Why Is Dominion Energy (D) Down 1.5% Since its Last Earnings Report?

A month has gone by since the last earnings report for Dominion Energy Inc. D. Shares have lost about 1.5% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is D due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Dominion Energy Q1 Earnings Beat on Solid Electric Sales

Dominion Energy Inc. reported first-quarter 2018 operating earnings of $1.14 per share, beating the Zacks Consensus Estimate of $1.03 by 10.7%. Earnings were near the top end of the guided range of 95 cents to $1.15 per share.

Operating earnings increased 17.5% from 97 cents reported a year ago. The year-over-year improvement was attributable to higher merchant generation margins, normal weather in its regulated service territory and the impact of tax reform.

GAAP earnings were 77 cents per share compared with $1.01 in the year-ago quarter. The difference between GAAP and operating earnings was due to one-time adjustments of 37 cents.

Total Revenues

Dominion’s total revenues came in at $3,466 million, beating the Zacks Consensus Estimate of $3,355 million by 3.3% and improving 2.4% year over year.

Highlights of the Release

Total operating expenses increased 12.4% year over year to $2,591 million primarily due to higher purchased gas and electric fuel prices.

Interest and related charges in the reported quarter were $314 million, up 7.5% from the year-ago quarter.

In the reported quarter, Power Delivery’s electric customer base increased by 26,966 from the prior-year quarter. Electricity consumption volumes also improved 7.96% year over year to 22,162 GWh in the first quarter.

Net income in the reported quarter was $741 million, up 21.3% year over year.

Segment Details

Power Delivery: Net income from this segment was $156 million, up 24.8% year over year.

Power Generation: Net income from this segment was $348 million, up 33.3% year over year.

Gas Infrastructure: Net income from this segment was $327 million, up 24.3% year over year.

Corporate and Other: Net loss was $90 million compared with a loss of $38 million in the year- ago quarter.

Financial Update

Cash and cash equivalents as of Mar 31,2018 was $189 million compared with $120 million as of Dec 31, 2017.

Total long-term debt as of Mar 31, 2018 was $25.76 billion compared with $25.59 billion at the end of 2017.

Cash from operating activities in the first quarter of 2018 was $1.23 billion, down 9.4% from $1.36 billion in first quarter of 2017.

Outlook

In second-quarter 2018, Dominion expects operating earnings of 70 to 80 cents per share.

For the full year, Dominion reiterated earnings per share guidance in the range of $3.80-$4.25.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter.

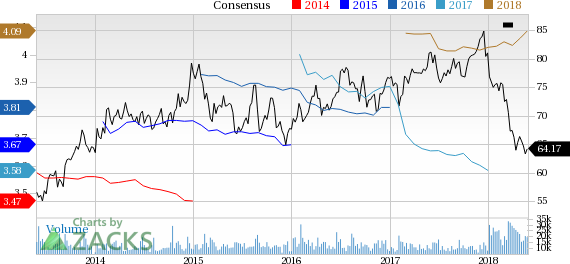

Dominion Energy Inc. Price and Consensus

Dominion Energy Inc. Price and Consensus | Dominion Energy Inc. Quote

VGM Scores

At this time, D has a subpar Growth Score of D, however its Momentum is doing a lot better with an A. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, D has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dominion Energy Inc. (D) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance