Why 2017 Was a Year to Forget for Wheaton Precious Metals Corp

The shares of precious metals streaming company Wheaton Precious Metals Corp (NYSE: WPM) rose 14.5% in 2017. It's hard to say that was a bad year, except that its peers Royal Gold, Inc (NASDAQ: RGLD) and Franco-Nevada Corp (NYSE: FNV) were each up roughly 30%. Here's why Wheaton's gold and silver production left it behind this pair, and why the company's future looks appealing just the same.

Leaning the wrong way

Very often, you'll hear companies talk about the mix of their product sales impacting their profits. Wheaton's laggard performance in 2017 was all about the mix of gold and silver sales. Franco-Nevada gets around two-thirds of its revenues from gold. Royal Gold's mix is even more tilted toward the yellow metal, which makes up around 75% of the top line. Wheaton's mix is weighted less toward gold, with silver making up roughly half of the the company's sales tally.

Image source: Getty Images.

This was a big deal because gold advanced nearly 13% in 2017, while silver was down a little more than 1%. That goes a long way toward explaining Wheaton's relative underperformance, here. But production was also an issue, with Wheaton expecting the amount of gold and silver it gets from its mining partners to be roughly flat in 2017. That's essentially the plan through 2021, as well, based on current operations.

But don't get too caught up on that, because there's still a lot of opportunity for Wheaton, and much of it is baked into the portfolio already.

A brighter future

Streaming companies like Wheaton are best thought of as specialty finance companies that own a portfolio of gold and silver mine investments. These investments span from operating mines to those that are in some phase of development. In Wheaton's case, it currently has investments in 20 operating mines and nine development projects.

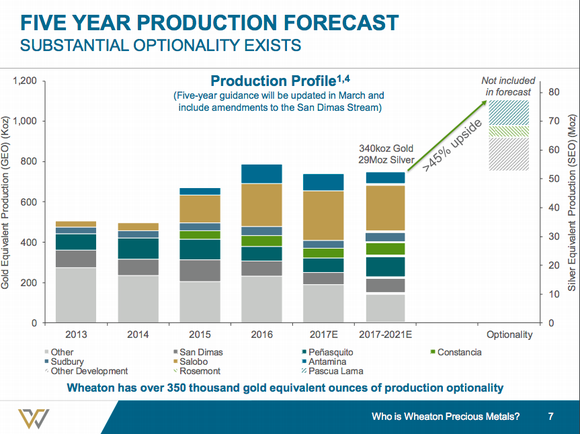

Wheaton's portfolio has a lot of growth potential built in today. Image source: Wheaton Precious Metals Corp.

The goal is to get the portfolio balanced so that production declines at older mine investments are more than offset by new mines and new mine investments. Assuming Wheaton doesn't ink any more streaming deals, it believes its gold equivalent production, which puts gold and silver on equal footing, could increase as much as 45% by 2021. To hit that number would require a lot of positive outcomes at the mine projects already in its portfolio, but it is reasonable to expect a good portion of this "optionality," as the company calls it, to be realized.

So, while 2017 wasn't a great year, there's a reason to believe the future will be brighter as mine projects get completed and their gold and silver production get added to the total. It's also worth noting that Wheaton's mix has been shifting. In 2015, Wheaton's silver sales made up closer to two-thirds of revenues. So the company's mix is more balanced than it once was, a direct result of management's plans to grow the company.

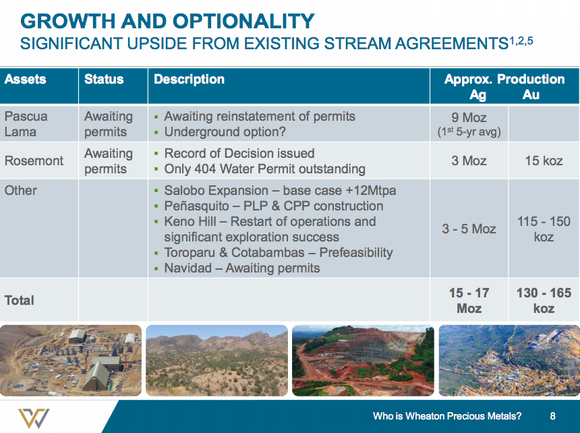

Some of the projects in Wheaton's portfolio that could push its production higher. Image source: Wheaton Precious Metals Corp.

Having so much silver in the mix was a drag in 2017, since gold handily outperformed silver. However, gold and silver are both commodities subject to often volatile and swift price fluctuations. While Wheaton is trying to shift away from its once heavy reliance on silver, having more silver exposure than its peers could just as easily turn into a positive should silver outperform gold in the future. More notable is that the company's fundamentals, specifically the opportunity to grow overall production, remain solid.

More positive than negative

So, at the end of the day, 2017 wasn't a year that Wheaton Precious Metals investors are likely to forget. Not because it was a horrible year, but because it was one in which the streaming company lagged its peers. But the reason for that performance highlights Wheaton's more balanced portfolio, something that could easily turn into a positive when dealing with often volatile precious metals prices. And while production results were a headwind as well, there remains a lot of opportunity for Wheaton to grow its business already built into its portfolio. If you're interested in a gold and silver investment, Wheaton is still worth a deep dive.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance