The week ahead in business and finance

Monday February 20

Bovis Homes will not deliver the number of houses it originally expected in 2016, after about 180 sales failed to complete before the end of the year. As such, investors should expect the number of houses build for 2016 to be between 3,950 and 4,000. The mid-cap company has also said its pre-tax profits for the year will be within a range of £160m-£170m. Just last month, the group’s chief executive David Ritchie stepped down following its latest profit warning, with Earl Sibley, the group’s finance director, assuming the role in the interim.

Full-year results: Hammerson, Bovis Homes Group

Interim results: Gemfields, Sareum Holdings, Vedanta Resources, London Finance & Investment Group

Economics: Rightmove HPI m/m (UK), CBI industrial order expectations (UK), PPI m/m (GER), consumer confidence (EU)

Tuesday February 21

InterContinental Hotels saw slower growth in room rates in the third quarter and this trend is set to continue in the fourth quarter. Growth in revenue per available room (RevPAR), a key industry measure, eased to 1.3pc in the three months through September at its hotels worldwide, from 2.5pc in the second quarter. Ahead of its full-year results, analysts at UBS think US RevPAR will continue to decelerate. Meanwhile, consensus forecasts point to revenue growth of just 1pc for 2016 to £1.7bn, and flat earnings per share of 194p. The group is also facing rising competition from online holiday rental startups such as Airbnb.

Jarrod Castle, of UBS, said: “While IHG has strong brands, management and digital strategy we think the market is too complacent when it comes to the shared accommodation challenges.”

Full-year results: John Wood Group, HSBC Holdings, InterContinental Hotels, Lighthouse Group, Anglo American

Interim results: Green Reit, Image Scan Holdings, Vernalis, Galliford Try, BHP Billiton, Safestore Holdings

Trading update: Eros International, Utilitywise, Travelport Worldwide

Economics: Inflation report hearings (UK), CBI realised sales (UK), flash manufacturing PMI (US), flash services PMI (US), existing home sales (US), FOMC meeting minutes (US), flash manufacturing PMI (EU), flash services PMI (EU), flash manufacturing PMI (GER), flash services PMI (GER), Ifo business climate (GER), final CPI y/y (EU)

Wednesday February 22

Investors focus will shift to Lloyds’ promised special dividend for 2016 when it delivers its full-year results. In December, analysts voiced concerns the British lender might have to reconsider its special dividend in order to fund its purchase of the MBNA UK credit card business from Bank of America for £1.9bn. However, Lloyds has previously said that it was confident of being able to deliver a progressive and sustainable ordinary dividend in 2016.

Ahead of its results, Morgan Stanley forecast pre-tax profit growth of 6pc and flat revenues quarter-on-quarter. Analysts at the US investment bank said: “We expect costs to increase quarter-on-quarter driven by the bank levy.”

Full-year results:UBM, Serco Group, Unite Group, Lloyds Banking Group, Indivior, Capital & Counties Properties, Petrofac, Weir Group

Interim results: Barratt Developments, Hays, Pan African Resources, McBride

Trading update: Metro Bank

Thursday February 23

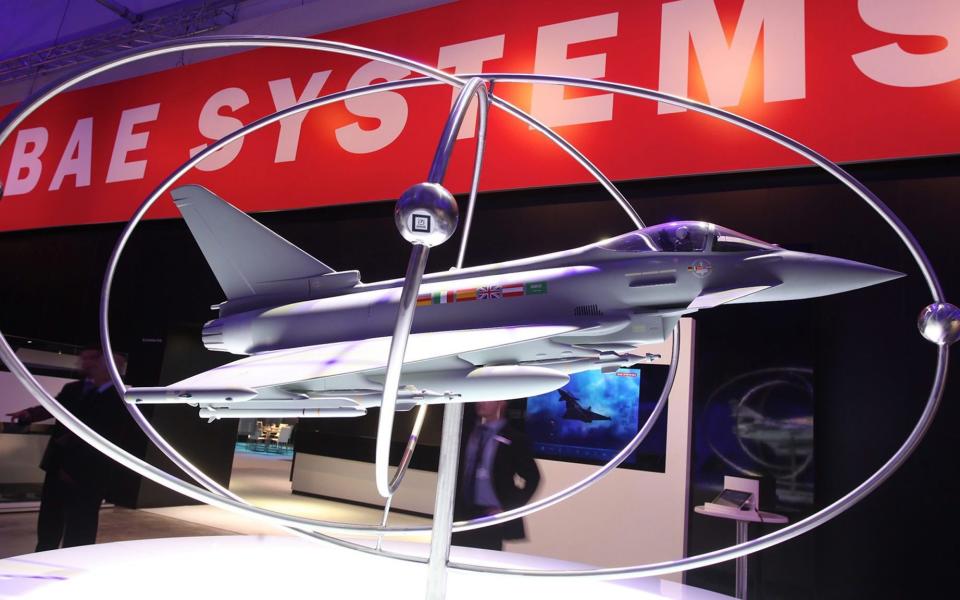

British defence BAE Systems’ full-year results will likely be focused on the group’s guidance for this year, whether the long awaited $10-12bn Saudi five-year support contract renewal has come through and management’s confidence over the pension valuation process. Ahead of its full-year results, Deutsche Bank expects the FTSE 100 group to deliver flat organic revenue and sales growth of 4pc, boosted by favourable foreign exchange rate moves. Analysts also think the market will be looking closely at its 2017 guidance, which Deutsche Bank expects will confirm low single digit organic sales growth, bolstered by expectations US President Donald Trump will ramp-up regional defence spending.

In October, BAE said trading was in-line with expectations, and it still expected to deliver a 5-10pc rise in underlying earnings per share this year.

Full-year results:RELX, Mondi, Intu Properties, Playtech, Howden Joinery Group, BAE Systems, Barclays, British American Tobacco, Glencore, Rathbone Brothers, Rentokil Initial, National Express Group, Morgan Advanced Materials, Kaz Minerals, Centrica, RSA Insurance, Greencoat UK Wind, Macfarlane Group

Interim results: Wilmington Group, Monitise

Economics: second estimate GDP q/q (UK), index of services 3m/3m (UK), preliminary business investment q/q (UK), BBA mortgage approvals (UK), unemployment claims (US), housing starts (US), new home sales (US), revised UoM consumer sentiment (US), revised UoM inflation expectations (US), final GDP q/q (GER),

Friday February 24

Expect a small rise in profitability when Jupiter Fund Management unveils its full year results. Consensus forecasts point to an uptick of revenue from £32.9.5m in 2015 to £354m last year, while pre-tax profits are anticipated to growth to £173m, up from £169.1m in the previous year. In the fourth quarter, clients pulled £373m from its investment products. Ahead of the results, Stuart Duncan, of Peel Hunt, cautioned: “A key will be on whether the outflows in the last quarter were a blip, or more indicative of challenging conditions.” Earlier this year, the fund manager said the effects of market uncertainty on its performance in 2016 had been muted. However, it cautioned political uncertainty could hurt investor sentiment this year.

Full-year results: Jupiter Fund Management, Pearson, Kennedy Wilson Europe Real Estate, Rightmove, Coats Group, TBC Bank Group, IMI, Standard Chartered, William Hill, Royal Bank of Scotland, Standard Life

Yahoo Finance

Yahoo Finance