How coronavirus could accelerate the demise of cable TV

Streaming is ballooning as the coronavirus pandemic locks most citizens indoors, and a new survey suggests it could also hastening the long-term trend of cable-cutting.

According to The Trade Desk, which surveyed nearly 3000 Americans recently, 64% of the respondents said they have either cut the cord, are planning to do so — or simply never subscribed to cable at all.

That number jumped to 75% for those aged 18-34 — suggesting that interest in cable is dwindling, especially amongst the younger generation.

“With only a quarter of young adults having any long-term interest in traditional cable TV, in a few years we won’t be talking about linear or cable TV at all. It will all be online and streaming,” The Trade Desk Chief Strategy Officer Brian Stempeck said in a statement.

A ‘billion dollar question’

To further illustrate that point, 11% of those households that still do have cable said they plan to cut the cord by the end of this year — with 18 to 34-year-olds once again leading the charge. These trends are expected to continue, as Americans adhere to stay-at-home orders — and streamers are capitalizing on this unprecedented moment.

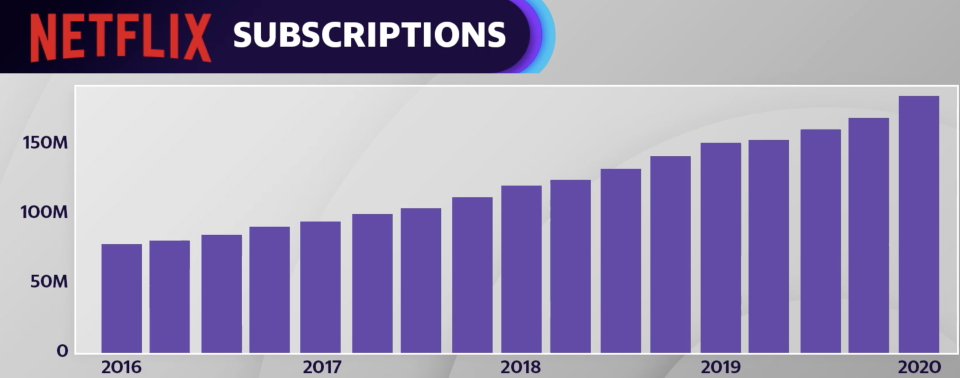

Netflix (NFLX) reported a record number of subscribers in the first quarter of 2020, nabbing nearly 16 million new accounts. That momentum is expected to continue even after the pandemic subsides.

“We anticipate the step-up will result in a permanent increase in penetration for Netflix's subscriber model and see its low price-point and staple nature supporting healthy fundamentals performance in a recession, even after stay-home orders are lifted,” Bank of America analyst Nat Schindler said recently.

Furthermore, the absence of live sports is also causing subscribers to rethink their cable plans. The majority of Americans (60%) say watching live sports is the primary reason they’ve kept their subscriptions in the first place, according to the survey.

Still, a larger question remains of whether or not streaming services will be able to keep people entertained when life eventually returns to normal.

“That is the billion dollar question right now,” Raymond James analyst Justin Patterson told Yahoo Finance this week.

The answer, Patterson said, likely lies in Netflix’s ability to continue to provide localized content to its various international markets — and the platform is willing to cough up big bucks to do just that.

The streamer announced on Wednesday that it will raise an additional $1 billion in debt to fund original programming and acquire new content, positioning itself as a major threat to U.S. studios whose futures now hang in the balance.

Alexandra is a Producer & Entertainment Correspondent at Yahoo Finance. Follow her on Twitter @alliecanal8193

Read more:

How the coronavirus is changing the media landscape — even for Netflix

Here's how Disney+ nabbed those 50 million-plus global subscribers

Disney an early streaming winner as Americans are stuck indoors amid coronavirus pandemic

Coronavirus forces certain films to go on-demand as pressure mounts for theaters

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance