Whirlpool (WHR) Relies on Growth Efforts Amid Inflation Woes

Whirlpool Corporation WHR has been reeling under a challenging environment and sluggish demand from rising inflation. This led to a dull year-over-year performance in fourth-quarter 2022.

The company has also been witnessing pressures related to global supply-chain disruptions, energy costs, and rising raw materials, freight and logistic costs. All these factors marred WHR’s margin performance across most regions in fourth-quarter 2022.

The company generated a gross profit of $645 million, down 39.3% from $1,063 million reported in the year-ago quarter. Ongoing EBIT of $171 million declined 66% from $502 million in the year-ago quarter. The ongoing EBIT margin of 3.5% contracted 510 bps year over year.

Management expects continued investments in marketing and technology, as well as currency headwinds, to negatively impact margins by 125 basis points in 2023. An unfavorable price/mix is likely to affect the ongoing EBIT margin by 225 basis points.

For 2023, net sales are anticipated to decline 1-2% to $19.4 billion, in sync with our estimate of a 1.7% decrease. On a GAAP and ongoing basis, Whirlpool expects earnings per share of $16-$18.

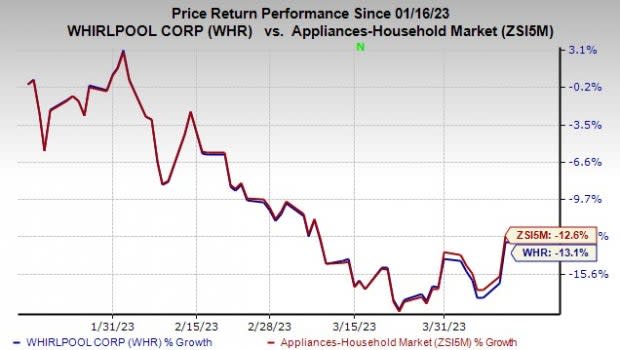

Image Source: Zacks Investment Research

Consequently, shares of WHR have lost 13.1% in the past three months, underperforming the industry’s decline of 12.6%.

Pricing Actions, Much-Needed Support

This Zacks Rank #3 (Hold) company has been on track with early and decisive actions to protect margins and productivity amid the ongoing supply-chain constraints and significant inflationary pressures. It has implemented cost takeout actions, including curtailing structural and discretionary costs, capturing raw material deflation opportunities, effectively managing working capital, and syncing supply chain and labor levels with demand.

The company announced significant cost-based price increases of 5% to 18% in various countries. WHR also launched a cost takeout program worth $500 million, which is likely to reduce fixed and variable costs in 2023. Keeping in these lines, management is on track with its cost takeout actions, and expects $800-$900 million related to gains from the aforementioned measures and eased raw material inflation. The company expects to generate $500 million in net cost takeout actions via premium cost reductions of more than $250 million and supply-chain inefficiencies.

In fourth-quarter 2022, the company concluded the strategic review of EMEA. As part of this, the company’s Europe major domestic appliance business will form a new entity with Arçelik. The deal is expected to close in the second half of 2023. The new company is likely to generate more than €6 billion in annual sales and above €200 million in cost synergies.

Conclusion

We believe that Whirlpool’s productivity and pricing actions will help offset the ongoing supply-chain constraints and significant inflationary pressures. Topping it, a VGM Score of B reflects its inherent strength. Also, earnings estimates for the current financial year have risen 0.6% in the past 60 days.

Stocks to Consider

Some better-ranked companies are Ralph Lauren RL, PVH Corp PVH and H&R Block HRB.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s next-financial-year sales and EPS suggests growth of 5% and 12.8%, respectively, from the year-ago reported figures. RL has a trailing four-quarter earnings surprise of 23.6%, on average.

PVH Corp currently carries a Zacks Rank #2. PVH has a trailing four-quarter earnings surprise of 23.4%, on average. PVH has a long-term earnings growth rate of 16.1%.

The Zacks Consensus Estimate for PVH Corp’s current financial-year sales and EPS indicates declines of 3.8% and 9.8%, respectively, from the year-ago period’s reported levels.

H&R Block provides assisted income tax return preparation and do-it-yourself tax return preparation services. HRB currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for H&R Block’s current financial year’s EPS suggests growth of 9.4% from the year-ago reported figure. H&R Block has a trailing four-quarter earnings surprise of 10.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Whirlpool Corporation (WHR) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance