What's in the Cards for Roper (ROP) This Earnings Season?

Roper Technologies, Inc. ROP is scheduled to report fourth-quarter 2019 results on Jan 30, before market open.

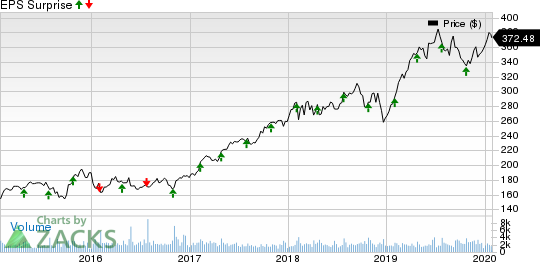

The company reported better-than-expected results in each of the trailing four quarters, with the average earnings surprise being 6.4%. Notably, in the last reported quarter, earnings of $3.29 per share surpassed the Zacks Consensus Estimate of $3.19 by 3.1%.

In the past six months, the firm’s shares have gained 3.1% compared with the industry’s growth of 8.5%.

Key Factors

Weakness in upstream oil and gas businesses is anticipated to have resulted in soft performance from Roper’s Process Technologies segment in the fourth quarter. The company’s policy of making large number of acquisitions might have added to integration risks. It’s worth mentioning here that it expects the net impact of acquisitions and divestures completed in the third and fourth quarter of 2019 to have an adverse impact of 8 cents on the to-be-reported quarter’s earnings.

In both second and third quarters of 2019, its cost of sales inched up 0.5% year over year. Also, operating expenses rose 4.3% and 5.6%, respectively, in the second and third quarters. We believe that high costs and expenses are likely to have adversely impacted its margin and profitability in the to-be-reported quarter as well. Moreover, Roper expects a high tax rate of 22% for the fourth quarter. This is expected to be reflected on its results.

However, growing adoption of Deltek business’ enterprise software offerings, and strength in the Strata business — led by solid bookings for cost accounting and Decision Support SaaS products in hospital market — are likely to have bolstered the Application Software segment’s revenues. In addition, strength in DAT, iTrade, MHA and RF IDeas businesses, along with the Foundry acquisition (closed in April 2019) are likely to have boosted the Network Software & Systems segment’s revenues.

Amid this backdrop, the Zacks Consensus Estimate for fourth-quarter revenues of Roper's Application Software segment is pegged at $419 million, indicating 3.5% growth from the prior-quarter reported number. The consensus mark for Process Technologies segment’s revenues stands at $172 million, implying a 7.5% sequential increase. The consensus estimate for fourth-quarter revenues from the Network Software & Systems segment is pegged at $442 million, suggesting a 13% rise from the third-quarter reported figure.

Earnings Whispers

According to our quantitative model, a stock needs to have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or at least 3 (Hold) to increase the odds of an earnings beat. But that is not the case here as we will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Roper has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $3.34.

Roper Technologies, Inc. Price and EPS Surprise

Roper Technologies, Inc. price-eps-surprise | Roper Technologies, Inc. Quote

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Here are some companies you may want to consider as our model shows that these have the right mix of elements to beat estimates this earnings season:

Stanley Black & Decker, Inc. SWK has an Earnings ESP of +1.21% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Rockwell Automation, Inc. ROK has an Earnings ESP of +1.36% and a Zacks Rank of 3.

Dover Corporation DOV has an Earnings ESP of +1.72% and a Zacks Rank #3.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance