Why Bitauto Holdings Limited Stock Lost 25.5% in March

What happened

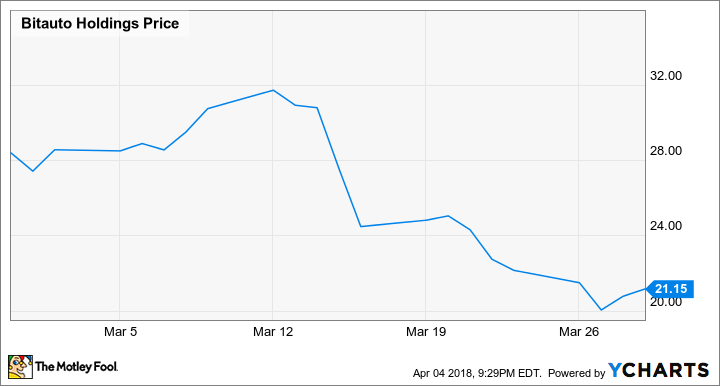

Shares of Bitauto Holding Limited (NYSE: BITA) lost 25.5% of their value in March, according to data provided by S&P Global Market Intelligence .

Shares sold off after Bitauto reported fourth-quarter earnings results, despite sales and earnings performance for the period coming in ahead of the market's expectations. A declining valuation for its Yixin subsidiary also pulled down the company's share price.

Image source: Getty Images.

So what

Bitauto's fourth-quarter sales climbed roughly 54% year over year to reach $413.5 million, beating the average analyst estimate of roughly $383 million in sales for the period. Adjusted earnings also slipped less than anticipated, dropping from $0.12 per share in the prior-year period to $0.11 when the average analyst estimate called for $0.10. However, management's guidance for first-quarter sales of between $302 million and $310 million fell short of the market's expectations, and shares dipped roughly 11% in the next day of trading.

Yixin, the online auto financing platform in which Bitauto owns a 47% stake, saw its valuation stumble last month as well -- further dragging on the parent company's share price.

Now what

Despite Bitauto's revenue target missing Wall Street's expectations of roughly $337 million in sales for the current quarter, the company is still guiding for year-over-year sales growth between 37% and 41% for the period. Bitauto is valued at roughly 0.8 times this year's expected sales and 10.5 times expected earnings. With China's middle class expanding at a rapid clip and lots of momentum in the e-commerce space, those metrics suggest the stock could be an appealing value play for risk-tolerant investors.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance