WestRock (WRK) Acquires Grupo Gondi, Expands in Latin America

WestRock Company WRK announced the completion of the previously announced acquisition of the remaining 67.7% stake in Grupo Gondi for $970 million, plus the assumption of the latter’s debt. The acquisition will enhance WRK’s geographic and end market diversification and help it grow in the promising Latin American containerboard, paperboard and consumer and corrugated packaging markets. It will be immediately accretive to the company’s earnings.

The acquisition adds Grupo Gondi’s four paper mills, nine corrugated packaging plants and six high graphic plants in Mexico to WestRock’s operations. This move marks a step forward in WestRock’s North American paper and packaging expansion strategy.

The company is well-poised to meet the growing demand in the region with fully integrated operations in Mexico. It will also expand capabilities to serve customers across other geographies while driving additional productivity and cost savings.

WestRock and Grupo Gondi have been joint venture partners over the past six years. WRK previously held 32.3% stake in Grupo Gondi and has now full ownership of the latter. This acquisition is expected to be immediately accretive to earnings, subject to purchase accounting adjustments.

Grupo Gondi’s is expected to deliver EBITDA of approximately $200 to $210 million in 2022. WestRock expects to achieve an incremental $60 million in annual synergies by year three following the closing. The company expects the transaction to achieve a return on invested capital greater than 10% within the next three years.

WestRock continues to invest in the business, which includes strategic capital projects with attractive returns, and targeted mergers and acquisitions. The company has been witnessing strong demand for containerboard and corrugated packaging in its Latin American business with strong growth in the Brazilian market.

Apart from the Grupo Gondi buyout, the company is well poised to expand growth in the region with the ramp-up of the TresBarras mill and Porto Feliz box plant in Brazil. The company will also reap the benefits of strategic capital projects in its mill and converting systems to improve the overall cost structure.

WestRock reported adjusted earnings of $1.43 per share in fourth-quarter fiscal 2022 (ended Sep 30, 2022), beating the Zacks Consensus Estimate of $1.40. The bottom line marked year-over-year growth of 16%, driven by higher selling price/mix which was partly offset by cost inflation, higher operating costs and lower volumes. In fiscal 2022, WRK’s adjusted earnings were $4.76 per share which came in line with the Zacks Consensus Estimate. The bottom line surged 40% year over year.

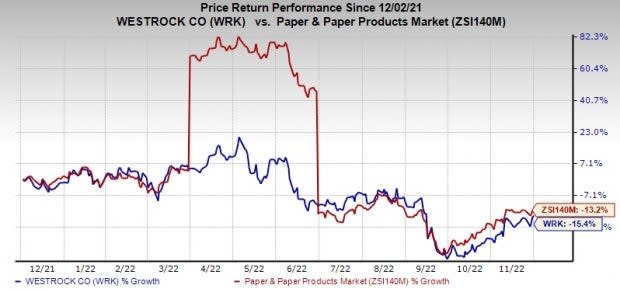

Price Performance

Image Source: Zacks Investment Research

Shares of WestRock have fallen 15.4% in the past year compared with the industry’s decline of 13.2%.

Zacks Rank & Stocks to Consider

WestRock currently carries a Zacks Rank #4 (Sell).

Some top-ranked stocks in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Commercial Metals Company CMC.

Steel Dynamics has a projected earnings growth rate of 36.1% for the current year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 7.3% upward in the past 60 days.

Steel Dynamics has a trailing four-quarter earnings surprise of roughly 6.2%. STLD has rallied roughly 74% in a year. The company currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel currently carries a Zacks Rank #1. The consensus estimate for ZEUS's current-year earnings has been revised 4.8% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 65% in a year.

Commercial Metals currently carries a Zacks Rank #1. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 13.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 53% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance