West Bancorp Inc (WTBA) Exceeds First Quarter Earnings Expectations and Declares Quarterly Dividend

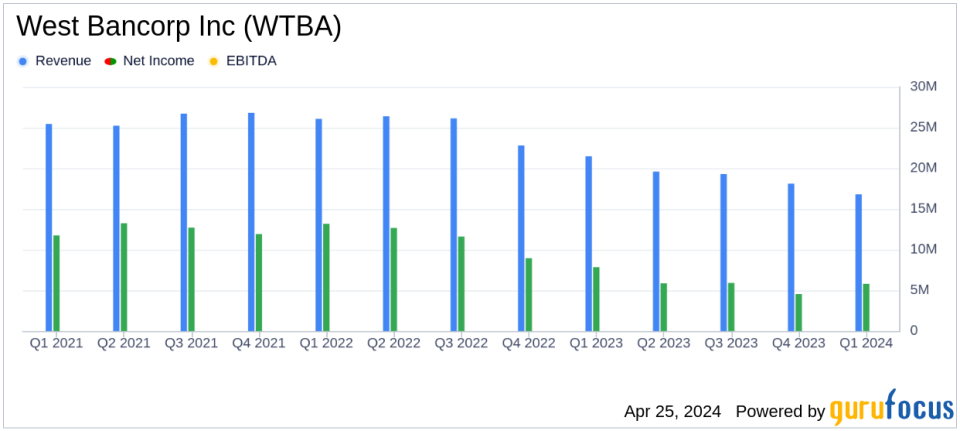

Net Income: Reported $5.8 million for Q1 2024, surpassing the estimated $4.55 million.

Earnings Per Share (EPS): Achieved $0.35, exceeding the estimate of $0.27.

Revenue: Net interest income for Q1 2024 was $16.8 million, falling short of the estimated $18.89 million.

Dividend: Declared a quarterly dividend of $0.25 per common share, payable on May 22, 2024.

Return on Average Equity: Recorded at 10.63%, indicating a strong profitability level relative to shareholders' equity.

Efficiency Ratio: Improved to 62.04% in Q1 2024 from 64.66% in the previous quarter, reflecting better operational efficiency.

Loan Growth: Loans increased by $52.6 million or 7.2% annualized, primarily due to the funding of previously committed construction loans.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On April 25, 2024, West Bancorp Inc (NASDAQ:WTBA) announced its financial results for the first quarter of 2024, revealing a net income of $5.8 million, or $0.35 per diluted common share, surpassing the estimated earnings per share of $0.27. This performance marks a significant improvement from the fourth quarter of 2023's net income of $4.5 million, or $0.27 per diluted common share. The details of these results are outlined in the company's recent 8-K filing.

West Bancorp Inc, headquartered in West Des Moines, Iowa, operates as the parent company of West Bank, focusing primarily on lending, deposit services, and trust services for small to medium-sized businesses and consumers. With a history dating back to 1893, the bank has established a strong presence in the financial sector, providing a range of banking services including online and mobile banking, treasury management, and merchant processing solutions.

Financial Highlights and Strategic Developments

The first quarter of 2024 saw West Bancorp Inc achieve a return on average equity of 10.63% and a return on average assets of 0.61%. The company's efficiency ratio improved to 62.04%, down from 64.66% in the previous quarter, indicating better cost management relative to its revenue. Notably, the bank has completed a significant move to a new headquarters building in West Des Moines, which is expected to consolidate corporate operations and support future growth.

President and CEO David Nelson highlighted the ongoing margin challenges faced by the industry, influenced by high short-term rates and aggressive deposit competition. However, he expressed confidence in the bank's strategy to navigate these challenges towards more normalized margins and earnings. This strategic foresight is crucial as the bank continues to adapt to the dynamic financial landscape.

Operational Performance

During the quarter, West Bancorp Inc reported an increase in loans by $52.6 million, primarily due to the funding of previously committed construction loans. The bank also saw a significant rise in deposits, with an increase of $91.3 million, bolstered by an increase in brokered deposits. These financial maneuvers reflect the bank's robust operational strategies and its ability to attract and retain customer deposits despite a competitive market.

The bank's net interest income for the quarter stood at $16.8 million, slightly up from $16.4 million in the previous quarter. This increment is a positive indicator of the bank's core income-generating activities. Moreover, the bank maintained a solid credit stance with nonperforming assets to total assets at a minimal 0.01%, underscoring its strong asset quality and risk management framework.

Looking Ahead

With its strategic initiatives and solid financial footing, West Bancorp Inc is well-positioned to continue its growth trajectory and navigate the challenges of the current economic environment. The bank's commitment to enhancing shareholder value is further evidenced by the declaration of a regular quarterly dividend of $0.25 per common share, payable on May 22, 2024.

For a detailed analysis of West Bancorp Inc's financial results, stakeholders are encouraged to review the Form 10-Q filed with the Securities and Exchange Commission, available on the Investor Relations section of West Bank's website at www.westbankstrong.com.

As West Bancorp Inc continues to build on its strong foundation and strategic initiatives, it remains a noteworthy entity for investors seeking stability and growth in the banking sector.

Explore the complete 8-K earnings release (here) from West Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance