We need a better IRS

It’s cool to hate the IRS, but it should be the opposite. Americans should demand Congress beef up funding for the nation’s tax police so it can force everybody to pay what they owe, the way most typical workers do.

New revelations about President Trump’s tax filings highlight the growing gaps in the IRS’s ability to combat aggressive tax evaders. A smallish example: Trump was apparently able to deduct $70,000 for hairstylists, even though tax rules disallow that. A bigger example: Trump pays “consulting fees” to people already on his company’s payroll, to reduce the income he needs to pay taxes on, which may also be forbidden. A huge example: Trump got a gigantic $72.9 million refund from the IRS relating to massive casino losses, even though he may have broken one of the rules required to get such a refund. Trump still has the money.

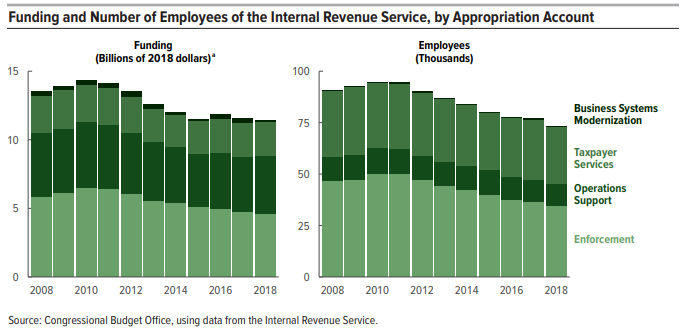

Trump seems to be a far more aggressive tax avoider than most wealthy people, but the gaps he’s exploiting are well-known and have been growing for a decade. Congress began to cut funding for the IRS in 2011, with continued declines since then that have gutted enforcement of the nation’s tax laws. From 2010 to 2018, IRS funding fell by 20%, after adjusting for inflation, according to the Congressional Budget Office. Staffing for tax audits fell by more, because that work is labor-intensive. Enforcement staffing fell 30% during the same time period, and the number of specialized “revenue officers” who handle the most complex cases fell by 48%.

Some people think software makes up for the loss of human enforcers, but the IRS software system dates to the 1960s and is the oldest at any federal agency. The use of software to flag fishy returns has actually declined, because of a 40% drop in staffing in that part of the IRS.

The upshot is a surge in tax avoidance—mostly by the wealthy—and a huge amount of tax revenue the IRS should collect each year, but doesn’t. When the IRS last estimated the “tax gap,” it totaled $381 billion from 2011 through 2013, or $127 billion per year. It’s almost certainly larger now, given the IRS’s well-known loss of enforcement ability. Even if it’s still just a $127 billion annual revenue loss, that’s enough to fund a generous infrastructure program, pay off most of the postal service’s massive debt in less than two years, cover the entire cost of Joe Biden’s generous health care plan and then some, or simply pay down the nation’s $27 trillion national debt.

The CBO thinks increasing the agency’s funding by a mere $2 billion per year would yield $6.1 billion in additional tax revenue collected. An extra $4 billion in funding would generate $10.3 billion in new revenue a year.

Economists Natasha Sarin of the University of Pennsylvania and Lawrence Summers of Harvard go further. In a recent paper, they argue that raising IRS funding back to 2011 levels, adjusted for inflation, would require an additional $10.7 billion per year, while yielding at least $100 billion per year in new revenue—or more than $1 trillion over a decade. That’s nearly as much revenue as Joe Biden’s plan to raise the corporate tax rate by 7 percentage points would produce. And it requires no new laws, just better enforcement of existing ones.

Anybody running a business would probably jump at an investment with a likely return ranging from 250% to 1,000%. So why doesn’t Congress? Mainly because of Republican hostility toward the IRS. The funding cutbacks began during the Obama administration, but only after Republicans took the House from Democrats in the 2010 midterm elections. Since then, Republicans have controlled one or both chambers of Congress, giving them the leverage to block funding increases for the IRS and lobby for funding cuts in budget negotiations. So it would probably take a win by Democrat Joe Biden, plus a Democratic sweep of the Senate, in this year’s elections to beef up the IRS.

Lax tax enforcement heavily favors the wealthy, for a few reasons. First, workers who get most or all of their income from reported wages can’t really hide income with complex tax strategies, and they mostly pay what they owe. Wealthy people getting more of their income from investments or businesses have far more opportunities to write off income, use tax loopholes and lower their tax—as Trump has done. And wealthy people obviously can more easily afford the costly accountants and lawyers necessary to exploit every loophole and outlast the IRS, if there’s an audit.

The IRS is so outgunned, in fact, that it now audits poor people at nearly the same rate as the top 1% of earners. Low-income people claiming the earned-income tax credit sometimes make mistakes, which is why the IRS targets them for audits, which are mostly automated. So they’re easy audits to do. But ProPublica last year found that “poor taxpayers continue to bear the brunt of the IRS’ remaining force,” and that the highest audit rates in the country weren’t in Greenwich or Bel-Air, but poor, rural, mostly Black communities in the south. That’s not looking where the money is. It’s looking where resistance is likely to be weakest and throwing in the towel on the harder work.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Get the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance