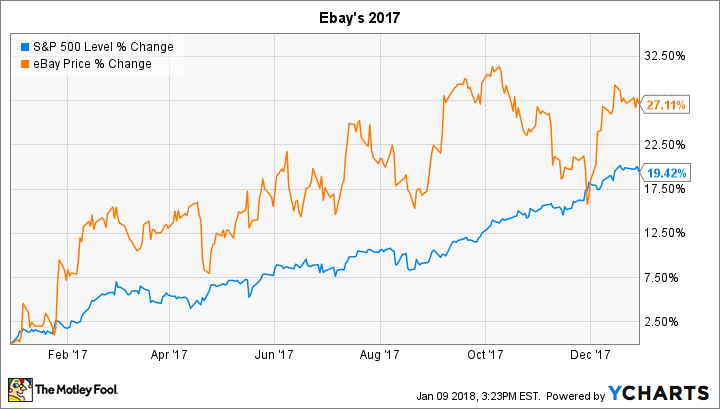

Why eBay Stock Gained 27% in 2017

What happened

Online marketplace eBay (NASDAQ: EBAY) gained 27% last year, compared to a 19% rise in the broader market, according to data provided by S&P Global Market Intelligence.

So what

2017 was a good year for most e-commerce specialists, and eBay was no exception. Sales volume growth accelerated over the prior year's 2016 pace to hit a three-year high in the third quarter. The company's pool of active buyers has steadily marched higher, meanwhile, and its so-called take rate, or the fee it charges merchants for the use of its platform, held steady at over 8%.

Image source: Getty Images.

Yes, those sales growth figures don't compare well to more vertically integrated retailers like Wal-Mart, which grew e-commerce volumes by over 50% in the most recent quarter. But eBay's light operating model produces far higher profits than peers.

Now what

To that end, eBay is targeting revenue growth of about 7% for the full 2017 year, which is far below the 30% that Wall Street is expecting to see from Amazon. As for the new fiscal year, results could be bumpy as the company continues rolling out platform improvements aimed at attracting more buyers. But even if its expansion holds steady, the company is likely to generate significant free cash flow that it can direct toward stock repurchases and, perhaps, a new dividend payout.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and eBay. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance