Why You Should Buy Pioneer Natural (PXD) Ahead of Q1 Earnings

Investors are closely monitoring Pioneer Natural Resources Company PXD as it prepares to announce first-quarter 2024 earnings on May 2, after market close. Some investors are considering whether to buy shares of this large exploration and production energy company before its earnings release or wait for a more favorable entry opportunity.

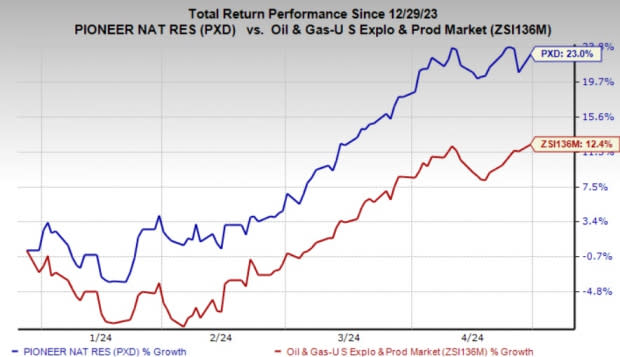

Promising Price Trends

Pioneer Natural has proven to be rewarding since the beginning of 2024, gaining 23.0% year to date, surpassing the 12.4% rise of the composite stocks belonging to the Zacks US Oil & Gas Exploration & Production industry. The acquisition of the company by Exxon Mobil Corporation XOM is probably the main catalyst that is driving the outperformance.

Image Source: Zacks Investment Research

Highly favorable oil prices, as evidenced by the average spot West Texas Intermediate crude oil prices per barrel in January, February and March of $74.15, $77.25, and $81.28, respectively, according to the U.S. Energy Information Administration’s data, are also bolstering the upstream major's price performance, and hence might have backed PXD’s first-quarter earnings.

The Zacks Consensus Estimate for first-quarter earnings per share stands at $5.01, with revenues estimated at $5.3 billion. Notably, our proven model predicts an earnings beat for Pioneer Natural this time around because the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. PXD has an Earnings ESP of +1.31% and a Zacks Rank #2.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Optimal Moment for Investment

Pioneer Natural's price chart might continue its upward trend, fueled by investors' optimism surrounding the pending acquisition by ExxonMobil in a $59.5 billion all-stock deal, slated for completion as planned in the first half of 2024. Notably, Pioneer Natural obtained shareholder approval for the merger on Feb 7.

The billion-dollar question now arises: How will Pioneer Natural shareholders benefit from the deal's completion? Under the agreement terms, PXD shareholders will be given 2.3234 shares of ExxonMobil for each Pioneer Natural share they own. Therefore, the proposed acquisition offers a lucrative opportunity for PXD shareholders, integrating them into a supermajor company.

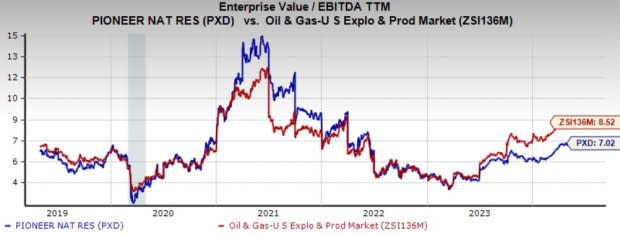

Clearly, the favorable developments are benefiting the leading upstream energy player and presenting an excellent opportunity to invest in the stock. Also, the stock is trading at a 12-month trailing Enterprise Value/Earnings before Interest Tax Depreciation and Amortization ratio of 7.02 times, which is at a discount to the Zacks US Oil & Gas Exploration & Production industry average of 8.52.

Image Source: Zacks Investment Research

Conclusion

Considering the impending mega-merger, it's likely that this will be Pioneer Natural's final earnings report as a standalone public enterprise. Thus, there awaits a lucrative opportunity for PXD shareholders to be a part of XOM, a large integrated energy company. Hence, it is a good idea for investors to buy the upstream firm before May 2.

Other Stocks to Consider

Here are two other firms that you may want to consider, as these, too, have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

PBF Energy Inc. PBF has an Earnings ESP of +14.10% and is a Zacks #2 Ranked player at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PBF Energy is scheduled to release first-quarter results on May 2. The Zacks Consensus Estimate for PBF Energy’s earnings is pegged at 55 cents per share, suggesting a massive 80% decline year over year.

ConocoPhillips COP has an Earnings ESP of +2.85% and is a Zacks #2 Ranked player at present.

ConocoPhillips is scheduled to release first-quarter results on May 2. The Zacks Consensus Estimate for COP’s earnings is pegged at $2.09 per share.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance