Why American Airlines' Share Buybacks Are Slowing Down

During 2015 and 2016, American Airlines (NASDAQ: AAL) set itself apart from its peers in the airline industry by repurchasing an enormous amount of stock. As a result, the company has reduced its share count by a stunning 37% since the middle of 2014.

However, American's share repurchase activity has declined to a more moderate level during 2017. Furthermore, while American Airlines is on track to post stronger free cash flow in 2018, the company may need to reduce its buyback activity even further in the coming year.

American Airlines Stock Buybacks (Quarterly), data by YCharts.

A buyback machine

Beginning in late 2014, profitability surged at American Airlines as oil prices fell. However, while American's stock price initially moved higher, the stock gave back some of its gains beginning in mid-2015. This encouraged management to start repurchasing stock at a phenomenal rate. The company spent more than $3.8 billion on buybacks in 2015 and $4.5 billion in 2016.

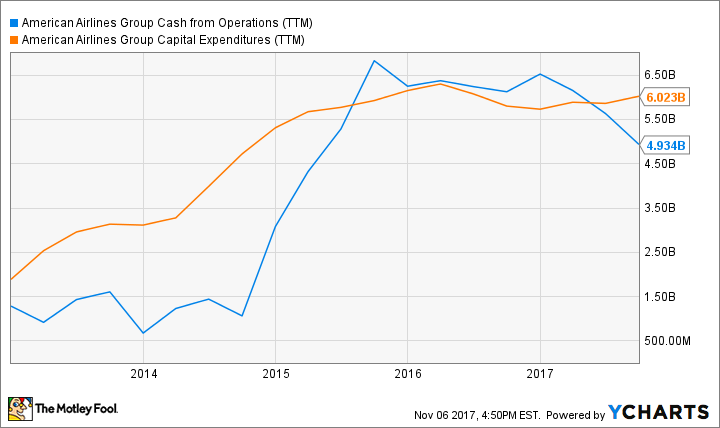

American Airlines' share repurchases have been particularly notable because the company hasn't generated much free cash flow in recent years. While operating cash flow skyrocketed as oil prices fell, American Airlines has been spending heavily to update its fleet. This capital spending has soaked up virtually all of the company's cash from operations.

American Airlines Cash from Operations (TTM), data by YCharts.

American Airlines has pulled off this combination of big share buybacks and heavy capital spending by borrowing extensively to fund its aircraft purchases. CEO Doug Parker views this as a wise move, because of the low cost of debt and American's somewhat depressed share price. Parker believes that it's reasonable for American to have more debt than its competitors, because it has a younger and more valuable fleet.

Operating cash flow is falling -- but free cash flow could rebound

Unfortunately for American Airlines shareholders, the company's operating cash flow is falling, because of runaway cost increases. Through the first nine months of 2017, American generated operating cash flow of $4.3 billion, down 27% from $5.9 billion in the same period of 2016.

This largely explains why the company reduced its share buybacks to $1.4 billion in the first nine months of 2017, from $3.9 billion in the first nine months of 2016. However, some analysts think the share buyback activity could accelerate again in 2018.

This hope is pinned on the fact that American Airlines plans to reduce capex to $3.2 billion next year, compared with about $5.7 billion in 2017. That should push free cash flow back into positive territory, even if operating cash flow doesn't improve much.

Debt repayments could trump share buybacks

Even though free cash flow is set to improve next year, it may not lead to higher share buyback activity. Instead, American Airlines may need to devote the bulk of its available cash to debt repayments in 2018 -- and beyond.

By financing the bulk of its aircraft purchases over the past few years, American Airlines has effectively agreed to pay off the cost over time. That bill is coming due: American's scheduled debt repayments for 2018 total $2.5 billion. This isn't a one-off situation, either. The company's debt maturities average more than $3 billion annually between 2018 and 2021.

American Airlines will face heavy debt maturities over the next few years. Image source: American Airlines.

Even if American Airlines continues to finance about 75% of the cost of its aircraft purchases, it would reduce its net debt by more than $1 billion just by paying off its scheduled debt maturities next year. That would soak up a large majority of its free cash flow, unless American posts much stronger earnings growth than what most analysts currently expect.

American Airlines will also need nearly $200 million to pay its dividend next year. While the company has been drawing down its cash balance to fund share buybacks this year, it is on track to end 2017 with no more than $1 billion of excess liquidity above its $7 billion target -- even if it goes cold-turkey on share buybacks in the fourth quarter.

In short, American Airlines' multi-year run of large share repurchases is probably coming to an end. For the foreseeable future, American will need to focus on paying off the debt it incurred to finance its share-buyback spree of the past few years.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Adam Levine-Weinberg has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance