Why Covid insurance ruling may mean more pain for small firms

The High Court’s decision in the closely watched Covid insurance test case could be the difference between going bust and surviving into next year for small businesses struggling to survive the lockdown and subsequent economic turmoil.

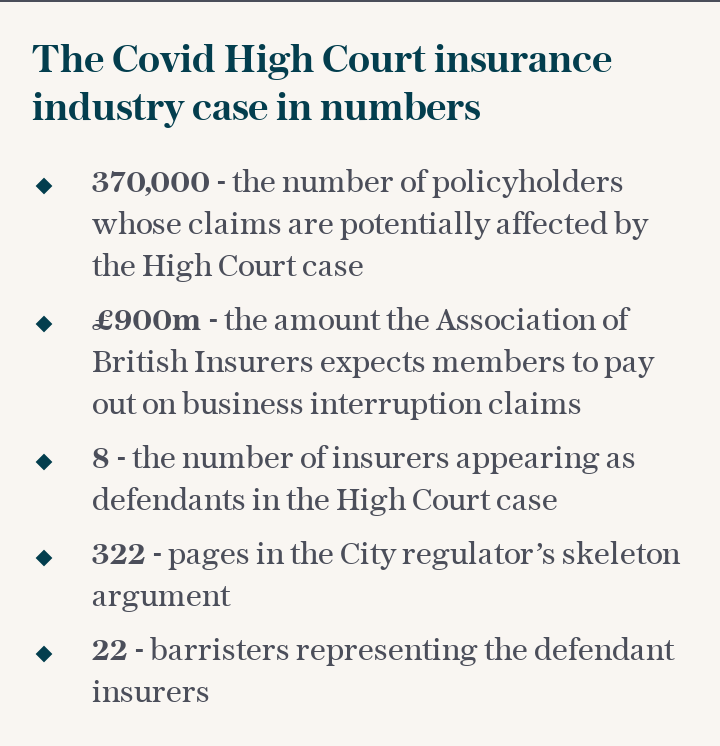

Murray Pulman and his daughter Emily were among the 370,000 business owners hoping the court would help them win a payout and keep trading into 2021.

The pair run the Posh Partridge Café in Dorchester, Dorset. They were denied a payout by their insurer, QBE, even though they had to shut from March 18 to July 4, cancelling £8,000 worth of orders in the first week alone and dumping food worth hundreds of pounds.

Pulman, who set up the business four years ago after previous jobs including designing equipment for the 2012 Olympics, says he was “monumentally let down” by his insurer and was forced to claim benefits for the first time.

After a fast-track legal process and an eight-day hearing in July, judges found that several sample business interruption policies provide coverage for pandemic-related losses suffered by firms.

Pulman’s lawyers, Mishcon de Reya, believe his claim is one of thousands that should now be paid following the decision. But for many businesses Tuesday’s complex 162-page judgment will not be the end of the matter.

“It’s not all unbridled joy [for small businesses],” says Ravi Nayer, an insurance lawyer at Brown Rudnick.

Parts of the ruling may be appealed either by the eight defendant insurers or by the Financial Conduct Authority (FCA) on behalf of policyholders.

Sonia Campbell, a partner at Mishcon de Reya who is representing a group of hospitality businesses seeking payouts, says: “We do anticipate that insurers will apply for permission to appeal but we hope they will do the right thing and now start paying claims.”

Any appeal is likely to “leapfrog” the Court of Appeal and go directly to the Supreme Court. This would accelerate the process but could still take until December or January to resolve, leaving businesses facing uncertainty.

Chris Woolard, interim FCA chief executive, is calling on insurers to progress claims irrespective of possible appeals. Industry bosses say this is abnormal as it would be difficult for insurers to recover money paid out if they subsequently win their appeal.

In addition, the ruling is helpful to many businesses but each payout will depend on the wording of the individual contract and the specific facts of the case.

The High Court also sided with insurers in relation to some of the contracts it reviewed, as reflected by big share price rises for two defendant insurers: Hiscox and RSA. Fellow defendant Zurich said its policies that were considered by the court do not provide cover in relation to Covid-19.

“It looks as though companies that were not required to close, [only] partially closed or closed their shops but continued to sell goods online will have difficult claims under prevention of access wording,” says Nayer.

Restaurants that operated a takeaway service instead of seating customers could also be disappointed, he adds.

In addition, the majority of firms will receive no payout. Most businesses do not purchase any kind of interruption insurance and of those that do, the FCA accepted several months ago that most policies do not cover losses caused by the pandemic.

Yahoo Finance

Yahoo Finance