Wayfair (W) Q2 Loss Narrower Than Anticipated, Revenues Beat

Wayfair Inc. W reported non-GAAP loss of $1.35 per share in second-quarter 2019, narrower than the Zacks Consensus Estimate of a loss of $1.36. However, the figure is wider than the year-ago loss of 77 cents.

Total second-quarter revenues came in at $2.34 billion, up 41.6% year over year. The figure also outpaced the Zacks Consensus Estimate of $2.26 billion.

The year-over-year increase in revenues was driven by strengthening of the company’s direct retail business across international regions.

Direct retail net revenues from the international segment in Canada, U.K. and Germany increased 41% year over year to $343 million (or up 47% on a constant-currency basis).

Although the Canadian business has been facing headwinds due to exchange rate and weaker consumer spending, management expects growth to accelerate in the near term due to logistics operations, allowing Wayfair to reduce the cost structure.

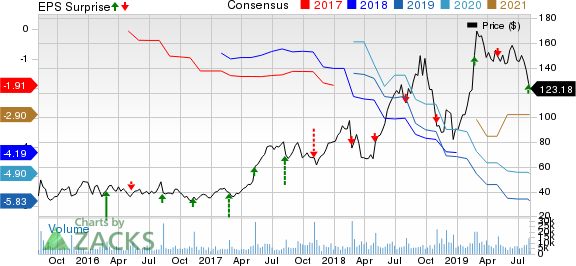

Wayfair Inc. Price, Consensus and EPS Surprise

Wayfair Inc. price-consensus-eps-surprise-chart | Wayfair Inc. Quote

Quarter in Detail

Direct retail net revenues, which include sales generated primarily through Wayfair’s sites, were $2.3 billion in the second quarter, increasing 42.1% year over year.

Active customers increased 39% from the prior-year quarter to 17.8 million. Also, LTM net revenues per active customer increased 1.6% year over year to $447 million.

Total number of orders delivered in the reported quarter was 9.2 million, up 42% year over year. In addition, orders per customer in the quarter were 1.86 million, reflecting an increase of 2.2% from the year-ago period. Further, repeat customers placed 6.2 million orders in the second quarter, up 46.1% year over year.

Operating Results

In the second quarter, Wayfair’s gross margin was 23.9%, up 60 basis points on a year-over-year basis.

Adjusted EBITDA margin was (3%) compared with (2.1%) in the year-ago quarter. This was led by increasing investments, mainly in international regions.

The company’s operating expenses of $730.8 million increased 52.1% year over year. Operating loss was $171.2 million, wider than the prior-year loss of $95.3 million.

Balance Sheet & Cash Flow

At the end of the second quarter, cash, cash equivalents and short-term investments were $714.5 million, down from $805.7 million in the comparable year-ago period. Accounts receivables were $77.3 million, up from $60.6 million in the first quarter.

Cash from operations was ($2.7) million and capital expenditure totaled $54.7 million. Free cash flow was ($91.5) million compared with ($166.8) million in the first quarter.

Zacks Rank and Stocks to Consider

Wayfair currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Alibaba Group Holding Limited BABA, Teradyne, Inc. TER and eBay Inc. EBAY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Alibaba, Teradyne and eBay is currently projected at 26.8%, 11.4% and 9.4%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report

Teradyne, Inc. (TER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance