What's in the Cards for Air Transport Services' (ATSG) Q4 Earnings?

Air Transport Services Group, Inc. ATSG is scheduled to release its fourth-quarter 2022 results on Feb 23 after the market close.

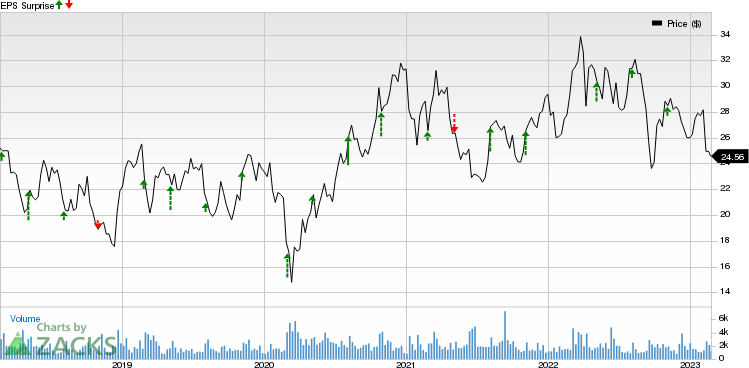

The company has had a stellar earnings surprise history. ATSG outperformed the Zacks Consensus Estimate in three previous quarters consecutively, delivering an earnings surprise of 17.78% on average.

The Zacks Consensus Estimate for fourth-quarter earnings has remained unaltered for the past 60 days at 57 cents. Moreover, the consensus mark is 9.6% higher than the fourth-quarter 2021 reported figure.

Air Transport Services Group, Inc Price and EPS Surprise

Air Transport Services Group, Inc price-eps-surprise | Air Transport Services Group, Inc Quote

Let’s look at the factors that are expected to shape the company’s fourth-quarter earnings.

The Zacks Consensus Estimate for the top line is currently pegged at $520.1 million, up 7.8% from the year-ago actual figure. The increase can be associated with better performances in ACMI (aircraft, crew, maintenance & insurance) services and Cargo Aircraft Management (CAM).

The Zacks Consensus Estimate for ACMI is currently pegged at $355 million, up 6.3% from the year-ago actual figure. Better cargo operations are expected to push such growth in ACMI revenues.

With CAM’s focus shifting to international demand along with domestic demand, the Zacks Consensus Estimate is pegged at $105 million similar to the year-ago figure. The results are expected to be supported by the new leases Boeing 767s completed in 2021.

The bottom line is expected to have been impacted by heightened travel costs to position flight crews, increased premium pay crew training costs and maintenance costs related to contracted lines.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for ATSG this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they're reported with our Earnings ESP Filter.

Air Transport Services Group has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

Stocks to Consider

Investors interested in the Zacks Transportation industry may also consider the following stocks:

Alaska Air Group, Inc. ALK is being aided by the improved air travel demand situation. In the fourth quarter of 2022, ALK reported better-than-expected results. The company expects a 23-29% increase in the top line of the company during the first quarter of 2023. ALK has been increasing its capacity to meet the upbeat demand. Capacity is expected to increase 11-14% in the first quarter of 2023.

Alaska Air, currently holding the Zacks Rank of 2, has evidenced the Zacks Consensus Estimate of the company’s earnings being revised upward by 29.4% in the past 60 days.

United Airlines UAL, currently carrying a Zacks Rank of 2, is seeing a steady recovery in domestic and leisure air-travel demand. UAL was profitable in the fourth quarter of 2022 due to upbeat air travel demand. The fourth quarter was the third consecutive profitable quarter at UAL. Driven by solid demand, management expects total revenue per available seat mile to grow almost 25% year over year for the first quarter of 2023. Total revenues are anticipated to grow almost 50% year over year.

The Zacks Consensus Estimate for first-quarter 2023 has been revised upward by 270% in the past 60 days to 68 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance