What's in the Offing for Kimco (KIM) This Earnings Season?

Kimco Realty Corporation KIM is slated to report fourth-quarter and full-year 2019 results on Jan 30, before the market opens. The company’s results are expected to reflect an increase in funds from operations (FFO) per share, while its revenues might have slightly declined, year on year.

In the last reported quarter, this New Hyde Park, NY-based retail real estate investment trust (REIT) delivered a positive surprise in terms of FFO per share. Results reflected increase in portfolio occupancy reaching an all-time high level, healthy leasing spreads on new lease and positive same-property net operating (NOI) growth. The company registered new leasing spreads of 27.2%.

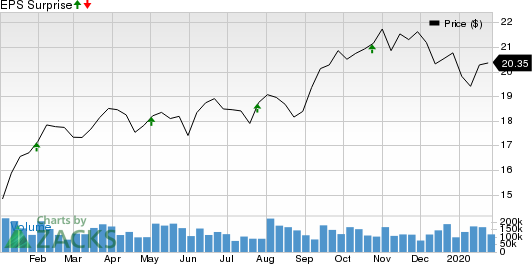

Over the trailing four quarters, Kimco beat estimates on two occasions and posted in-line results in the remaining two, the average positive beat being 1.39%. The graph below depicts this surprise history:

Kimco Realty Corporation Price and EPS Surprise

Kimco Realty Corporation price-eps-surprise | Kimco Realty Corporation Quote

Let’s see how things are shaping up for this announcement.

Factors at Play

Kimco is on track with its 2020 Vision that envisages the ownership of high-quality assets, concentrated in major metro markets which offer several growth levers. As part of such efforts, in 2019, the company acquired three grocery-anchored parcels and enhanced its ownership stake in an existing property for a total of $34 million.

Amid transformation in the retail landscape, the company remains well poised to navigate through the retail apocalypse, with focus on service and experiential tenants, and omni-channel players. Moreover, the company is aiming to expand its small shops portfolio. These shops basically comprise service-based industries, such as restaurants, salons and spas, personal fitness and medical practices. The shops enjoy frequent customer traffic and are Internet resistant.

Amid limited new supply and favorable demographics, this diversification is likely to have helped Kimco limit its operating and leasing risks. In addition, with a healthy job-market environment stimulating consumer spending, the company is likely to have witnessed decent occupancy level and healthy leasing spreads in the to-be-reported quarter.

Also, the company is expected to have maintained a strong balance sheet backed by its strategic measures to boost the capital structure. It also remains focused on growing its unencumbered asset pool, which is encouraging.

Simultaneously, Kimco is shedding non-core assets in sync with this strategy. During the fourth quarter, the company capitalized on the solid demand for open-air shopping centers amid sufficient liquidity in the transaction market.

Earlier this month, the company announced fourth-quarter 2019 disposition of 12 properties, aggregating 1.9 million square feet for $153.0 million. The company’s share of these sales amounted to $146.5 million. The company also sold two wholly-owned land parcels totaling $47.5 million.

Furthermore, in full-year 2019, Kimco disposed 32 properties for $542.5 million, which aggregated 4.8 million square feet of space. The company’s share of the sales would be worth $375.2 million. It also sold five wholly-owned land parcels in the year, aggregating $50.8 million.

While the disposition efforts are encouraging for the long term, the dilutive impact on earnings from high asset sales cannot be averted in the near term. Additionally, despite all these efforts, the choppy retail real estate environment might have curbed its growth momentum to some extent. This is because secular industry headwinds, including retailer downsizing and tenant bankruptcies, have been dampening industry fundamentals.

The recent data from Reis shows that both the retail and the Mall vacancy rate increased in the quarter. Particularly, the retail vacancy rate inched up 0.1% to 10.2% in the fourth quarter. Further, the retail rent growth was just 0.1%, while mall rents were flat.

Amid these, the Zacks Consensus Estimate for Kimco’s fourth-quarter revenues is currently pinned at $281.3 million — reflecting around 1.02% estimated decline from the prior-year quarter’s reported figure.

In addition to the above, Kimco’s activities during the October-December quarter were inadequate to gain analyst confidence. Consequently, the Zacks Consensus Estimate for FFO per share of 37 cents for the fourth quarter remained unchanged over the past month. Nevertheless, the figure indicates a 5.7% increase, year on year.

For full-year 2019, Kimco projects FFO as adjusted of $1.46-$1.47 per share. The company expects same-property NOI, excluding redevelopments, in the range of 2.50-2.80%. The Zacks Consensus Estimate for 2019 FFO per share is $1.47, indicating an increase of 1.38%, year over year, on revenues of $1.13 billion.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive surprise in terms of FFO per share for Kimco this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Kimco carries a Zacks Rank of 3, its Earnings ESP of -1.49% makes surprise prediction difficult.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Apartment Investment and Management Company AIV, slated to release fourth-quarter earnings on Jan 30, has an Earnings ESP of +0.77% and carries a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Boston Properties, Inc. BXP, set to report quarterly numbers on Jan 28, has an Earnings ESP of +0.54% and carries a Zacks Rank of 2, currently.

AvalonBay Communities, Inc. AVB, scheduled to release October-December quarter results on Feb 5, has an Earnings ESP of +0.46% and currently holds a Zacks Rank #2.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Apartment Investment and Management Company (AIV) : Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance