UK rail: Where does your money go, and why do train fares keep going up?

There’s one thing that can always be relied upon to arrive on time in the rail industry: ticket price rises.

Regulated fare increases are predictable and punctual, yet the shock and outcry from passengers, consumer groups and unions is always deafening.

Rises in regulated ticket prices are set by the Government and take hold from today, with the uptick based on the previous July’s retail price index (RPI) measure of inflation. Last month’s figure was 3.6pc, so many fares, including commuter season tickets, will increase by the greatest amount in five years.

Passengers commonly question where the money is being spent, with some potentially holding the view it falls straight into train operating company coffers.

Their incredulity is amplified when growth in wages is failing to keep up with ticket price rises. Frequent strike action and other unscheduled disruption, most notably on the Brighton-London Southern link, stoke the sense of injustice.

A recent survey by consumer group Transport Focus showed commuting passengers had an overall satisfaction score for value for money of just 33pc. The figure obscures some better scores such as 72pc for Grand Central (which runs services from King’s Cross to Sunderland) but also massages the dire numbers for Southern.

Less than a quarter of the franchise’s passengers are satisfied they get value for money from the Go-Ahead/Keolis joint venture Govia. Greater Anglia, run by Abellio, is also on 24pc. The money does not only line the pockets of franchise holders, yet the amount being spent on the network is broadly the same as it was in 2003.

Data from the Rail Delivery Group, which aims to bring train operating companies and Network Rail together to help them better coordinate their operations, suggests more money is being spent on major projects such as capacity improvements. Meanwhile spending on routine maintenance, such as repairing signals, has fallen in the past decade.

The Department for Transport says that in the five years to 2019, Network Rail will spend more than £40bn on maintaining and improving the network, adding that on average, 97p of every £1 of a passenger’s fare goes back into the railway. So does this mean there is a disconnect between the investment which has and is being put into the rail industry, and the expectations of passengers?

Liberum transport analyst Gerald Khoo wonders whether many passengers remember the bad old days of public ownership.

“In the 20 years since privatisation, a back-of-the-envelope calculation would suggest the majority of people using the railway now never used the nationalised system,” he says. Here lies the problem, perhaps. In each of British Rail’s 50 years from its formation in 1948, passenger numbers continually declined.

“Nobody would have bet against a 50-year trend but that would have been the right thing to do,” adds Khoo. “Nobody thought ‘how will we accommodate growth’?”

While billions of pounds has been pumped into the railway in the past decade and beyond, demand has grown exponentially, thus creating problems of delays, overcrowding and how to accommodate major infrastructure projects.

David Sidebottom, director at Transport Focus, says feedback from passenger groups and individual rail users created a sense that the forthcoming rise was a “tipping point”.

There have been steeper rises, such as 8pc rise in 2011. “But that was done with the promise of saying to passengers if they pay up now, we will deliver a better and more reliable railway,” says Sidebottom. “That is happening with billions of pounds being pumped into projects such as London Bridge, King’s Cross and Euston but it seems slow and painful. Rebuilding a railway with millions of journeys is difficult.”

Sidebottom believes the rail industry is “struggling to keep up with demand”.

A service like Northern has enjoyed a 60pc rise in customers in recent years with only a tiny percentage increase in the size of its fleet. Successive Governments to have sought to shift the financial burden of the railways onto passengers and away from the taxpayer.

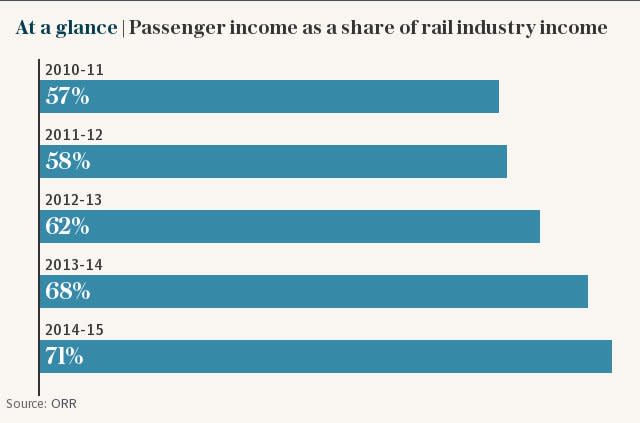

Income from fares made up 71pc (£9.6bn) of the costs in 2015, according to the most recent data. This is up from just 57pc (£6.6bn) in 2010.

Pete Moorey, head of campaigns at Which?, says the predicted fare increase is a “kick in the teeth for the majority of passengers”.

“We would completely agree investment is needed and will always come at a cost but what people would expect is that investing millions and billions of pounds in upgrading the rail system would lead to improvement,” he said. “But we are still seeing people having problems with delays, overcrowding, dirty trains and some issues around compensation for those passengers. The industry has got an awful lot more to do with simply dealing with the basics people expect.”

Train companies have been and are investing in their fleets but much of this investment usually comes in the early years of a franchise – a contract of ordinarily 10 years maximum. There’s little incentive to invest more money towards the end of the end of the contract in case it’s lost in the tender process.

It raises questions about the whole structure of the UK rail industry, including whether franchises should be extended to encourage train operators to invest more money. More profitable franchises also incur premium payments to Government, part of which helps subsidise less profitable ones.

Some would argue this takes away money from often busier lines preventing the companies in control of them using that to cut fares or invest in their fleet. Commentators on most sides of the debate agree a more coherent plan is needed to communicate what is going on and what is being spent.

The Office of Rail and Road, established in 2004, is making strides in improving transparency in the rail industry but this is unlikely to be enough for those whose annual season tickets are approaching five figures when a London travel card is included (Swindon to London is expected to be £9,448) or further above the £10,000 mark predicted for Birmingham to London commuters (currently £10,200).

Those passengers will no doubt be waiting in anticipation for the industry’s promised 6,400 more services and over 5,500 new trains by 2021 and hoping they’ll be as reliable as their fare rises.

Yahoo Finance

Yahoo Finance