Why You Should Add Reliance Steel (RS) Stock to Your Portfolio

Reliance Steel & Aluminum Co. RS is benefiting from strong demand across key end-use markets, a diversified product base and strategic acquisitions.

We are optimistic about its prospects and believe that the time is right to add the stock to the portfolio as it looks poised to carry the momentum ahead.

Let’s delve deeper into the factors that make this Zacks Rank #2 (Buy) stock an attractive choice for investors.

An Outperformer

Shares of Reliance Steel have gained 23.1% over a year against the 6.4% decline of its industry. It has also outperformed the S&P 500’s roughly 13% decline over the same period.

Image Source: Zacks Investment Research

Estimates Northbound

Over the past two months, the Zacks Consensus Estimate for earnings for 2022 for Reliance Steel has increased 13.4%. The consensus estimate for 2023 earnings has also been revised 9% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

Positive Earnings Surprise History

Reliance Steel’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average being 13.4%.

Upbeat Prospects

Reliance Steel is gaining from strong underlying demand in its major markets. It remains cautiously optimistic about the business environment in 2022 and sees robust demand in the majority of its end markets.

The company witnessed improved demand in non-residential construction, its largest market, in the second quarter of 2022. It is cautiously optimistic that demand for non-residential construction activity in the key areas in which it operates will remain steady into the third quarter.

Reliance Steel is also seeing strength in semiconductors and energy markets. Demand also remains steady for the toll processing services that it provides to the automotive market despite the impact of global microchip shortages on production levels. Demand also recovered in commercial aerospace during the second quarter.

The company has also been following an aggressive acquisition strategy for a while as part of its core business policy to drive operating results. Its latest acquisitions of Rotax Metals, Admiral Metals and Nu-Tech Precision Metals are in sync with its strategy of investing in high-quality businesses.

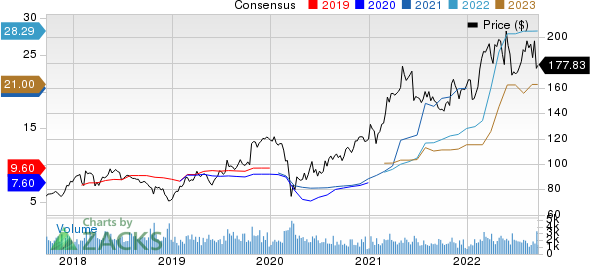

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Univar Solutions Inc. UNVR and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 425.3% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 63.7% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 28% in a year.

Univar, currently carrying a Zacks Rank #2, has an expected earnings growth rate of 52.7% for the current year. The consensus estimate for UNVR's earnings for the current year has been revised 5.9% upward in the past 60 days.

Univar’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 27.6%. UNVR has gained around 3% over a year.

Sociedad has a projected earnings growth rate of 530.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 18.8% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 85% in a year. The company currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Univar Solutions Inc. (UNVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance