‘We weren’t trying to avoid tax – but now our lives are in ruins’

Every call was the same. “Call after call, all of them were totally distressed, some crying. If they were crying, I’d tell them to get a cup of tea and I would talk until they were ready to speak.

“They all said the same thing. Nurses, IT contractors, pilots, people from all walks of life, they all said, ‘I thought everything was fine, I checked it was HMRC-approved, I don’t know what I’ve done wrong’.”

This was how a volunteer for the Loan Charge Action Group described what it was like to answer the campaign group’s helpline, set up more than five years ago to help people who had been handed devastating tax bills by HM Revenue and Customs.

To HMRC, they are tax cheats who need to pay their fair share, but thousands of middle-income earners caught up in the effort to clawback more than £3bn insist they were none-the-wiser and were led astray by their advisers and employers.

But whoever is to blame, one thing is clear – the pursuit of unpaid taxes is causing widespread distress and MPs are now calling for the hunt to be called off. The debacle is also now being compared to the Post Office Horizon scandal.

More than 50,000 self-employed workers have been hit with crippling tax liabilities in HMRC’s pursuit of the loan charge, a controversial law linked to 10 suicides.

The loan charge was introduced in 2017 to target contractors – including nurses, IT workers and teachers – who had been paid their salaries via loan schemes.

Some workers claim they were told by agencies they had to be paid this way if they wanted to work for certain companies.

The loan charge can result in catastrophic bills. When it was first introduced, all the loans received by the contractor were treated as income for one year – meaning the tax was usually due at the top rate of 45pc.

HMRC has been criticised for aggressively chasing after sums that are blatantly unaffordable. If someone cannot afford to pay their tax bill all in one go, the tax office will set up a ‘time to pay’ arrangement.

But some contractors were given unmanageable payment plans. One individual was ordered to pay £3,511 every month despite the fact their monthly income was only around £2,000, according to the Loan Charge Action Group.

Another was warned HMRC would start bankruptcy proceedings if they did not pay £70,000 within 11 days.

One man, who asked to remain anonymous, told The Telegraph that HMRC rang him while he was in the hospice and asked if he was expecting an inheritance after his father’s death.

“I was completely shocked by this. It was a few hours before my father passed away.”

In an email to the contractor, an HMRC caseworker apologised for “any distress and upset” caused by their colleague’s question.

Dozens of others have reached out to The Telegraph with stories of how the loan charge destroyed their marriage, pushed them into depression and drove them to try and take their own life.

‘It makes you feel powerless’

In early 2018, Rob Jessel, 43, a freelance writer from Oxfordshire, came home to a letter from HMRC.

At the time he was saving up for a deposit on a house. He thinks he was about a year off meeting his savings target when the letter arrived, saying he owed years’ worth of tax.

“Everything changed after that,” he said. “I don’t earn a massive amount, yet over six to eight years I’d been using this umbrella company, and I stood to pay about £5,000 for each year.”

Mr Jessel claims his first freelance job had required him to use a particular umbrella company and after that he shopped around for similar arrangements. He believed it was completely legitimate.

“People who don’t have experience of this think we’re tax avoiders who got what they deserved,” Mr Jessel said. “Freelancers will understand this a bit more.”

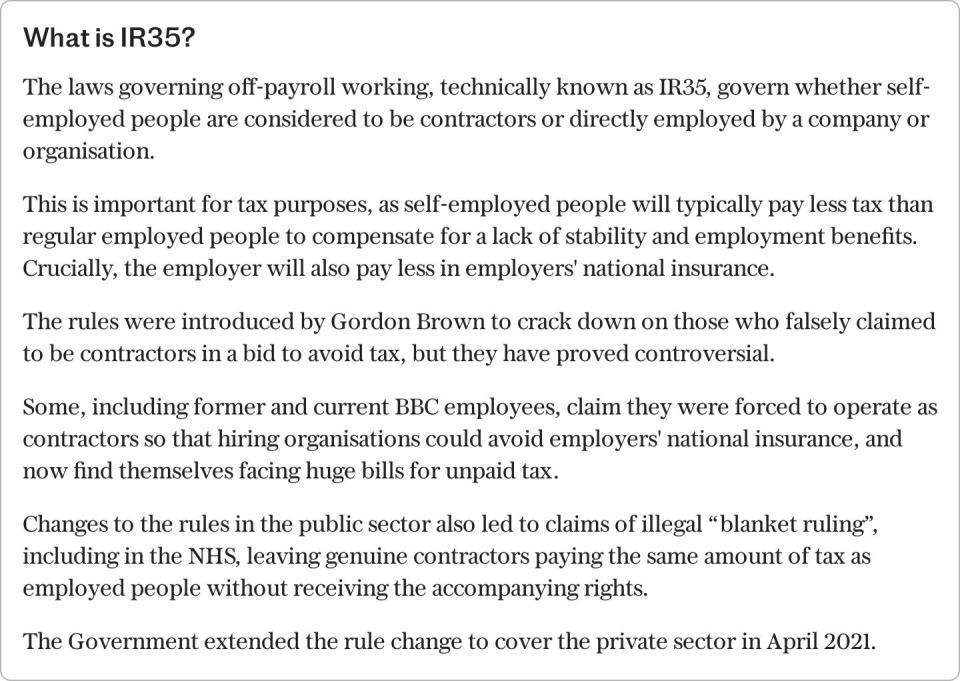

Many contractors sought to delegate their tax affairs to professional firms following the introduction of IR35 “off-payroll working rules” in 2000.

These rules blurred the line between self-employment and employment. Anyone who fell foul of them could be investigated by HMRC.

Sarah Gabbai, of law firm McDermott Will & Emery, said: “The vast majority of those affected by the loan charge were not seeking to avoid tax, but instead sought the administrative convenience of an umbrella company solution and also to avoid the uncertainty of being deemed to be ‘inside IR35’, having followed what they thought was professional advice and conducted reasonable due diligence.”

Mr Jessel said: “If I knew, I wouldn’t have done it.”

HMRC had known about these arrangements for decades and had attempted to defeat them in tribunals.

But tax lawyers have criticised HMRC for failing to warn contractors of what they were exposing themselves to.

Keith Gordon, of barristers Temple Tax Chambers, said: “In 2004, HMRC required schemes to notify them of participants. But HMRC failed to notify participants of their views about the viability of these schemes.

“HMRC did nothing and allowed people to build up fiscal timebombs, causing untold misery.”

Shirley Read, based in Milton Keynes, was encouraged to use a loan scheme when she started working in London as a freelance project manager. “I believe I did my due diligence as I was told to call HMRC and check the scheme,” she said.

She was reassured when HMRC confirmed the scheme’s reference number.

HMRC issues a reference number to all schemes notified to them so that tax returns can be flagged up and challenged. A scheme reference number does not mean that HMRC approves the scheme.

But Mr Gordon said the reference number gave many contractors a false sense of security. “They stayed in for longer because HMRC continued to express no objection.”

The tax liability forced Mr Jessel to give up on his dream of home ownership.“I’ve decided that things like owning your own home happen to other people. It’s changed what I expected to get out of life,” he said.

Ms Read was hit with a £30,000 bill for her involvement in the scheme.

“No explanation, no breakdown of the calculation. I received it on a Saturday, so I could not even get hold of anyone to ask about it.”

Retrospective tax is “unjust”

The loan charge is controversial because it is a form of retrospective taxation. Through it, HMRC recoups money from schemes entered into years ago when they were technically legitimate.

One contractor compared this to reducing the speed limit on a road, and then going after drivers who had passed through years before.

Greg Mulholland, of the Loan Charge Action Group, said: “The outrage of the loan charge is that it overrides the basic taxpayer protections, allows HMRC to ignore statutory time limits and also pursue closed tax years, where they didn’t open an enquiry (meaning people would have certainly assumed, according to the law at the time, that their tax affairs were in order and accepted by HMRC).”

There have been 13 attempted suicides in connection with the loan charge scandal, Parliament heard this month.

Stephen Clee said the stress drove him to consider taking his life.

“That is not an easy declaration to make,” he said. “But I am willing to make it public to try to highlight the kind of methods the HMRC were using to bully innocent people into believing they had broken the law.

“The stress caused me, through complete paranoia, to lose three very good permanent job roles in three years. I believed I was being persecuted and felt I had to leave these roles before I was pushed.

“On leaving the third one I worried that I couldn’t go home again to my poor, long-suffering wife and tell her I’ve just lost another job.

“I spent hours driving around thinking of the best place to send my car over a cliff to end the worry and misery I was heaping upon her.

“Then at some point it dawned on me that, despite my current state of mind, my wife had recently gone through a series of heartfelt losses and it wouldn’t be fair on her to put her through even more heartache.

“I finally pulled in the courage to go home to her and face the music. There was no ‘music’. She was totally distraught that I considered ending my life and begged me to promise her that I would never contemplate that again, and if the gloom descends on me again to talk to her and we would sort it out together.

“The sense of despair and shame I was made to feel has never left me, and my life is still affected up to this day.”

The Loan Charge Action Group has had to close its helpline due to a lack of funding and volunteers, but it still offers support to those impacted by the loan charge.

HMRC said it is working with Samaritans to identify vulnerable taxpayers and signpost them to the charity’s dedicated helpline.

Last week, cross-party MPs urged the Government to open a new independent review into the loan charge scandal, and consider scrapping the charge outright.

However, Nigel Huddleston, financial secretary to the Treasury, said after the debate that he did not believe a case had been made to launch a new review.

After the Morse Review, carried out in 2019, the Government decided the loan charge should only apply to outstanding loans made on, or after, Dec 9 2010 (rather than April 1999).

However, many who took out loans before this date still had to pay tens of thousands of pounds through an accelerated payment notice – a requirement issued by HMRC to pay tax that is in dispute.

The Morse Review also said that individuals subject to the loan charge should not be asked to pay more than half their disposable income each year.

In October 2022 a group of 64 tax professionals, including Ms Gabbai and Mr Gordon, proposed a potential settlement for the loan charge victims.

This included the recommendations that loan charge victims only pay sums which are “genuinely affordable”, in recognition of HMRC’s failure to collect PAYE from the employers and shut down the schemes.

“Unfortunately the Government’s response was inadequate and failed to address the issues raised in our letter,” Ms Gabbai said.

An HMRC spokesman said: “We never forget that there’s a human story behind every unpaid tax bill and we take the wellbeing of all taxpayers very seriously.

“We recognise that dealing with large tax liabilities can lead to pressure on individuals and we are committed to identifying and supporting customers who need extra help with their tax liabilities, and we have made significant improvements to this service over the last few years.

“HMRC has support in place to help customers who have used a tax avoidance scheme to settle their use. This includes paying by instalments in a ‘time to pay’ arrangement. The arrangement we agree will be based on what the taxpayer can afford and there’s no upper limit over how long we can potentially spread payments.

“Our message to anyone who is worried about paying what they owe is: please contact us as soon as possible to talk about your options.”

Recommended

HMRC owes tax rebates to millions – here’s how to get yours

Yahoo Finance

Yahoo Finance