Weak Ad Revenues to Hurt The New York Times (NYT) Q1 Earnings

The New York Times Company NYT is scheduled to report first-quarter 2020 financial numbers on May 6, before the opening bell. In the last reported quarter, the company recorded positive earnings surprise of 22.9%. This diversified media conglomerate has a trailing four-quarter positive earnings surprise of 22%, on average.

The Zacks Consensus Estimate for first-quarter earnings is currently pegged at 13 cents, which indicates a decline of about 35% from the year-ago reported figure. We note that the Zacks Consensus Estimate has risen by a cent in the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $444.1 million, suggesting growth of about 1.2% from the prior-year quarter.

Factors Holding Key

The New York Times Company has been grappling with declining print readership and soft advertising revenues for quite some time now. Readers’ preference for accessing news online, mostly free, has made the print-advertising model increasingly redundant. Management at its last earnings call guided approximately 10% decline in total advertising revenues for the quarter to be reported. Moreover, the company had projected mid-single digit fall in digital advertising revenues.

Nonetheless, the company has been making concerted efforts to lower dependency on traditional advertising and focus on digitization. The company has been diversifying business, adding new revenue streams and streamlining operations to increase efficiencies. It has been gearing up to become not only an optimum destination for news and information but is also focusing on service journalism with verticals like Cooking, Watching and Well. The company has been also resorting to data analytics and modeling to engage the audience and provide targeted marketing services on behalf of local businesses.

Moreover, with readers’ increasing preference for accessing news online, the company has been concentrating on online activities, as evident from its pay-and-read model. We note that management had earlier forecast an increase of mid-single digit in total subscription revenues and high-teens in digital-only subscription revenues for the first quarter.

However, industry experts have not ruled out the impact of the coronavirus outbreak on the company. While they believe that that company may have gained from a rise in paid digital subscriptions, the dwindling advertising revenues remain a concern.

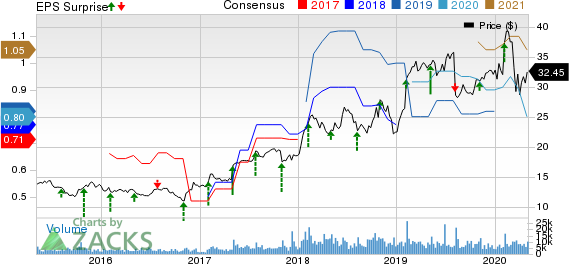

The New York Times Company Price, Consensus and EPS Surprise

The New York Times Company price-consensus-eps-surprise-chart | The New York Times Company Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for The New York Times Company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Although The New York Times Company carries a Zacks Rank #3, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Boingo Wireless WIFI has an Earnings ESP of +26.47% and a Zacks Rank of #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

NetEase NTES has an Earnings ESP of +3.70% and a Zacks Rank of #3.

Discovery DISCA has an Earnings ESP of +1.24% and a Zacks Rank of #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discovery, Inc. (DISCA) : Free Stock Analysis Report

The New York Times Company (NYT) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Boingo Wireless, Inc. (WIFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance