Here is where ChargePoint (NYSE:CHPT) is Expanding and How Long it can Sustain Expenses

This article was originally published on Simply Wall St News

As many investors know, ChargePoint Holdings (NYSE:CHPT) markets networked electric vehicle (“EV”) charging system infrastructure (“Networked Charging Systems”) and cloud-based services which connect customers to the charging stations.

ChargePoint is currently a market leader in North America in commercial Level 2 Alternating Current (“AC”) charging, where it has the largest market share. The company is also expanding into Europe with the rationale that a mix between EV usage growth and government incentives that drive down the cost for EV's will provide opportunities for revenue growth.

Most of the Europe expansion is occurring by way of acquisitions, and ChargePoint is currently integrating 2 companies:

has.to.be gmbh (“has.to.be” or “HTB”) for approximately Euro 250.0 million in cash and Company common stock subject to adjustments. has.to.be is an Austria-based e-mobility provider with a European charging software platform.

ViriCiti B.V. (“ViriCiti”) for approximately Euro 75.0 million in cash, subject to adjustments. ViriCiti is a Netherlands-based provider of electrification solutions for eBus and commercial fleets.

We will take a quick overview of the current performance of the company, and a deeper dive into the capacity of ChargePoint to finance growth projects, which should yield cash flows for investors. Always keep in mind the end-game when looking at a business, it is their ability to generate cash flows to investors (and lenders), not revenues, not even net income (statutory profits).

From the get-go we have a large red flag, as the company is operating since 2007 and has incurred net operating losses and negative cash flows from operations every year since its inception. Additionally, we looked at the projections, and it is hard to see this company becoming profitable in the next 3 years. None of this is actually bad, it may well be worth the wait, but investors should be aware that they are buying into a company whose market cap, values the present value of cash flows above US$6.6b!

Les's see how the company stands according to the latest report.

On the 3rd of September, ChargePoint release its second quarter 2021 earnings. The company reported a mediocre second quarter result with increased losses and weaker control over costs, although revenues improved.

Second quarter 2022 results:

Revenue: US$56.1m (up 61% from 2Q 2021)

Net loss: US$84.9m (loss widened 141% from 2Q 2021)

The revenues are on route and growing. The company even issued an update on guidance, raising revenue expectations to US$235m for the whole Fiscal Year 2021.

The net loss position is a feature of a developing company, because they have to make massive reinvestments in order to attain the market share needed to turn a profit. Continually investing necessitates a clear path to profitability for the company, as well as a sense of the extent of the profit potential. In other words, management needs to come up with a clear path to when the company will be profitable and by what margin.

View our latest analysis for ChargePoint Holdings

Now that we have a sense of the business performance and what to expect going forward, let's examine ChargePoint's capacity to fund projects before breaking profit.

How Long Is ChargePoint Holdings' Cash Runway?

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn.

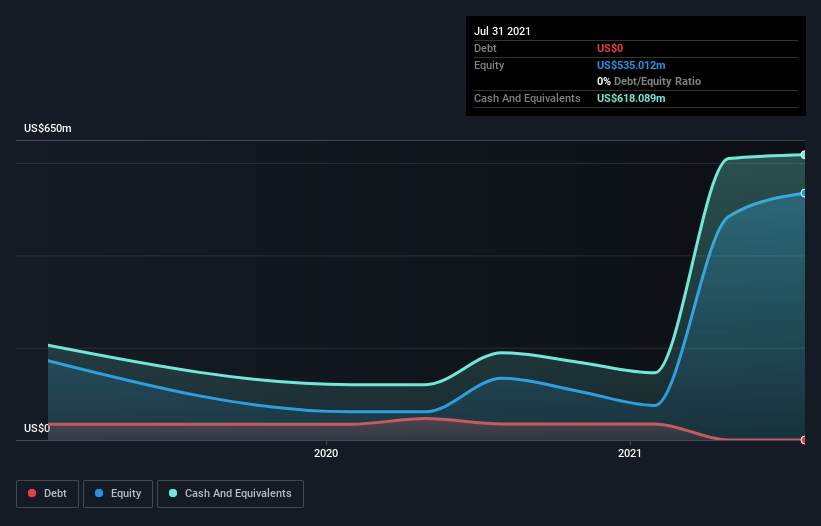

In July 2021, ChargePoint Holdings had US$618m in cash, and was debt-free. Importantly, its cash burn was US$116m over the trailing twelve months. Meaning that it had a cash runway of about 5.3 years from July 2021.

Depicted below, you can see how its cash holdings have changed over time.

How Well Is ChargePoint Holdings Growing?

Some investors might find it troubling that ChargePoint Holdings is actually increasing its cash burn, which is up 22% in the last year. The silver lining is that revenue was up 22%, showing the business is growing at the top line.

While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For ChargePoint Holdings To Raise More Cash For Growth?

While ChargePoint seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, as companies that are still developing tend to use investor funding.

Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalization, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

ChargePoint Holdings' cash burn of US$116m is about 1.7% of its US$6.6b market capitalization. So it could easily raise the cash by issuing a few shares.

Key Takeaways

ChargePoint is in the initial phases of developing its business model since it became a publicly traded company. Growth is well under way, but the company is far from profitable, and it is hard to estimate what the profit margins will look like when the company grows. This adds on to the risk of investing, since investors are speculating on what the cash flows are going to look like 10 or more years from now.

The company is heavily investing into projects and is also moving into Europe, currently by way of acquisitions. The capacity for investing based on the current cash and expenditures is some good 5.3 years. Investors would note, that at present market valuation the company can easily raise additional capital by issuing additional shares and with that, extend the cash runway for developing the business.

It's important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for ChargePoint Holdings that investors should know when investing in the stock.

Of course ChargePoint Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance