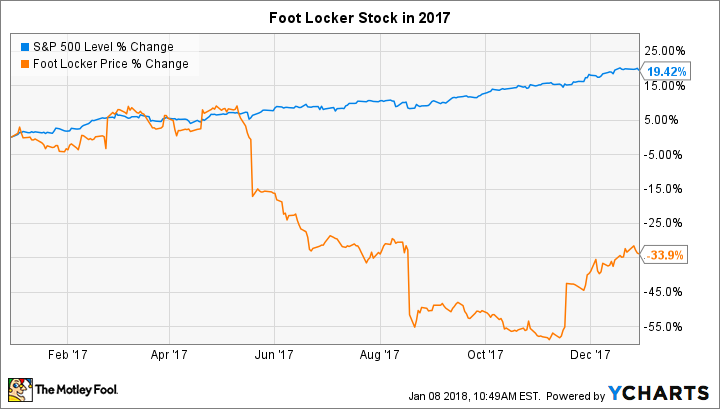

Why Foot Locker Stock Dove 34% in 2017

What happened

Foot Locker (NYSE: FL) investors trailed the market by a wide margin last year. Their stock shed 34% compared to a 19% gain in the S&P 500, according to data provided by S&P Global Market Intelligence.

The slump pushed the sports apparel and footwear retailer's stock down to levels shareholders hadn't seen since 2013.

So what

Wall Street punished the stock after fiscal first-quarter results, issued in May, showed a significant deterioration in core operating trends. Sales growth fell to below 1% from over 5% in the prior quarter, even as gross profit margin slipped.

Image source: Getty Images.

These figures didn't improve in subsequent earnings results. Instead, comparable-store sales fell 6% in the second quarter and decreased by 3.7% in the third.

Now what

Heading into the critical holiday shopping season, Foot Locker found a few faint reasons for optimism. Management was seeing hints of stabilizing customer traffic trends, they said, thanks to an influx of innovation from Nike and other suppliers.

That packed product pipeline formed the basis for cautious optimism from Foot Locker executives that the worst of the sales slump could be passed. Yet any stabilization would be just the first step in a long-term rebound strategy whose next phase likely includes store closures and a more aggressive push into the digital sales channel.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Nike. The Motley Fool owns shares of and recommends Nike. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance