Why Britain’s future generation of pensioners may never own a home

As housing costs increase disproportionately to wage growth, it is increasingly difficult to own your own home.

At the end of 2023, the average house price was 8.1 times the average income in England and Wales, according to ONS data. And we are not building enough new homes.

As a result, the number of people still renting or paying off a mortgage in retirement is likely to increase significantly over the next 20 years.

In fact, if the current trajectory continues the proportion of retirees who own their homes is set to fall from 78pc to 63pc by 2041 and the proportion living in private rented accommodation is set to rise from 6pc to 17pc, according to analysis by think-tank the Pensions Policy Institute (PPI).

The consequences for future generations of British pensioners are stark.

Either paying rent in your retirement, or paying off a mortgage if you don’t yet own your home outright, is a significant outgoing at a time when your income has dried up. High housing costs in later life will also limit how much can be saved into a pension.

A single person needs an income of £31,300 a year for a moderate retirement or £43,100 for a comfortable one, according to the trade body the Pensions and Lifetime Savings Association. But this estimate of how much you need to save for when you retire, a key metric used within the pensions industry, assumes you don’t have rent or a mortgage to pay in retirement.

That means thousands of pensioners’ savings could fall short of what they will need, and by significant amounts.

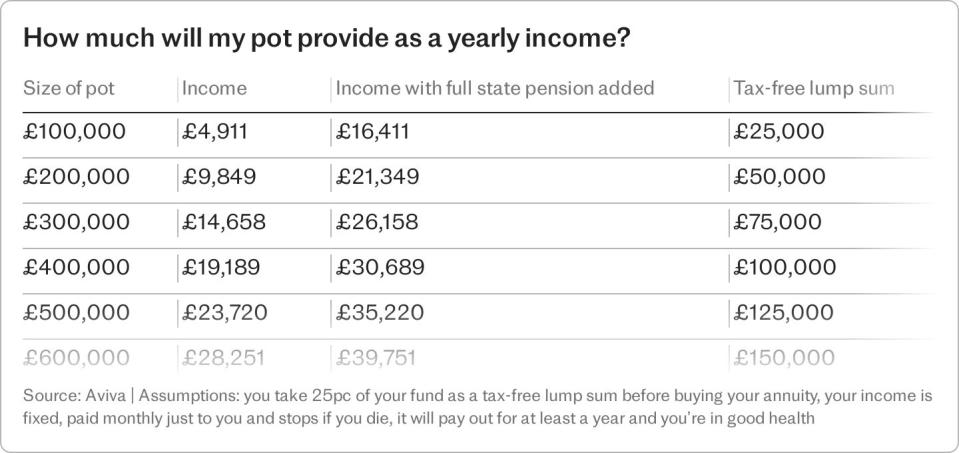

Retirees in England with annuities paying low rates may need as much as 40pc more in their pension pots above the recommended amount to achieve a moderate retirement, if they are going to be renting when they leave work, according to figures from pension provider Aviva. In some areas of Scotland the pension pot deficit is as much as 60pc.

Even those with annuities paying higher incomes (rates have been climbing for the past couple of years) may have to find an extra 38pc for their pots in order to cover these housing costs. In London, savers could need an extra 68pc for a reasonable standard of living if they will be renting after they finish working.

It is a stark prospect and one experts agree the pensions industry cannot fix alone.

Helen Morrisey, head of pensions analysis for Hargreaves Lansdown says: “It really blows your mind, the scale of the challenge. This is a bigger issue than the pensions sector can solve.”

Morrisey says housing costs, both for retirees and those in work, need to come down.

“Those paying high rents throughout their life can’t save. Renters’ retirement resilience at all ages is far lower than anyone who owns their own home.”

Anna Brain, research associate at the PPI, warns that there are significant assumptions which are embedded into our pensions system that haven’t been reviewed, resulting in the increased likelihood of pension shortfalls.

One example is the decline of “defined benefit” schemes, and the rise of “defined contribution” plans that rely more heavily on individuals paying in. As a result, more people will retire with workplace pensions paying a far lower proportion of their working salary than in the past.

Similarly, she says, the PLSA’s calculations assume home ownership and that even lower income workers will have benefitted from the Right to Buy scheme, or will have access to social housing that will keep housing costs at a manageable level.

However, the amount of social housing has declined by around a quarter over the past 40 years, according to official data. And regulations introduced after the financial crisis to prevent risky property loans make it harder for buyers to get on to the ladder even before the increase in interest rates.

And yet there is little policy discussion about how to approach the issue.

Sir Steve Webb, a former pensions minister and partner at consultants LCP, says: “Remarkably little thought has been given to this issue so far.”

In part, he suggests, it is because of the fragmented operation of government, for example the Department of Work and Pensions isn’t responsible for housing and social care both of which really play a large role in your standard of living in retirement.

“You really do need someone in government with the ability to look across departments,” says Sir Steve.

How to fix the pension problem

Pension experts say awareness needs to be raised among savers who do not realise they were likely to be under saving. Morrisey suggests more needs to be done to help people understand pensions earlier in their working life, as well as changes to workplace pensions.

Implementation of 2017 reforms to lower the age workers are automatically enrolled into a pension scheme from 22 to 18 have been delayed to the mid or late 2020s.

Sir Steve suggests that the message we send to those in their 20s and 30s may need to become more nuanced. Whereas the traditional message has been to put any spare money into your pension, perhaps it should now emphasise the importance of home ownership.

“If you are renting and liable to remain renting then putting money aside for home ownership is possibly the best pension plan you can have. If you can make sure you are a homeowner by retirement then the amount you need in your pension pot is dramatically reduced.”

There are moves to help first-time buyers get on to the housing ladder, one of the more popular options is for taking out a longer dated mortgage that reduces your monthly payments. In fact, the average mortgage term for first time buyers has increased to 32 years, according to data from lender TSB.

However, by paying off your mortgage for longer, you risk having to pay down the loan later in life and reduce the amount you can save into your pensions in your 50s and 60s, warns Sir Steve.

“Historically someone might have paid off their mortgage in their late 50s and then they have cash to top up their pension each month,” he says. “Well that period doesn’t exist any more because you are paying a mortgage up to retirement. So be careful.”

Don’t count on an inheritance

One factor that could improve the situation for some is receiving a lump sum through inheritance, allowing them to pay down a mortgage or even get on the housing ladder.

For those born in the 1970s, the average age of receiving an inheritance is expected to be 62, meaning that some renters may be able to purchase a home outright later in life, according to the Institute for Fiscal Studies.

However, it is hard to predict the impact generational wealth will have across the country, says Brain.

“Our view is that policymakers and families can’t depend on inheritance to solve this problem.”

Pensioners relying on benefits

There is also the question of benefits in later life. As many as 400,000 more households could become dependent upon income-related pensioner benefits by 2041, according to the PPI. And an increase in those renting in later life will likely result in a higher reliance on housing benefit, the IFS says.

The think-tank estimates that spending on state pensions and other benefits for retirees could rise by £100bn a year by 2070.

Retirees currently benefit from the triple lock – a guarantee that the state pension will increase every April by the highest of wages, prices or 2.65pc. However, there is no guarantee of how long the policy will be in place and the pension age is set to keep increasing to 2050 meaning many will have to wait longer to receive the pay out.

A spokesman for the Department for Work and Pensions claimed the Government’s reforms would boost the average earner’s pension by 50pc.

He said: “Automatic enrolment has already helped an extra 11 million people save for their futures, and our plans to expand this, alongside our transformative Mansion House reforms, could help see the average earner’s pension increase by nearly 50pc when saving over a career, while a minimum wage worker could see their pension pot increase by nearly 90pc.

“We are also investing £30bn in housing support this year, and we are committed to creating a fair housing system that works for everyone by boosting availability of new, genuinely affordable housing.”

Yahoo Finance

Yahoo Finance