Werner's (WERN) Q2 Earnings Meet Estimates, Stock Down 2.3%

Werner Enterprises Inc. WERN reported second-quarter 2021 earnings (excluding 20 cents from non-recurring items) of 86 cents per share, in line with the Zacks Consensus Estimate. The bottom line surged 38.7% year over year. However, bottom-line results seem to have displeased investors. The stock lost 2.3% of its value since its earnings release on Jul 29.

Total revenues of $649.8 million outperformed the Zacks Consensus Estimate of $643 million. The top line moved up 14.2% on a year-over-year basis. The uptick can be primarily attributed to higher revenues in the Truckload Transportation Services and Logistics segments.

Operating income (adjusted) came in at $79.1 million in the reported quarter, up 37% year over year. Adjusted operating margin increased 210 basis points (bps) to 12.2%. Operating expenses surged 11% to $5723 million.

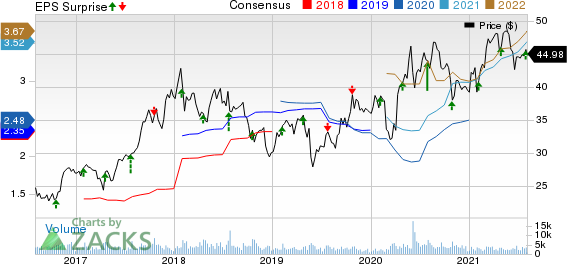

Werner Enterprises, Inc. Price, Consensus and EPS Surprise

Werner Enterprises, Inc. price-consensus-eps-surprise-chart | Werner Enterprises, Inc. Quote

Segmental Results

Revenues in the Truckload Transportation Services (“TTS”) segment increased 10% on a year-over-year basis to $491.2 million. The upside can be attributed to 68% rise in fuel surcharge revenues. Adjusted operating income surged 33% to $74.4 million. Additionally, adjusted operating margin expanded 250 bps to 15.1%. Adjusted operating ratio (operating expenses, as a percentage of revenues) expanded 250 bps to 84.9%. Notably, lower the value of the metric, the better.

Werner Logistics segment’s revenues totaled $141.7 million, up 29% year over year owing to 10% rise in truckload logistics volume and 37% rise in revenues per shipment. The segment reported operating income of $3.93 million, up 25% from the year-ago quarter’s levels. Further, operating margin was 2.8%, flat year over year. The Other segment accounted for the rest of the top line.

Liquidity

As of Jun 30, 2021, Werner, carrying a Zacks Rank #2 (Buy), had cash and cash equivalents of $192.1 million compared with $29.33 million at 2020 end. Long-term debt (net of current portion) totaled $300 million at the end of the second quarter compared with $175 million recorded at the end of 2020. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Outlook

Werner now anticipates TTS truck growth of 1-4% year over year in 2021 (previous expectation: 1-3% growth year over year). It includes the addition of 500 trucks in its fleet, owing to the acquisition of 80% equity ownership interest in ECM Transport Group, which was finalized on Jul 1, 2021.

Net capital expenditures are estimated in the band of $275-$300 million (unchanged from the previous guidance).

Effective income tax rate is still expected in the range of 24.5-25.5%.

Truck age and Trailer age is expected to be at two years and low-to-mid “four” years, respectively.

Under the TTS guidance, One-Way Truckload revenues per total mile are now expected to increase in the 16-19% band for the second half of 2021 from second-half of 2020 levels (earlier expectation was for an increase in the 13-16% band).

The company expects gains on sales of equipment in the range of $9-$13 million in the third quarter of 2021.

Sectorial Snapshot

Within the broader Transportation sector, Delta Air Lines DAL, J.B. Hunt Transport Services JBHT and Kansas City Southern KSU recently reported second-quarter 2021 results.

Delta, carrying a Zacks Rank #3 (Hold), incurred a loss (excluding $2.09 from non-recurring items) of $1.07 per share. The figure was narrower than the Zacks Consensus Estimate of a loss of $1.41. Revenues of $7,126 million were substantially higher than the year-ago quarter’s levels, buoyed by the recent uptick in air-travel demand. The metric also topped the Zacks Consensus Estimate of $6,340.9 million.

Kansas City Southern, carrying a Zacks Rank of 4(Sell), reported second-quarter 2021 earnings (excluding $6.23 from non-recurring items) of $2.06 per share. The figure missed the Zacks Consensus Estimate of $2.16. Quarterly revenues of $749.5 million surpassed the Zacks Consensus Estimate of $733.1 million and increased 36.8% year over year. The upside was driven by 31% rise in overall carload volumes.

J.B. Hunt, a Zacks #3-Ranked player, reported better-than-expected second-quarter 2021 results. Quarterly earnings of $1.61 per share surpassed the Zacks Consensus Estimate of $1.55. Total operating revenues of $2908.4 million outperformed the Zacks Consensus Estimate of $2722 million and rallied 35.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance