WH Smith sells £25 tax return guide that's five years out of date

WH Smiths has been accused of putting the public at risk of fines after selling a guide to completing a tax return that is out of date by five years.

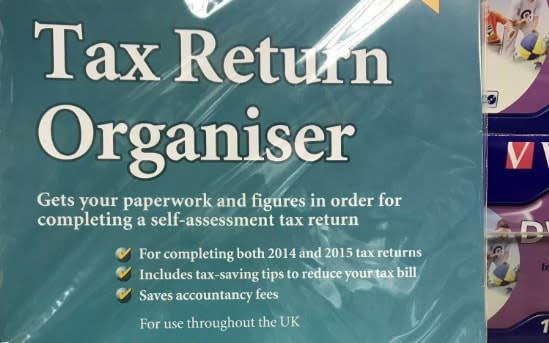

The glossy booklet, titled “Do-it-yourself Tax Return Organiser”, was spotted on Saturday in Sevenoaks, Kent, by Phil Hall, head of public affairs at the Association of Accounting Technicians (AAT), a trade body.

It was available to buy for £24.99.

The front cover boasts that it “includes tax-saving tips to reduce your tax bill” and “saves accountancy fees". However, the book relates to tax returns filed in 2014 and 2015.

Shameless @WHSmith (rated worst UK retailer by @WhichUK) is selling a “DIY” self-assessment #taxreturn pack for staggering £24.99 & its for 2014 i.e. it’s 5 years out of date! If stuck with your #tax return, find an @YourAAT licensed accountant here: https://t.co/FLw9jM7uf4… pic.twitter.com/p4VzcMYpnT

— PhilHallAAT (@PhilHallAAT) August 18, 2019

Returns due in January 2020, for which people may be shopping for guidance, correspond to the 2018-19 tax year.

A huge amount has changed in the intervening five years, including increases to the tax-free personal allowance and higher-rate thresholds.

Mr Hall said: “Selling the public a DIY self-assessment kit that’s five years out of date beggars belief. There have been various tax changes since then, not least numerous changes to the annual allowance, so any member of the public using these could find themselves getting into a real mess, and potentially facing an HMRC fine as a result.”

A spokesman for the high street stationary shop said the error was a “one off” and that the product had since been removed from the shelves.

He said: “In error this product code had not been removed from our stock system. This is an isolated issue. We take our responsibility for the products we sell very seriously and we are removing this product from sale immediately.”

The deadline for filing a self-assessment tax return – a requirement for the self-employed or those who have income outside their regular salary – is Jan 31 2020.

Those who fail to file on time face automatic fines of £100, rising to more than £1,000 for returns which are filed more than a year late.

Yahoo Finance

Yahoo Finance