Alliance’s cloud-native software platform and modern interface improve the use of automation technology, making work easier for scientists. The company has approximately 40 employees in Switzerland, France and the United States.

The acquisition will help analytical laboratory instrument and software developer Waters to expand share in the growing pharmaceutical market. The software and new technologies acquired from the deal will help Waters provide better and enhanced offerings to customers, thereby expanding customer reach.

In addition, the deal will expand Waters' reach in the mass spectrometry market. Per data from Markets and Markets, the mass spectrometry market is expected to reach $6.3 billion by 2024, growing at a CAGR of 6.7% between 2019 and 2024.

Waters is already one of the leading players in the mass spectrometry market and has been garnering significantly from the sale of advanced mass spectrometry instruments. Waters' global pharmaceuticals business, its largest single market and a major revenue driver, is gaining traction over the last few quarters and fueling growth of the Waters Division.

Chris O’Connell, Chairman and Chief Executive Officer of Waters Corporation said, “The acquisition of Andrew Alliance broadens our technology portfolio to include advanced robotics and software that will positively impact our customers’ workflows across pharmaceuticals, life sciences and materials science markets".

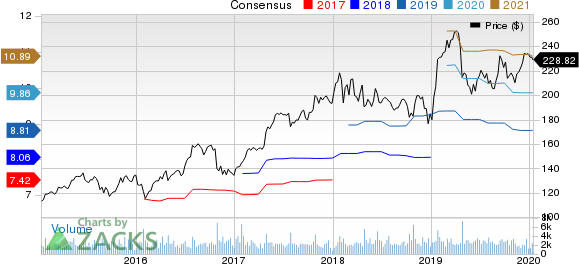

Waters Corporation Price and Consensus

Waters Corporation price-consensus-chart | Waters Corporation Quote

Price Performance

Waters has returned 15.8% compared with the industry 24.1% rally in the past 12 months.

Zacks Rank & Other Key Picks

Currently, Waters carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Itron, Inc. ITRI, MACOM Technology Solutions Holdings, Inc. MTSI and Fiverr International Ltd. FVRR. While Itron sports a Zacks Rank #1 (Strong Buy), the other two stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Itron, MACOM Technology and Fiverr is currently projected at 25%, 15% and 44.2%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waters Corporation (WAT) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Fiverr International Lt. (FVRR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance