We've got 3 more years in this bull market — but there's a catch

I’m one of the few bulls on Wall Street who feels we are just starting year three of a potential five-year bull market. Contrary to what the media says, we are not in a nine-year bull market. We experienced a bear market from mid-2015 through mid-2016 and a new bull market began in July 2016 after the Brexit vote.

Although this summer will likely be volatile and see little progress, I feel we will eventually break out of the market’s trading range later this year for another sustained move higher. I’m basing my theory on five factors: History, Earnings, Interest Rates, Technicals and Psychology.

History

So far, 2018 is doing exactly what a market should do following a strong year. After the stock market experiences a healthy gain (as it did in 2017), it is perfectly normal for it to move sideways and digest those gains. Many people forget that 2017 was NOT a normal year.

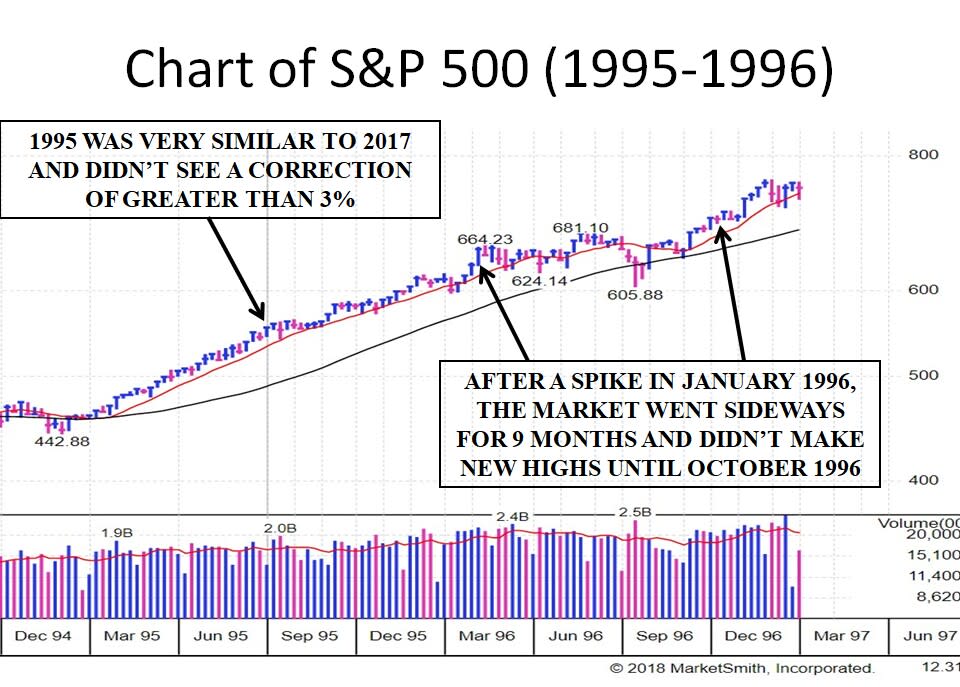

The average intra-year decline over the past 80 years has been around 14%-15%, but 2017 didn’t see a correction of greater than 3%. The last time that happened was in 1995. The following year (1996) had a quick 9% gain in January followed by sideways movement for 9-10 months.

So far, 2018 is following the same pattern, as we have been trading in a range since the quick 7% gain in January.

Another strong year was 2003. The following year also saw 9-10 months of digestion before finally breaking out to new highs after the 2004 U.S. presidential Election.

I feel the S&P 500 will eventually break out of its range later this year, but it might not come until after the mid-term elections in November, similar to 2004. I would like to stress that the EXACT time we move to new highs is not my main point and is very difficult to predict. I am simply emphasizing that a 9-10 month consolidation after a strong year is very normal.

Earnings

Recent quarterly earnings reports from many market leaders continue to show incredible acceleration in growth and profit margins. I’m not only referring to the FANG stocks, but also to Consumer Discretionary, Enterprise Software and Semiconductor stocks.

In addition, valuations have come down since the beginning of the year. In January, the S&P 500’s forward PE was around 19. Now it is around 16. There is plenty of room for its multiple to expand, especially when you consider that since 1997, the average PE for the S&P 500 has been over 23. PE ratios are higher now because profit margins are expanding, there are fewer stocks in the market, and there is more money globally that wants to be invested in the U.S. markets.

Interest rates

We are still in a globally coordinated effort to keep interest rates low and the markets high. Although the U.S. Fed has started to raise interest rates, please keep in mind that rates are still historically low. As David Tepper said, “Wake me up” when the 10-year gets to 4%. This rate-friendly environment will continue to provide the backdrop the market needs to grind higher.

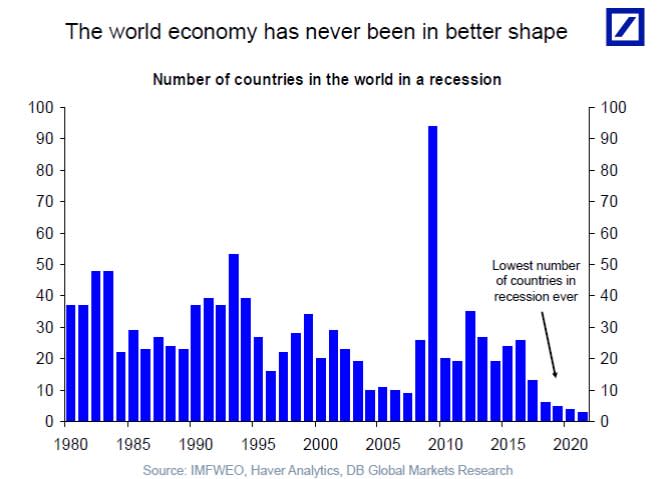

Some people feel the U.S. is about to head into a recession, but I feel the exact opposite and that the economy is just STARTING to accelerate its growth. While I don’t believe we are in a nine-year bull market, I do believe we are in a nine-year economic recovery.

However, over the past nine years, the economy was never in an explosive growth stage. We have simply been growing GDP at 1.5%-2.5% per year. Why can’t this continue for a while? Why can’t it accelerate to 3% or higher? My point is the economy never got overheated during the past nine years, and it can continue to make slow and steady progress or even accelerate. In addition, the chart below shows that we currently have the lowest number of countries in the world in a recession.

Technicals

I constantly remind people that the big institutions control the market, as they account for 70% of trading volume. That’s why it is so important to follow what they are doing on a daily and weekly basis. When they are buying, ride the trend and don’t argue with the market. When they are consistently selling, get defensive and protect your portfolio. Since we started this new bull market in July 2016, the institutions have been consistently supporting the market and accumulating shares. When selling occurs, the market usually drops to levels of logical support, and then the institutions step in and buy again.

The best way to sum up the market’s technicals is in one word: Resilience. Think of all the negative headlines that have been thrown at this market over the years: geopolitical concerns, dramatic elections, viruses, Brexit, terrorist attacks, etc. — and guess what? The market continues to be INCREDIBLY resilient and brushes off any bad news.

Psychology

There is an overwhelming feeling among market participants that this Bull Market is about to end any day now. I keep hearing the same phrases over and over: “We are obviously late in the economic cycle” and the bull market is in its “late stages.” Part of the reason I feel there is more upside left is that the market tends to fool the majority and I have trouble seeing this bull market ending soon when almost everyone is expecting it.

In addition, there’s a consistent psychological pattern over the past few years. When the market starts to pull back, many sentiment measures move to bearish extremes. For example, the stock market had a normal pullback to its 50-day moving average at the end of June 2018, and I was shocked by the incredible escalation in fear recorded by several sentiment measures. $20 billion flowed out of equity mutual funds, the CBOE put/call ratio spiked to an unusually high reading, CNN Fear/Greed moved to an “Extreme Fear” level, AAII sentiment saw one of its biggest weekly jumps in Bearish sentiment, and NAAIM (a survey of active managers) dropped below its recent average of investment levels.

This “one foot out the door” mentality makes sense because I think the 2008-2009 financial crisis is still fresh in people’s minds and no one wants it to happen to them again. The stock market trades on psychology more than people realize. This constant fear is helping the markets to grind higher because, once again, the market tends to fool the majority.

There is one catch

We are just starting what I believe to be year three of a possible five year bull market. The market is currently going through a normal consolidation, especially considering the big year it had in 2017. The summer will likely be volatile and see little progress, but we will eventually break out of the current range and see a sustained move higher. The exact time of the move is impossible to predict, but my guess is it will occur during the fourth quarter — possibly after the midterm election.

Here’s the catch: The move higher will not be easy. There will be corrections, shakeouts and pullbacks along the way. Many of them will be sharp and VERY convincing that the Bull Market is over. I’ve used the analogy many times (see above chart) comparing the 1987 recovery to the current market’s recovery.

Even during the great bull market of 1995-2000, there were big corrections in 1997 and 1998 during the Asian economic and Russian debt crises. The biggest challenge for investors will be sticking to your investment process and having conviction during the corrections. While many continue to call for a top, I’m one of the few saying this bull market still has a long way to go. It might even accelerate and surprise to the upside if you have some patience.

I can be reached at: jfahmy@zorcapital.com.

Joe Fahmy is the managing director of Zor Capital.

Read more:

Things aren’t looking bullish, and they aren’t looking bearish either

Why Trump’s trade war hasn’t tanked the markets or the economy yet

One consistent pattern in the stock market

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Yahoo Finance

Yahoo Finance