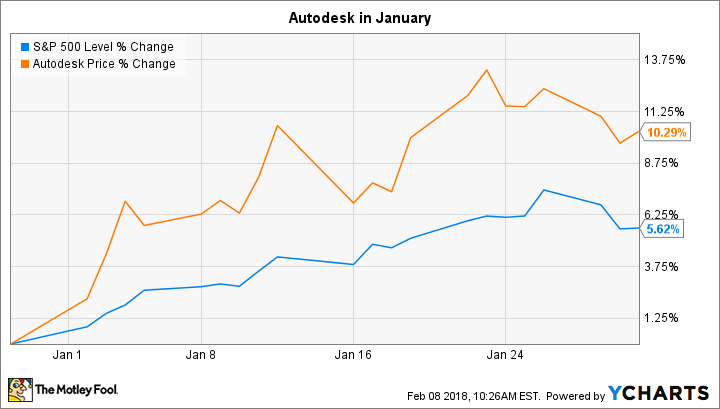

Why Autodesk Stock Gained 10% in January

What happened

Computer-aided design software specialist Autodesk (NASDAQ: ADSK) beat the market last month, rising 10% compared to a 6% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

The boost extended into early 2018 a rally that saw the stock surge by 42% in 2017.

So what

The company didn't announce any business updates last month. Instead, investors likely snapped up shares in response to growing optimism around Autodesk's shift to a cloud-delivered, subscription-based operating model.

Image source: Getty Images.

Hints of the long-term power of that approach was evident in its most recent quarterly results, which showed a 24% spike in annual recurring revenue, to almost $2 billion. Autodesk gained over 300,000 new subscribers in the third quarter to push its user base to 1.9 million.

Now what

Tempering that healthy growth was news that Autodesk is restructuring its business, including doing layoffs and shifting spending toward different investment priorities. That realignment didn't impact management's sales forecast for the 2017 fiscal year. However, it could figure prominently in the company's 2018 outlook, which will be part of fiscal fourth-quarter results due out in early March.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance