Why Facebook (NASDAQ:FB) is a Strong, Fundamentally Driven Stock

This article was originally published on Simply Wall St News

Long term Facebook (NASDAQ:FB) shareholders experience the stability of a good money generator as the stock is up 175% in five years. There are some strong value generators for Facebook, and we will make an overview of the fundamental factors that can drive future stock growth.

This will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Facebook

Value Driver: EPS

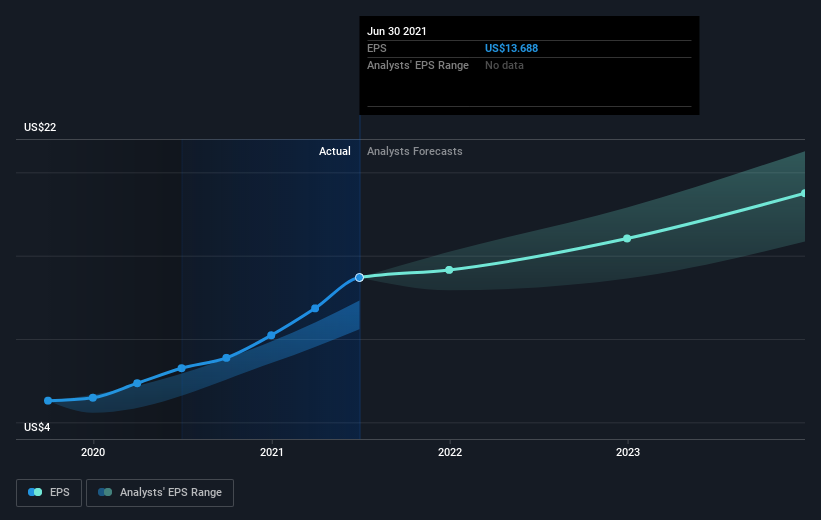

During five years of share price growth, Facebook achieved compound earnings per share (EPS) growth of 43% per year.

The EPS growth is more impressive than the yearly share price gain of 22% over the same period. So it seems the market isn't so enthusiastic about the stock these days - which may potentially mean that the stock in undervalued and the market may be overestimating some emotionally negative events, that will have some effect in the long run, but are not at par with the value being generated in the company.

View our Intrinsic valuation of Facebook HERE.

Analysts also expect EPS growth rates to continue, which solidifies Facebook's value for shareholders. The forecasted annual earnings growth is 14%.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Facebook has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

Value Driver: Margins

Companies with high margins represent both value for investors and a target for competition.

That is why these margins need to rely on high barriers to entry including: technological know how, systems in place, patents, large networking benefits, etc. Facebook already has a vast user ecosystem and has interconnected multiple communication platforms. The company has also massive infrastructure that make the systems able to function at scale.

As a main paid service, the Facebook algorithm aggregates and optimally disperses advertising information to small and large advertisers at a cost-effective rate - This has taken significant market share from traditional advertisers such as Comcast (NASDAQ:CMCS.A) and the affordable advertising on a vast network is partly responsible for the large profit margins we see below.

Facebook has the kind of margins that can be considered desirable and defensive. Their EBIT margin is 42.5% and grew by 15% from 1 year ago - the positive margin growth makes Facebook's profits desirable.

The EBIT margins have varied between around 30% in 2015 and 50% in 2018, and the fact that they are nowhere near negative, gives them a defensive moat for investors.

Key Takeaways

Facebook's return for the year was broadly in line with the market average, at 38%. That gain looks pretty satisfying, and it is even better than the five-year return of 22% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down.

The company has some strong fundamentals, including defensive margins and growing EPS. For long term investors, this gives comfort and stability to a portfolio.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance