Why Ford Is Rushing to Build More Big SUVs

Ford Motor Company's (NYSE: F) all-new 2018 Ford Expedition and Lincoln Navigator have been flying off dealer lots since their launches last year. Both of the big truck-based SUVs are hugely improved over their predecessors, and both are commanding big prices from eager buyers.

So, it was no surprise that Ford announced on Monday that it's planning to make more of both.

Early demand for Ford's all-new 2018 Expedition has been very strong. Image source: Ford Motor Company.

Ramping up production of Ford's big SUVs

Ford said it will spend $25 million to increase the speed of the production line building the two big SUVs. That spending follows a $900 million investment Ford announced last year, money spent to revamp Ford's Kentucky Truck Plant to build the all-new Expedition and Navigator.

Among other changes, Ford added 400 new robots and a new 3D printer to the production line that builds the SUVs in preparation for their launch last fall. It also significantly upgraded the plant's data-analytics system.

Ford added 400 new robots to its Kentucky Truck Plant to build the all-new Expedition and Navigator. Image source: Ford Motor Company.

The new robots will allow Ford to increase the speed of the production line while keeping its human workers safe from repetitive-motion injuries, it said. The 3D printer allows it to print individual parts for its tooling, doing in hours or days jobs that often took weeks until now. The new data analytics hub helps workers and plant managers spot potential problem (like low parts inventories) earlier than before.

Together, the new technologies and equipment will help Ford run the production line at a higher speed with less downtime, the company said.

Super-sized SUVs generate super-sized profits

Americans buy just a fraction of the big truck-based SUVs that they did 15 years ago. Today, big SUVs are an extremely profitable niche market, and until recently, General Motors (NYSE: GM) has had the niche mostly to itself.

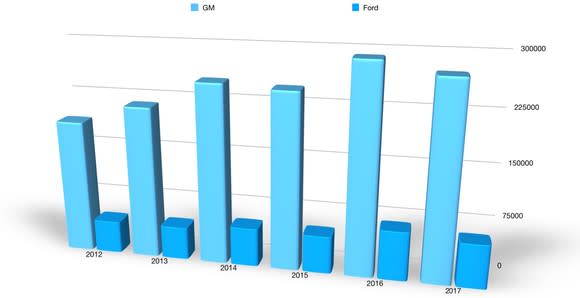

GM's line of big truck-based SUVs include the Chevrolet Tahoe and Suburban, GMC Yukon, and Cadillac Escalade. As a group, their sales have towered over the combined sales of the Expedition and Navigator for several years now.

Data sources: Ford Motor Company, General Motors. GM results reflect the combined sales of the Cadillac Escalade (including ESV and EXT variants), Chevrolet Tahoe and Suburban, and GMC Yukon and Yukon XL for each year shown. Ford results reflect the combined total sales of the Ford Expedition and Lincoln Navigator for each year shown.

Simply put, GM's big SUVs have been a big source of profits for the General for years, and Ford is aiming to get a larger share of that pie.

Ford's new SUVs have been designed to maximize profit, taking advantage of buyers' willingness to pay up for these big vehicles. Consider that the new Expedition starts at over $51,000, and pricing on Platinum-trim models can approach $80,000; Platinum-trim Expeditions accounted for 29% of sales in January, pushing average transaction prices up $7,800 from a year ago, Ford said.

The Navigator is even more profitable: It starts at $72,000 and can break $100,000 in fully loaded Black Label trim; a whopping 84% of the Navigators sold in January were in Black Label or next-step-down Reserve trim; average transaction prices were up over $21,000 from a year ago, Ford said.

In top-of-the-line Black Label trim, the new Lincoln Navigator's price can top $100,000. Image source: Ford Motor Company.

While profit margins on individual products are closely guarded secrets at Ford and other automakers, it's clear that the all-new Expedition and Navigator -- which share engineering with Ford's full-size pickup trucks -- are delivering huge profits right now.

They're selling quickly, too. "Days to turn" is a measure of how long vehicles spend on dealer lots after delivery before being sold. It's a way to measure the intensity of consumer demand. For reference, 30 days is considered pretty good; the Navigator and Expedition "turned" in just seven days in January.

The upshot: Striking while the iron is hot

The Expedition and Navigator are that rare thing for an automaker: Highly profitable products for which there is suddenly big demand.

With Ford's margins under pressure in recent quarters (and lagging GM's, among others), it's a much-needed boon -- and with this additional investment in its Kentucky Truck Plant, Ford is moving quickly to take full advantage.

More From The Motley Fool

John Rosevear owns shares of Ford and General Motors. The Motley Fool owns shares of and recommends Ford. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance