Why Should You Add FMC Corp (FMC) Stock to Your Portfolio?

FMC Corporation’s FMC stock looks promising at the moment. The chemical maker’s shares have gained around 10% over the past three months. It is benefiting from strong demand for its herbicides and insecticides, pricing actions and its efforts to expand product portfolio and boost market position.

Let’s delve deeper into the factors that make this Zacks Rank #2 (Buy) stock an attractive choice for investors right now.

Price Performance

FMC has outperformed the industry it belongs to over the past six months. The company’s shares have rallied 29.5% compared with 22.8% rise recorded by the industry. It has also topped the S&P 500’s 3.1% rise.

Image Source: Zacks Investment Research

Positive Earnings Surprise History

FMC has an impressive earnings surprise history. It beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 7.9%.

Estimates Northbound

Earnings estimate revisions have the greatest impact on stock prices. Over the past month, the Zacks Consensus Estimate for earnings for FMC for 2023 has increased around 0.6%. The consensus estimate for earnings for 2023 is currently pegged at $8.34, reflecting an expected year-over-year growth of around 13%.

Superior Return on Equity (ROE)

FMC’s ROE of 29.3%, as compared with the industry average of 19.3%, manifests the company’s efficiency in utilizing shareholder’s funds.

Capital Allocation

FMC remains committed to return value to shareholders leveraging healthy cash flows. It expects to generate free cash flow of $440-$560 million for full-year 2022. FMC Corp. also expects to return up to around $470 million to shareholders through dividends and share repurchases for 2022.

Growth Drivers in Place

FMC Corp is gaining from healthy demand for its industry leading products, driven by strong global agricultural market fundamentals. It is well placed to capitalize on the underlying strength in global crop protection markets thanks to high commodity prices. The strong demand environment coupled with the company’s price increase actions is driving its top line.

The acquisition of BioPhero ApS, a Denmark-based pheromone research and production company, also adds biologically produced state-of-the-art pheromone insect control technology to the company’s product portfolio and R&D pipeline, highlighting FMC's role as a leader in delivering innovative and sustainable crop protection solutions.

FMC Corp also remains focused on boosting its market position and strengthening its product portfolio. It is investing in technologies and products as well as new launches to enhance value to the farmers. New products launched in Europe, North America and Asia are gaining significant traction and are contributing to volume growth. Product introductions are expected to support the company’s results.

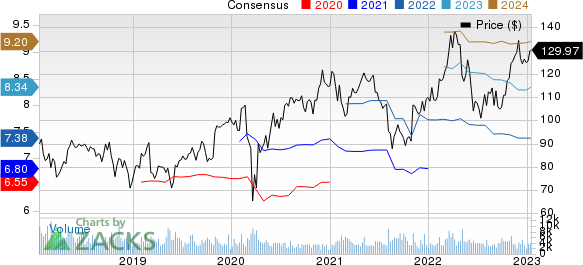

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Olympic Steel, Inc. ZEUS, Commercial Metals Company CMC and Nucor Corporation NUE.

Olympic Steel currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 1.5% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 74% in a year.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 19.4% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 16.7%, on average. CMC has gained around 54% in a year.

Nucor currently carries a Zacks Rank #1. The company has a projected earnings growth rate of 21.5% for the current year.

Nucor’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 3.9%, on average. NUE has rallied roughly 48% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance