WEC Energy (WEC) Arm Starts Buying 6% Notes to Cut Interest Costs

WEC Energy Group, Inc.’s WEC subsidiary Integrys Holding, Inc. begins purchasing 6% junior subordinated notes up to $150 million due 2073 for a total consideration of $27.20 (including $1.25 of early tender premium). The offer for purchase will expire on Nov 4, 2021. The company aims to repurchase a portion of the $400 million above-mentioned junior subordinated notes.

The utility’s interest expenses declined to $239.5 million in the first six months of 2021 from $253.8 million in the comparable period of 2020. The current move will help it further trim its interest expenses.

Debt Position

As of Jun 30, 2021, the company had long-term debt of $12,695.7 million compared with $11,728.1 million on Dec 31, 2020. This increase can be attributed to the $600-million worth 0.80% senior notes issued in March 2021 to repay the $340-million term loan taken in March 2020 and for general corporate purposes.

Its times interest earned ratio at the second-quarter end improved to 4.14 from 4.04 in the prior quarter. A strong ratio indicates that the firm will be able to meet its debt obligations in the near future without any difficulties.

Moreover, WEC Energy carries strong investment-grade credit ratings, ranging between A- and Baa1, which allow it to enjoy superior creditworthiness in the market. This, in turn, allows the company to access cheaper sources of funds for its investment projects.

Peer Moves

Other utility companies are also tapping the low interest rate environment by either redeeming their debts or refinancing the same from the proceeds of a new series issued at a lower interest rate to lower capital servicing costs.

In September, NRG Energy NRG announced plans to redeem $500 million of its 6.625% senior notes due 2027 to reduce its annual interest burden by $33.1 million. In May, Brookfield Infrastructure Partners LP BIP offered $250-million subordinated notes with an interest rate of 5%, net proceeds from which will be utilized in redeeming its existing debts.

Price Performance

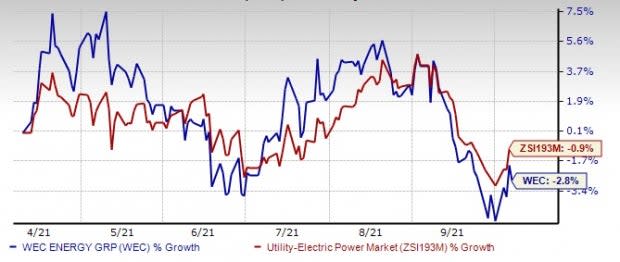

Shares of WEC Energy have lost 2.8%, compared with the industry’s fall of 0.9% in the past six months.

Six Months Price Performance

Image Source: Zacks Investment Research

Zacks Rank & Key Pick

Currently, the company has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked utility is Otter Tail Corporation OTTR, flaunting a Zacks Rank #1 at present. Otter Tail came up with an earnings surprise of 31.80%, on average, in the last four quarters. Its long-term earnings growth rate is pegged at 4.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Brookfield Infrastructure Partners LP (BIP) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Otter Tail Corporation (OTTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance