Will Weak Equity Markets Dampen Franklin's (BEN) Q2 Earnings?

Franklin Resources, Inc. BEN is scheduled to report second-quarter fiscal 2020 results, before the opening bell on Apr 30. The company’s results are projected to reflect year-over-year declines in earnings and revenues.

In the last reported quarter, Franklin’s results surpassed the Zacks Consensus Estimate. The company’s results reflected higher revenues and assets under management (AUM). Also, a strong capital position was a positive. However, net outflows and escalating expenses were undermining factors.

In addition, Franklin recorded positive earnings surprises in three out of the trailing four quarters and a negative in the other, the average positive beat being 3.5%.

Nevertheless, the company’s activities in the fiscal second quarter were inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for earnings of 44 cents remained unchanged over the last seven days. Also, the figure reflects a year-over-year plunge of 38.9%.

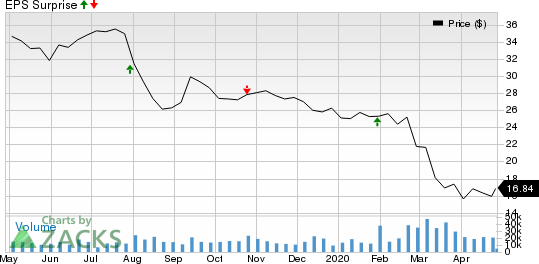

Franklin Resources, Inc. Price and EPS Surprise

Franklin Resources, Inc. price-eps-surprise | Franklin Resources, Inc. Quote

Earnings Whispers

Franklin does not have the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The company has an Earnings ESP of 0.00%.

Zacks Rank: Franklin’s Zacks Rank of 4 (Sell) decreases the predictive power of ESP.

Factors at Play

Tepid Markets: Performance of equity markets was weak during the January-March quarter on the coronavirus concerns. The S&P 500 Index decreased 19.6% sequentially in the quarter. Moreover, the index measuring international equity performance — the MSCI EAFE — depreciated 22.7% sequentially. This is expected to have impacted the California-based asset manager’s performance to a large extent.

Lower AUM: Given Franklin’s AUM disclosure for March 2020 and unfavorable foreign-currency fluctuations, its results are predicted to display a lower AUM, on a sequential basis. Also, the company is likely to have recorded outflows mainly tied with U.S. and non-U.S. mutual funds.

Per the Zacks Consensus Estimate, total AUM for the to-be-reported quarter is projected to be down 18.1% to $572 million sequentially.

Revenue to Decline: Investment management fees, which mark a significant portion of the company’s revenues, might have registered a decline in the fiscal second quarter. The consensus estimate for investment management fees of $890 million indicates a 9.2% sequential decrease. Furthermore, sales and distribution fees are projected to drop 8.2% sequentially to $323 million in the quarter.

Overall, the Zacks Consensus Estimate for revenues of $1.33 billion indicates a year-over-year fall of 7.4%.

Controlled Expenses: Management remains focused on prudent cost control. It expects expenses to be down 2-2.5% year over year in 2020, which might be reflected in the fiscal second-quarter results as well.

Stocks That Warrant a Look

Here are a few stocks you may want to consider, as according to our model these have the right combination of elements to post an earnings beat this quarter.

Moody's Corporation MCO is scheduled to release results on Apr 30. The company currently has an Earnings ESP of +0.18% and currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Boston Private Financial Holdings, Inc. BPFH is +1.54% and the stock carries a Zacks Rank of 3, currently. The company is set to announce quarterly numbers on Apr 29.

First BanCorp. FBP is slated to report earnings figures on Apr 30. The company, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +8.51%.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

First BanCorp. (FBP) : Free Stock Analysis Report

Boston Private Financial Holdings, Inc. (BPFH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance