Welltower (WELL) to Post Q4 Earnings: What's in the Cards?

Welltower, Inc. WELL is slated to report fourth-quarter and full-year 2022 earnings on Feb 15, after market close. While the quarterly results are likely to reflect year-over-year revenue growth, funds from operations (FFO) per share might exhibit a decline.

In the last reported quarter, this Toledo, OH-based healthcare real estate investment trust (REIT) witnessed normalized FFO per share of 84 cents, in line with the Zacks Consensus Estimate. The results reflected better-than-anticipated revenues. The same-store revenues of the seniors housing operating (SHO) portfolio increased year over year, owing to an improvement in SHO portfolio occupancy and average revenues generated per occupied room per month (REVPOR) during the quarter.

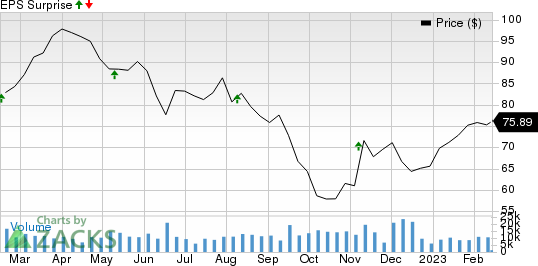

Over the preceding four quarters, Welltower’s FFO per share beat the Zacks Consensus Estimate on two occasions and met the same in the other two, the average surprise being 0.91%. The graph below depicts this surprise history:

Welltower Inc. Price and EPS Surprise

Welltower Inc. price-eps-surprise | Welltower Inc. Quote

Factors at Play

Welltower has a diversified portfolio in the healthcare real estate industry in the major, high-growth markets of the United States, Canada and the United Kingdom.

During the fourth quarter, the company’s SHO portfolio is likely to have continued to benefit from an aging population and a rise in healthcare spending by this age cohort, which is generally higher than the average population.

In addition, robust pricing power, evidenced by strong realized renewal rate growth and improving street rates during the quarter are expected to have aided the SHO portfolio’s performance.

Per WELL’s November business update, management anticipates SHO portfolio year-over-year same-store revenue growth of around 9.5%, backed by accelerating rate growth and continued occupancy gains. Moreover, a decline in agency labor expense is likely to have been a tailwind.

WELL expects an acceleration in same-store net operating income growth for the SHO portfolio across all geographies to be 21% at the midpoint.

The Zacks Consensus Estimate for the fourth-quarter resident fees and services is pegged at $1.09 billion, indicating an increase of 2.5% from the previous quarter’s $1.07 billion and 22.2% from the year-ago quarter’s $897 million. The consensus estimate for quarterly rental income stands at $365 million, implying a 1.7% rise from the prior-year quarter’s actuals.

Total revenues for the fourth quarter are pegged at $1.50 billion, suggesting a rise of 14.4% from the prior-year period’s reported number.

Welltower’s restructuring initiatives over the recent years have enabled it to attract top-class operators, while its dispositions have helped improve the quality of its cash flows. Also, these efforts have added to its balance sheet strength, poising it well to capitalize on growth opportunities.

In December 2022, Welltower and Integra Health entered into a master lease for the entirety of the 147-property skilled nursing portfolio originally owned by Welltower and ProMedica in an 85/15 joint venture (JV). The move was part of Welltower’s efforts to transition the nursing portfolio.

As a result, ProMedica surrendered its 15% interest in the 85/15 JV and was released of all its lease obligations for the entire portfolio.

Simultaneously, Welltower sold 15% interest in 54 skilled nursing assets to Integra for around $73 million. This represented the initial tranche of the earlier announced 85/15 JV between the two entities.

However, per the November business update, higher interest rates and a stronger U.S. dollar are anticipated to have led to a reduction in normalized FFO per share of 6 cents and 3 cents from the year-ago and prior-quarter numbers, respectively.

The Zacks Consensus Estimate for the fourth-quarter FFO per share has been unchanged at 82 cents over the past month. It implies a fall of 1.2% from the year-ago quarter’s reported figure.

Welltower projected fourth-quarter 2022 normalized FFO per share to be 80-85 cents.

For the full year, the Zacks Consensus Estimate for FFO per share has been revised marginally upward to $3.35 over the past week. Moreover, the figure indicates a 4.4% increase from the prior year on revenues of $5.81 billion.

Earning Whispers

Our proven model does not conclusively predict a surprise in terms of FFO per share for Welltower this season. The combination of a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that’s not the case here.

Earnings ESP: Welltower has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: WELL currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks That Warrant a Look

Here are some stocks from the REIT sector, which according to our model, have the right combination of elements to deliver a surprise this reporting cycle:

Digital Realty Trust DLR is scheduled to report quarterly figures on Feb 16. DLR currently has an Earnings ESP of +0.99 % and a Zacks Rank of 3.

Park Hotels & Resorts PK is scheduled to report quarterly figures on Feb 22. PK currently has an Earnings ESP of +3.66% and a Zacks Rank of 3.

VICI Properties VICI is scheduled to report quarterly figures on Feb 23. VICI currently has an Earnings ESP of +0.29% and a Zacks Rank #2 (Buy).

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance