Why Arista (ANET) is an Attractive Portfolio Pick Right Now

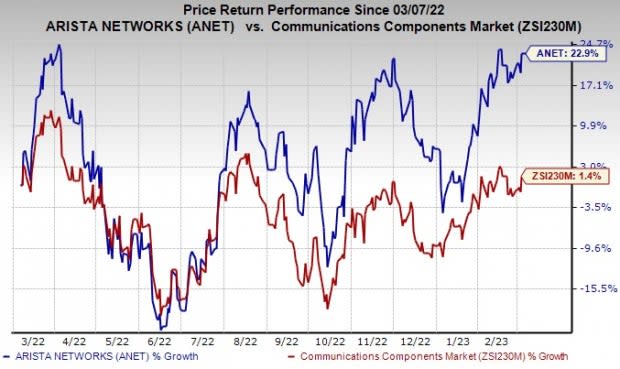

Shares of Arista Networks, Inc. ANET have risen 22.9% over the past year, driven by solid demand trends and healthy customer additions. Its current fiscal-year earnings estimates have moved up 37.2% over the past year, while that for the next fiscal year has appreciated 34.2% over the same time frame, implying healthy growth potential. Despite intense market volatility, this Zacks Rank #1 (Strong Buy) stock appears to be a solid investment option at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Arista continues to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. It is well-poised for growth in data-driven cloud networking business with proactive platforms and predictive operations.

The company holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. It is increasingly gaining market traction in 200- and 400-gig high-performance switching products. It remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

With customers deploying transformative cloud networking solutions, it has announced several additions to its multi-cloud and cloud-native software product family with CloudEOS Edge. It has introduced cognitive Wi-Fi software that delivers intelligent application identification, automated troubleshooting and location services. This supports video conferencing applications like Google Hangouts, Microsoft Teams and Zoom.

Arista has introduced a network observability software, DANZ Monitoring Fabric (DMF), on its switching platforms for enterprise-wide traffic visibility and contextual insights. The offering enables mission-critical monitoring of enterprise traffic while improving efficiencies and reducing operating expenses through the adoption of modern cloud networking principles. DMF enables IT operators to extensively monitor all user, device and application traffic by gaining complete visibility into physical, virtual and container environments. The DMF offering is based on Arista’s popular switching platforms with optional advanced nodes.

The buyout of Awake Security, a Network Detection and Response platform provider that combines artificial intelligence with human expertise to autonomously hunt and respond to insider and external threats, has strengthened its market position. The company expanded its cognitive campus portfolio with new platforms, including the 750 Series modular chassis and the 720 Series 96 port fixed switch. Arista announced unified edge innovations across wired and wireless networks for its Cognitive Campus Edge portfolio for Enterprise Workspaces. It has also introduced an enterprise-grade Software-as-a-Service offering for the flagship CloudVision platform.

Arista continues benefiting from the expanding cloud networking market, driven by strong demand for scalable infrastructure. In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability, enabling integration with third-party applications for network management, automation and orchestration. It offers one of the broadest product lines of datacenter and campus Ethernet switches and routers in the industry. Arista provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency. The company also innovates in areas such as deep packet buffers, embedded optics and reversible cooling.

The stock delivered an earnings surprise of 14.2%, on average, in the trailing four quarters. With a long-term earnings growth expectation of 14.2%, this stock appears to be an enticing investment option for the volatile market.

Other Key Picks

Viavi Solutions Inc. VIAV, carrying a Zacks Rank #2 (Buy), is a key pick. Headquartered in Scottsdale, AZ, Viavi is a leading provider of network test, monitoring and service enablement solutions to diverse sectors across the globe. The product portfolio of the company offers end-to-end network visibility and analytics that help build, test, certify, maintain, and optimize complex physical and virtual networks.

Viavi also offers high-performance thin film optical coatings for light-management solutions used in anti-counterfeiting, 3D sensing, electronics, automotive, defense and instrumentation markets. It delivered an earnings surprise of 9.1%, on average, in the trailing four quarters.

Juniper Networks, Inc. JNPR carries a Zacks Rank #2. It has a long-term earnings growth expectation of 7% and delivered an earnings surprise of 1.6%, on average, in the trailing four quarters.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence.

Deutsche Telekom AG DTEGY, sporting a Zacks Rank #1, is likely to benefit from the accretive post-merger integration of T-Mobile US Inc. and Sprite in the United States, in which it owns about 43% stake. The removal of forced cable TV access in multiple dwelling units in Germany through telecom legislation is likely to help Deutsche Telekom expand its broadband market.

Moreover, an aggressive fiber rollout strategy across the country is expected to augment its domestic market hold. The Zacks Consensus Estimate for current-year earnings for Deutsche Telekom has been revised 21.8% upward over the past year. It has a VGM Score of A and a long-term earnings growth expectation of 15.7%. The stock has gained 38% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Deutsche Telekom AG (DTEGY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance