We're Keeping An Eye On OnTheMarket's (LON:OTMP) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether OnTheMarket (LON:OTMP) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for OnTheMarket

When Might OnTheMarket Run Out Of Money?

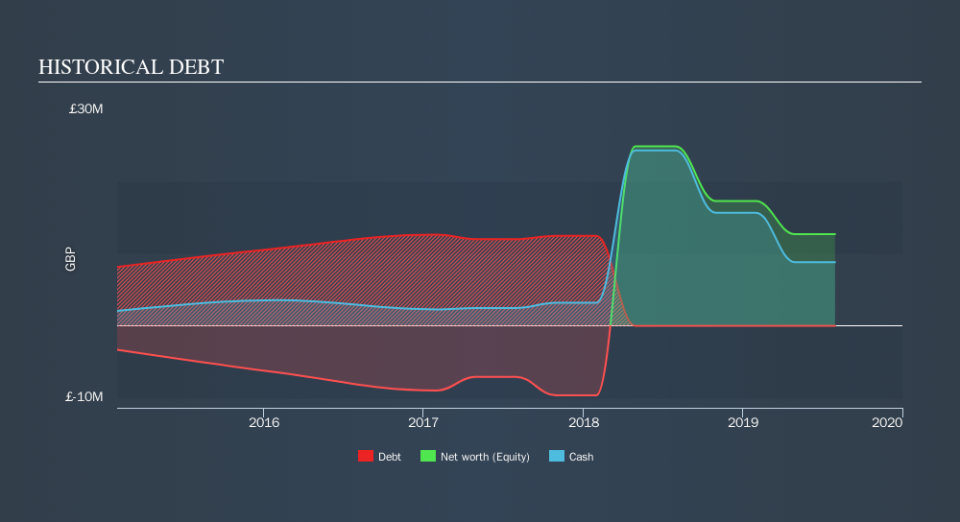

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When OnTheMarket last reported its balance sheet in July 2019, it had zero debt and cash worth UK£8.8m. In the last year, its cash burn was UK£15m. That means it had a cash runway of around 7 months as of July 2019. Notably, analysts forecast that OnTheMarket will break even (at a free cash flow level) in about 17 months. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. You can see how its cash balance has changed over time in the image below.

How Well Is OnTheMarket Growing?

Notably, OnTheMarket actually ramped up its cash burn very hard and fast in the last year, by 174%, signifying heavy investment in the business. While operating revenue was up over the same period, the 11% gain gives us scant comfort. Considering both these metrics, we're a little concerned about how the company is developing. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can OnTheMarket Raise More Cash Easily?

Given the trajectory of OnTheMarket's cash burn, many investors will already be thinking about how it might raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of UK£44m, OnTheMarket's UK£15m in cash burn equates to about 34% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About OnTheMarket's Cash Burn?

On this analysis of OnTheMarket's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. We think it's very important to consider the cash burn for loss making companies, but other considerations such as the amount the CEO is paid can also enhance your understanding of the business. You can click here to see what OnTheMarket's CEO gets paid each year.

Of course OnTheMarket may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance