Why China's economy is in BIG trouble

How the Chinese economy hit the skids

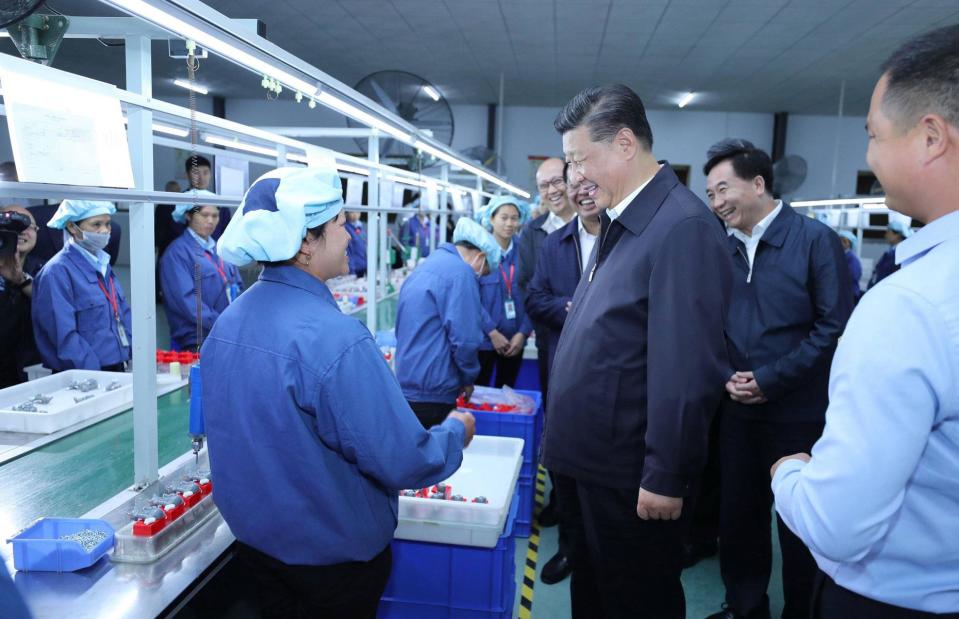

STR/AFP via Getty Images

Only a few years go, the Chinese economy was the envy of the world. From 1979 to 2018, the nation's GDP grew at a phenomenal rate and China transformed from one of the poorest countries on the planet into a manufacturing superpower.

Fast-forward to 2024 and growth has stalled. The economy has suffered everything from a property slump to enormous public debt and high youth unemployment. And given China's rapidly ageing population and other factors such an increased trade protectionism abroad, its long-term economic prospects seem pretty grim...

Read on to find out why the Chinese economy is in trouble right now. All dollar amounts in US dollars.

The start of China's economic miracle

Dean Conger/Corbis via Getty Images

China's economic miracle began in 1978 when leader Deng Xiaoping introduced market-orientated reforms to the country's closed command economy. Foreign investment was allowed the following year.

At the time, communist China was dirt-poor. In fact, its GDP per capita was about a third of the average of Sub-Saharan African countries. As you can imagine, poverty was rife and living standards were low across the board.

China's manufacturing bonanza

Wally McNamee/CORBIS/Corbis via Getty Images

Bar a blip following the Tiananmen Square massacre in 1989, further market reforms opened up the Chinese economy and overseas investment poured into the country. The lifting of price controls and a wave of privatisations had a particularly marked effect on growth.

Boosted by government incentives and foreign money, China's manufacturing sector mushroomed. Business blossomed, with the West all too happy to lap up the remarkably affordable goods churned out by the nation's factories.

The world's factory floor

China Photos/Getty Images

Costs were kept lower thanks to an abundance of cheap labour and generous government support, making Chinese exports hard to resist.

After the People's Republic joined the World Trade Organization (WTO) in 2001, exports positively surged. By 2010, China had become the world's leading exporter. That same year, it stole Japan's crown as the world's second-biggest economy. Annual growth was averaging 9.5%, millions of people had been lifted out of poverty, and a large and affluent middle class had developed.

China's Global Financial Crisis spending

PETER PARKS/AFP via Getty Images

Yet even then, all was not well with the Chinese economy. Amid the 2008 Global Financial Crisis, the authorities embarked on the mother of all spending sprees in a bid to keep the country afloat.

Borrowing, both public and private, skyrocketed in the country after the government ordered banks to lend like crazy. To stimulate the economy, local governments saddled themselves with eye-watering debt after taking out massive loans to fund largely unnecessary infrastructure, with the intention of paying them back by selling land usage rights.

China's growing housing bubble

In Pictures Ltd./Corbis via Getty Images

At the same time, a housing bubble was brewing. Regulations and restrictions on property ownership had loosened significantly in the early 2000s and house prices soared as a result, with a lifetime of pent-up demand fuelling sales.

With the banks bending over backwards to lend money and local governments hawking land usage rights en masse, private-sector speculation exploded and a home-building boom ensued.

Key economic driver

Feng Li/Getty Images

Property had become a major driver of China's economy. At the height of the housing bubble, real estate represented up to 30% of China's GDP, with 70% of all assets invested in the sector. And those numbers have hardly changed.

Housing was seen as a trusty investment and the number-one vehicle to safeguard financial security. Though prices dipped and plateaued at times, they remained on an upward trajectory for years. Purchasing property, even at inflated prices, seemed a no-brainer for vast swathes of the Chinese population.

Overleveraged property developers

LIU JIN/AFP via Getty Images

Moreover, scant investment opportunities exist in communist China, so most people choose to put their investment cash into housing. And since China's social safety net is minimal, people are encouraged to be frugal and save for a rainy day, with property the go-to nest egg for the majority.

By the late 2010s, the borrowing frenzy had reached fever pitch. Developers were massively overleveraged and relying on continued buoyant sales to fund the completion of projects that buyers had already paid for.

China's housing bubble begins to pop

MARK RALSTON/AFP via Getty Images

Overbuilding, especially in less prominent lower-tier cities, had become a major problem, with the country littered with empty, abandoned, and unfinished housing projects. The bubble started to burst in 2020 when the government began to clamp down on the rampant property speculation.

President Xi, who in 2017 declared that “houses are for living in, not for speculation”, introduced his three red lines in 2020. Developers now had to abide by strict rules capping their debt-to-cash, debt-to-assets, and debt-to-equity ratios.

Tougher housing market regulations

JADE GAO/AFP via Getty Images

Basically, overleveraged developers were being forced to rein in debt and suddenly found themselves unable to borrow. Further housing market regulations followed, including mortgage spending limits and rent caps in some cities.

The tougher rules combined with the COVID pandemic upended China's housing market. At the end of 2021, sales started to slump and house prices tumbled, exacerbating the financial woes of the struggling developers.

Evergrande collapse

PEDRO PARDO/AFP via Getty Images

The catalyst was monster developer Evergrande, which overleveraged to the max, defaulted on its bonds in December 2021. Once the world's most valuable real estate brand, the giant company was saddled with a jaw-dropping $300 billion (£238bn) debt.

The death knell came in January 2022 when Evergrande was ordered to liquidate its business. The firm's assets amounted to a little over $242 billion ($192bn) according to Bloomberg, leaving a shortfall of around $58 billion (£46bn), while millions of its apartments are paid for yet remain unfinished.

China's housing market meltdown

STR/AFP via Getty Images

Since 2021, more than 50 Chinese property companies have defaulted on their debts, according to The New York Times, including Evergrande's arch-rival Country Garden, which defaulted last October. Millions of people have been left out of pocket and an estimated 20 million pre-sold homes across the nation are in need of completion.

According to some estimates, there are now enough vacant units in the country to house three billion people – more than double China's population. That said, a good proportion of these are only half-built.

China's tech industry crackdown

AFP via Getty Images

In yet another blow to China's economy, the government also decided to launch a crackdown on the country's tech industry, which started in November 2020 with the cancellation of Alibaba affiliate ANT's IPO.

The crackdown has wiped an estimated $1.1 trillion (£870bn) off the Chinese tech industry, stifled entrepreneurship, and spooked foreign investors to boot.

China's declining exports

MANDEL NGAN/AFP via Getty Images

While the housing market crashed and the tech industry wrestled with tougher regulation, China's manufacturing output was suffering amid dampening demand (both at home and abroad). This was due to a variety of factors from prolonged zero-COVID lockdowns to increased protectionism among Beijing's biggest trading partners.

The US got the ball rolling in 2018 with President Trump's tariffs on Chinese goods. Since then, trade between the two countries has declined and last year Mexico surpassed China to become the top exporter to America.

Decreasing foreign demand

Sean Gallup/Getty Images

In 2023, China's exports fell for the first time since 2016 due to muted demand for its goods (apart from cars) across the world.

The dip in demand comes as foreign companies relocate manufacturing from China to friendlier countries in response to increased state intervention and control, higher labour costs, growing geopolitical tensions with the West, and other make-or-break factors.

Decreasing foreign investment

Imago/Alamy

For many of the same reasons, foreign investment is falling off a cliff. Last year, overseas investment in China nosedived to a 30-year low.

Foreign firms are moving money out of the People's Republic and investing it elsewhere, which doesn't bode well for the nation's economy going forward.

China's stock market downturn

STR/AFP via Getty Images

Reflecting China's economic slump is the appalling performance of the country's stock market, which has seen $6 trillion (£4.7trn) erased from its value since 2021.

The government has introduced a range of measures in an attempt to revive the flagging stock market, including placing restrictions on short-selling and using public money to buy up floundering stock, but a sustained recovery is unlikely to happen any time soon.

China's currency dip

STR/AFP via Getty Images

China's currency has also plunged in value.

In September, the renminbi dropped to its lowest level against the US dollar for 16 years, following news of a marked fall in Chinese exports. The Chinese government has taken steps to stabilise the rate by delaying interest rate cuts, among other measures. But the currency remains in the doldrums – along with the Chinese economy.

Consumer spending woes

August_0802/Shutterstock

A boost in consumer spending would work wonders on China's economy. But as we've mentioned, the emphasis has long been put on saving – and because many savers are hard up as a result of the housing crisis, the Chinese public are in no mood to splurge.

Then there's the issue of youth unemployment...

China's high youth unemployment

Cynthia Lee/Alamy

The general economic slowdown and other factors such as widespread skills mismatches have led to a spike in joblessness among China's younger workforce.

The number of young people out of work hit a record 21.3% last June. The figure was such a cause for concern that China's statistics bureau stopped publishing youth unemployment data, but it resumed in January using a new method that excludes students. Though the youth joblessness rate has dropped since June, it remains worryingly high.

The level of despair among China's Gen Zs and younger Millennials is evident from the growth of the slacker Lying Flat and Full Time Children movements, social trends that have seen young people reject the career ladder with some even getting paid by their parents to stay at home. These have largely been a response to increasing competitiveness in the job market, which is causing many workers to burn out.

Chinese local government debt

Kevin Frayer/Getty Images

In contrast to 2008, China can't 'spend' itself out of this economic malaise. Since the Global Financial Crisis, the country's debt-to-GDP ratio has doubled to a staggering 280%, according to Reuters, and the lion's share of liabilities is held by local governments.

Drowning in debt, they're now having to curb their borrowing, embrace austerity, and cancel or scale down infrastructure projects. Needless to say, this certainly isn't doing the wider economy any favours.

China's deflation nightmare

PEDRO PARDO/AFP via Getty Images

While much of the world has been battling to stem inflation, China has had to deal with deflation over the past few months. This has worsened the consumer spending slump since deflation saps demand as people put off purchases, expecting further reductions.

In January, prices fell at their fastest rate for 15 years. While they recovered slightly in February, damagingly low inflation rates are forecast to persist.

Japan asset price bubble vibes

STR/AFP via Getty Images

China's current economic crisis has drawn comparisons to Japan's asset price bubble that burst in 1989, crashing the country's economy and ushering in the Lost Decades of stagnant growth.

A slew of economists speculate this is where China is heading, given how similar the economic conditions were in both countries prior to their respective downturns.

China's middle-income trap

STR/AFP via Getty Images

Economists are also voicing concerns China will end up languishing in the dreaded middle-income trap.

In this scenario, a country is unable to achieve the growth that would propel it to higher-income status. It can no longer compete with cheaper countries due to rising wages. But at the same time, it lacks the necessary productivity and innovation to take on more advanced economies.

China's slowing GDP growth

STR/AFP via Getty Images

Between 1979 and 2018, China enjoyed average annual GDP growth of 9.5%, a pace hailed by the World Bank as “the fastest sustained expansion by a major economy in history.”

The Chinese government can only dream of that figure these days. Growth came in at a dismal 3% in 2022. Last year it picked up to 5.3% but the IMF predicts the annual number to fall to as low as 3.5% by 2028, while Bloomberg envisages growth of just 1% a year for China by 2050.

A question mark now hangs over whether the People's Republic will ever eclipse the US as the world's biggest economy. A decade ago, pundits predicted China would steal America's throne by 2024!

China's 'Five Crises' and 'Four Ds'

PETER PARKS/AFP via Getty Images

China's economy has suffered the 'Five Crises' of employment, exports, private investment, real estate, and debt defaults, according to Tapei expert Wu Jialong.

In terms of challenges, the economy will have to contend with the 'Four Ds', says economist Zongyuan Zoe Liu. These are debt, demand, demographics, and decoupling (from trading partners).

Chinese government efforts to revive the economy

Imago/Alamy

China's authoritarian government can be more a hindrance than a help, with its crackdowns on the housing and tech industries prime examples of its economic missteps.

Although Beijing is acting proactively to revive the country's economy, some of its moves could be seen as misguided, particularly surrounding manufacturing and trade.

China's advanced manufacturing push and alleged goods dumping

STR/AFP via Getty Images

Xi's government wants to pivot China towards high-tech advanced manufacturing, but the country will have a hard time competing with – let alone surpassing – America's tech prowess.

In the shorter term, the Chinese government is flooding the West with cheap goods as it attempts to kick-start the country's economy by ramping up exports.

The risk of relying on exports to save China's economy

STR/AFP via Getty Images

This approach could backfire spectacularly. Unlike the first 'China Shock' of the noughties, Western countries now have zero tolerance for what they perceive as dumping. Trade protectionism is now the name of the game.

The US recently warned China about its surging exports of cheap electric vehicles (EVs) and green tech, while the EU is contemplating slapping more tariffs on Chinese EVs. Plus, the UK is threatening China with “robust” trade sanctions. And Donald Trump has vowed to slap tariffs of 60% or higher on Chinese goods if he's elected US president for the second time later this year.

China's rapidly ageing population

JADE GAO/AFP via Getty Images

Looking further ahead, China's population is ageing fast.

The country could end up becoming old before it gets rich as the older population proliferates and weighs heavy on the economy. And considering China's weak social safety net, local government debt levels, and ticking pensions time bomb, the demographic shift won't be easy as the swiftly-shrinking younger workforce struggles to support the senior population.

China's military spending drive

Kosorukov Dmitry/Shutterstock

But one sector has seen a major injection of cash: the Chinese government has been throwing money at its military. In 2023, the defence budget swelled by 7.2% and it's set to grow an additional 7.2% this year, hitting a record $233 billion (£184bn).

Beijing's increased military spending and belligerent stance have prompted some analysts to speculate China will invade Taiwan to distract from the country's economic problems. Others say the poorly performing economy is making an invasion even less probable.

The potential economic effects of a Chinese invasion of Taiwan

lev radin/Shutterstock

If China did go ahead and invade Taiwan, the economic fallout would be devastating. According to Bloomberg, the People's Republic would take a 8.9% blow to its GDP during the first year of an invasion following a trade blockade. In the event of a full-blown war, the economy would slump by 16.7%.

The rest of the world would take an economic battering too. As per Bloomberg, an invasion would cost the global economy $10 trillion (£7.9trn), knocking 10% off its GDP.

The effect of China's slump on the global economy

nui7711/Shutterstock

Whether China invades Taiwan or not, the performance of its economy reverberates across the globe.

Asian markets that depend on exports to the People's Republic have suffered the most from China's slowdown. And while some countries such as upstart exporters Mexico and India stand to benefit to an extent from China's misfortunes, the nation's economic issues are becoming a general drag on global growth, according to British think tank Chatham House. Whether the People's Republic can recover remains to be seen.

Yahoo Finance

Yahoo Finance