Why is Allegheny (ATI) Up 2.4% Since its Last Earnings Report?

It has been about a month since the last earnings report for Allegheny Technologies Incorporated ATI. Shares have added about 2.4% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is ATI due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Allegheny's Earnings & Revenues Top Estimates in Q1

Allegheny reported net earnings of $58 million or 42 cents per share for first-quarter 2018, compared with $17.5 million or 16 cents recorded a year-ago.

Barring one-time items, adjusted earnings came in at 32 cents per share for the quarter, which surpassed the Zacks Consensus Estimate of 24 cents.

Revenues for the quarter rose 13% year over year to $979 million, beating the Zacks Consensus Estimate of $950 million.

Segment Highlights

Revenues from the High Performance Materials & Components (“HPMC”) segment improved 10% year over year to $560.7 million in the first quarter driven by increased sales of forged and cast components.

Operating profit increased to $85.5 million from $50.9 million in the prior-year quarter. The increase is due to higher productivity from increasing aerospace and defense sales, and better product mix of next-generation nickel alloys and forgings for the aero engine market.

The Flat-Rolled Products (“FRP”) segment’s sales rose 17.7% year over year to $418.3 million on the back of higher shipment volume for high-value products, mainly nickel-based and specialty alloys for oil & gas projects.

The segment’s operating profit came in at $10.9 million, down from the year-ago figure of $19 million. The decline is due to roughly $8 million of unfavorable impact from required accounting changes on retirement benefit cost capitalization in inventory, as well as reduced benefits of foreign currency hedges.

Financial Position

Allegheny’s cash in hand as of Mar 31, 2018 was $110 million, down 31.2% year over year. Long-term debt fell 13.4% to $1,535.3 million.

The company generated operating cash flows of $47.1 million in the quarter.

Outlook

Allegheny expects continued operating margin improvement and revenue growth in its HPMC unit in 2018 from improved asset utilization and aerospace market demand growth. Allegheny also expects FRP unit to capitalize on the operational improvements and A&T Stainless joint venture and growth in differentiated products.

Additionally, the company anticipates to generate at least $150 million of free cash flow in 2018, excluding contributions to the ATI Pension Plan.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

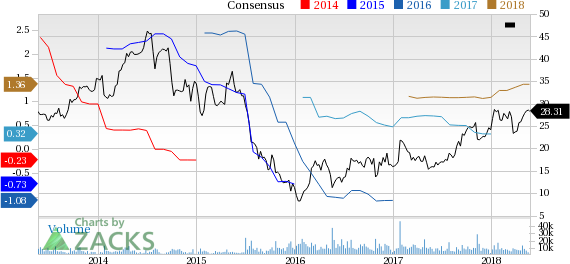

Allegheny Technologies Incorporated Price and Consensus

Allegheny Technologies Incorporated Price and Consensus | Allegheny Technologies Incorporated Quote

VGM Scores

At this time, ATI has an average Growth Score of C, however its Momentum is doing a bit better with a B. The stock was also allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for momentum investors than those looking for value and growth.

Outlook

ATI has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance