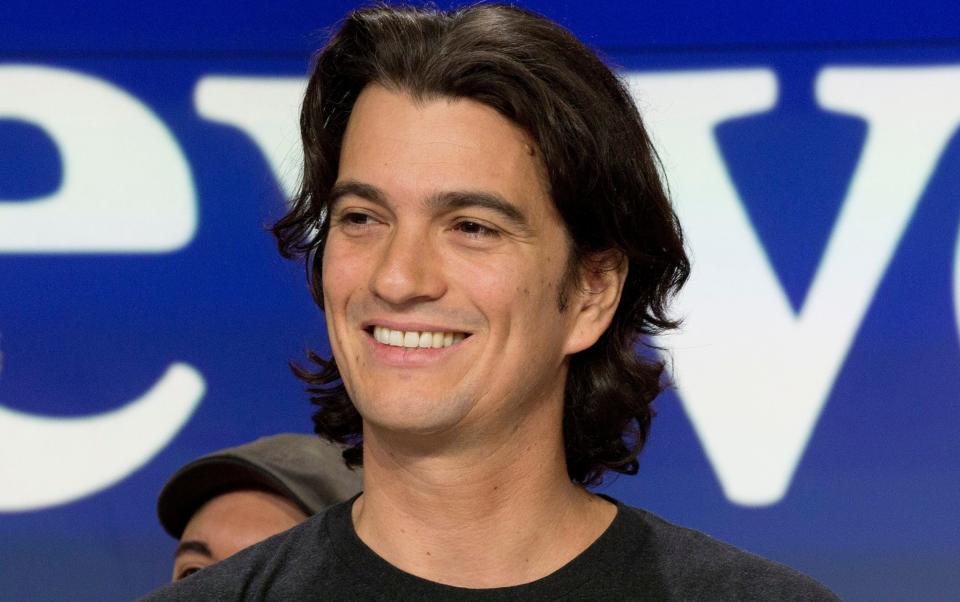

WeWork founder Adam Neumann seeking to buy former company out of bankruptcy

Adam Neumann, the founder of the office provider WeWork who quit after a botched attempt to take it public, has offered to make a sensational return by buying the business out of bankruptcy.

Mr Neumann, 44, has been seeking to acquire WeWork with support from the billionaire hedge fund investor Dan Loeb since December, according to a letter from his lawyer.

WeWork declared bankruptcy in November after the rise of home working meant it was unable to keep up with billions of dollars in lease payments.

Mr Neumann claims to have been ignored by lawyers overseeing the bankruptcy process, meaning he is unable to make a full offer to buy back the company.

In a letter to WeWork’s bankruptcy advisers, Mr Neumann’s lawyer Alex Spiro said: “We write to express our dismay with WeWork’s lack of engagement even to provide information to my clients in what was intended to be a value-maximising transaction for all stakeholders.

“Although my clients have attempted since December 2023 to obtain information necessary for an offer to purchase the company or its assets, they still do not have access to that information.

The letter said Mr Neumann had previously offered to arrange up to $1bn in financing for WeWork and had offered to make a “substantial” investment in the company shortly before it went bankrupt.

It said that Mr Neumann’s “management expertise” could significantly boost WeWork’s value, adding: “WeWork should at least educate itself about that potential and not preclude itself from maximising value.”

Mr Spiro confirmed Mr Neumann’s interest, which was first reported by the New York Times.

Mr Neumann had sought to take WeWork public at a valuation of up to $47bn (£37bn) but endured a dramatic fall from grace as investors began questioning the company’s worth and its chief executive’s impulsive behaviour.

Mr Neumann previously enjoyed majority control at WeWork, owning stakes in properties leased to the company and at one point personally owned trademarks related to the “We” brand.

Reports of his behaviour included taking drugs on international flights and banning meat at WeWork events.

He quit in 2019 after losing the support of key investors including SoftBank. The company’s valuation dropped to $9bn when it went public in 2021 before declaring bankruptcy in November last year.

Mr Neumann has since launched a start-up called Flow Global, which has raised $350m from the Silicon Valley venture capital firm Andreessen Horowitz.

Mr Loeb, the activist investor behind the hedge fund Third Point, has targeted companies such as Disney and Yahoo in recent years.

A WeWork spokesman said: “WeWork is an extraordinary company. As such, we receive expressions of interest from external parties on a regular basis. We and our advisors always review those approaches with a view to acting in the best interests of the company.

“We continue to believe that the work we are currently doing – addressing our unsustainable rent expenses and restructuring our business – will ensure WeWork is best positioned as an independent, valuable, financially strong and sustainable company long into the future.”

Yahoo Finance

Yahoo Finance