Why Canon (CAJ) Is A Stellar Growth Stock

A select group of tech stocks, including Facebook FB and Amazon AMZN, have become increasingly popular in the growth investing world over the past few years.

But growth investors are always looking for the next pick, and as Q3 report season winds down, we have some time to think about what the next stocks with the potential for major top and bottom line expansion might be.

Some investors will spend their time looking for the next up and coming company, like a Netflix NFLX, but growth stocks can also come in the form of a well-established company that has dominated an industry for years.

With this in mind, one firm investors might want to consider is Canon CAJ.

Growth Fundamentals

This Japanese company manufactures and sells everything from cameras to computer printers and medical equipment. Canon is currently a Zacks Rank #1 (Strong Buy) and sports a “B” grade for Growth in our Style Scores system.

In terms of growth potential, our Zacks Consensus Estimates help to show that Canon is poised to see its sales and earnings skyrocket.

Canon revenues are projected to soar over 90% in the fourth quarter to reach as high as $9.89 billion. On top of that, the company’s full-year revenues are expected to surge over 15% to $36.64 billion.

The camera maker’s earnings are also expected to climb based on our current consensus estimates. Canon’s Q4 earnings are projected to shoot up over 115%. For its full fiscal year, Canon’s earnings are set to hit $1.97 per share, which would mark an impressive 65.55% year-over-year climb.

On top of these growth estimates, Canon also rocks “B” grades for both Value and Momentum in our Style Scores system, to help it earn an overall “A” VGM grade.

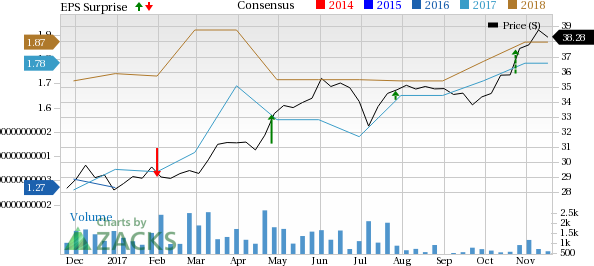

Canon, Inc. Price, Consensus and EPS Surprise

Canon, Inc. Price, Consensus and EPS Surprise | Canon, Inc. Quote

Investors might also be happy to know that after experiencing a bit of a rough patch, Canon has topped earnings estimates in the trailing three quarters.

What’s more, shares of Canon have climbed over 36% since the start of 2017, which crushes the S&P 500’s 12.70% movement, as well as the “Office Automation and Equipment” industry’s average.

Canon stock does currently sit near its 52-week high of $39.15 per share, but if the company can match our outsized growth estimates, shares of Canon should be able to easily storm into a new range.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius. Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Canon, Inc. (CAJ) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance