Western Union (WU) Restores Remittance Services to Cuba

The Western Union Company WU recently announced the resumption of its remittance service from the United States to Cuba. Services were paused since Jan 28, shortly before a Cuban official declared a cybersecurity incident that impacted Cuba's electronic payment systems. No specific cause of the technical issues was shared.

Western Union collaborated with its processing partner Orbit S.A. to reinstate the services, which are essential for the country's economy. Customers in the United States will have the capability to send up to $2,000 in a single transaction from any of its retail location. They can also use remittance services online or via WU’s mobile app.

The money can be transmitted to their families in Cuba who hold accounts at Banco Popular de Ahorro, Banco Metropolitano S.A., and Banco de Crédito y Comercio (Bandec). Receivers of the remittance services can get the money on the same day, irrespective of holidays and weekends. This is expected to greatly benefit consumers, as alternative money-changing services are frequently more expensive.

Western Union reintroduced remittances to the island country in 2023 through a pilot phase, almost three years after the Trump administration imposed sanctions, which led to a suspension in services. The latest resumption is expected to boost WU’s transactions. It is a significant stakeholder in the global remittance market, with operations in more than 200 countries and territories. It provides services in around 130 currencies.

The company’s efforts like this will boost transactions and revenues. Recently, it reinforced its cross-border remittance services in Mexico with its partner OXXO. These companies are expected to implement a communication strategy within specific concept stores in Oaxaca, featuring Western Union services. WU has also joined forces with Adonis supermarkets to enhance cross-border money transfer services in Canada.

WU has made significant investments in building a robust digital platform, providing swift and cost-efficient money transfer services. This investment has proved immensely beneficial amid the rapid growth of digital economies, as more people opt for digital money transfers. It allows the company to establish new partnerships and strengthen existing ones, which supports its network utilization.

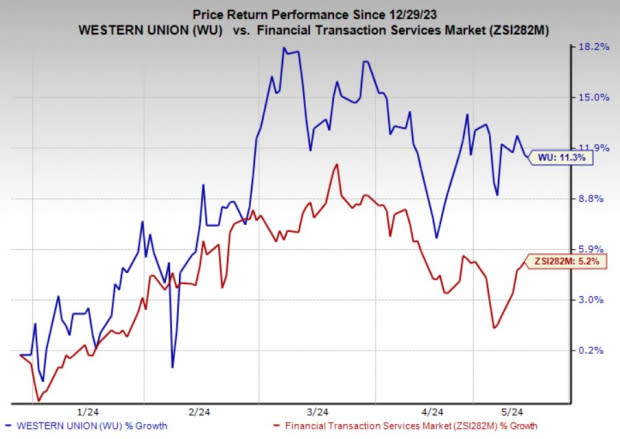

Price Performance

Western Union shares have gained 11.3% in the year-to-date period compared with the 5.2% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Western Union currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked stocks in the broader Business Servicesspace are Global Payments Inc. GPN, PagSeguro Digital Ltd. PAGS and WEX Inc. WEX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Global Payments’ 2024 earnings is currently pegged at $11.63 per share, indicating 11.6% year-over-year growth. It beat estimates in each of the past four quarters with an average surprise of 1.1%. The consensus mark for GPN’s revenues of $9.2 billion suggests a 6.5% increase from the year-ago level.

The Zacks Consensus Estimate for PagSeguro’s 2024 earnings is pegged at S1.29 per share, signaling an 18.4% jump from the previous year. It beat estimates in all the past four quarters, with an average surprise of 10.1%. The consensus estimate for PAGS’ revenues of $3.3 billion predicts a 1.8% increase from the year-ago level.

The Zacks Consensus Estimate for WEX’s 2024 earnings of $16.27 per share suggests 9.9% year-over-year growth. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 3.3%. The consensus estimate for WEX’s current year revenues is pegged at $2.7 billion, a 7.7% increase from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance